Two competing macroeconomic narratives: Is the glass half-full or half-empty?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 17, 2024

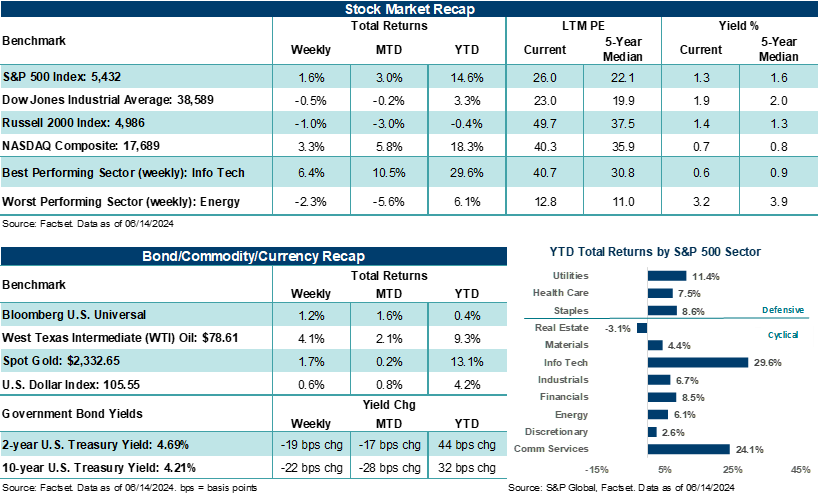

The S&P 500 Index and NASDAQ Composite scored their seventh week of gains out of eight last week, led by none other than Information Technology. Nevertheless, stock performance was mixed across the major U.S. averages, as the Dow Jones Industrials Average and Russell 2000 Index finished last week lower. Clearly, stocks, sectors and industries with visible secular growth drivers continue to outperform this year, while cyclical and interest rate sensitive areas underperform.

That said, inflation data for May came in weaker than expected on several fronts, helping place a tailwind behind stocks and fueling the soft-landing narrative. Notably, the Federal Reserve left interest rate policy unchanged last week, as expected. And while policymakers slightly upped their inflation forecast and dialed back the number of rate cuts for this year, the overall bias from the committee suggests its next move is highly likely to be a rate cut later this year.

Bottom line: Continued momentum across Big Tech stocks, easing inflation pressures, and a Federal Reserve content on letting already restrictive monetary policy help curb the last mile of inflation had investors cheering the “glass half full” outlook. More on that in a moment.

“In our view, investors should lean toward the glass-half-full view but recognize macroeconomic conditions, as well as the nuances across corporate profits, consumers, and incoming economic data, may evolve in ways not fully discounted in asset prices at the moment.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Last week in review

- The S&P 500 Index rose +1.6%, logging several closing highs during the week and finishing above 5,400.

- The NASDAQ Composite jumped +3.3%, also logging several all-time closing highs during the week.

- Apple rose nearly +8.0% on the week, competing with Microsoft as the largest company on the planet by market capitalization. The company shared more details about “Apple Intelligence” at its Worldwide Developers Conference. Apple will partner with OpenAI to integrate ChatGPT into Siri, which will likely be available in new products starting in the fall.

- The May Consumer Price Index (CPI) showed core (ex-food and energy) and headline inflation cooling more than expected. On an annualized basis, core CPI stood at +3.4% last month, which was below April’s level of +3.6%. May headline CPI grew by +3.3% year-over-year, which was below April’s +3.4% pace. The May Producer Price Index (PPI) also showed a trend of decline last month. While lower energy prices helped both inflation components ease last month, areas of services inflation (that sticky last mile) also experienced easing pressure.

- As expected, the Federal Reserve unanimously decided to leave its fed funds target rate range at 5.25% - 5.50% for the seventh consecutive meeting. The rate currently stands at a two-decade-plus high.

- The most noteworthy item from last week’s policy meeting is that the committee, in aggregate, now sees just one 25 basis point rate cut in 2024. That’s down from three cuts forecast in March.

- Fed Chair Powell indicated that progress on inflation continues to evolve favorably. In addition, Mr. Powell stated that he and the committee believed that monetary policy was sufficiently restrictive. Still, policymakers continue to lack conviction in seeing the immediate need to reduce the fed funds rate given current price dynamics.

- U.S. Treasury prices rallied as 2-year and 10-year Treasury yields sank on evidence of further progress on inflation and the Fed’s willingness to hold the line on monetary policy.

- The U.S. Dollar Index rose, Gold edged higher, and West Texas Intermediate (WTI) crude finished with gains.

- Lastly, a preliminary look at June Michigan Consumer Sentiment dropped to its lowest level since November, while one year ahead inflation expectations remained unchanged at +3.3%. Survey respondents' assessments of their personal finances dipped in June amid modestly rising concerns about higher prices as well as weakening income.

Two competing macroeconomic narratives that, interestingly, can be true at the same time

The glass is half-full: An increasing number of investors are pointing to the mid-1990s as an analogous period to compare the current state of markets and the economy. In 1995-96, the Federal Reserve began lowering interest rates to help support economic activity, corporate profits were in a period of growth, and there was this new technology called the “internet.” Today, the economy is normalizing, corporate profits are entering a period of growth, and there’s this new technology called “artificial intelligence.” Secular growth trends combined with a solid economic backdrop could help the bull market extend its reach for years, albeit with bouts of volatility along the way. In addition, inflation is trending lower, long-term inflation expectations appear well-anchored, and the Federal Reserve is now in a position to lower rates to support growth if needed. Here, gradually cooling inflation and normalizing labor trends, combined with a willingness by Fed officials to adjust policy when needed, should keep the economy and profits rolling on an upward trajectory at least through year-end.

The glass is half-empty: Services inflation is still elevated and could result in the Fed leaving rates higher for longer than most expect. And, even if the Fed does cut rates by 25 or 50 basis points over the next few quarters, is that really going to change overall conditions significantly? Prices of many goods and services are materially higher than they were before the COVID-19 pandemic. Consumer behavior responds to “end prices,” not calendar month-over-month or year-over-year comparisons. Notably, lower-to-middle-end consumers are beginning to struggle under higher prices and reduced savings, which could lower profit expectations as we move further out into the year. In addition, a 25 or 50 basis point Fed rate cut is unlikely to meaningfully change demand in areas like housing, considering many existing homeowners have sub-4% mortgages. And frankly, less of the economy, particularly on the services side, is as sensitive to changes in interest rate policy relative to history. Thus, slowing growth and employment, still elevated inflation, and perils that stocks are underpricing profit risks are reasons to remain somewhat guarded. Some may even argue history is generally unkind to a scenario that sees the Fed gradually cutting rates, like in the mid-1990s. Typically, the Fed leaves rates too restrictive for too long and then needs to cut aggressively. Such a scenario would likely be disruptive for stocks temporarily.

Bottom line: In our view, investors should lean toward the glass-half-full view but recognize macroeconomic conditions, as well as the nuances across corporate profits, consumers, and incoming economic data, may evolve in ways not fully discounted in asset prices at the moment. However, the fundamentals of a growing economy, inflation that is winding lower, and technological innovation that appears in a secular uptrend are reasons to consider being a long-term buyer of equities should volatility arise in the second half outside of an unforeseen event shock.

The week ahead

Stocks will likely open the week against a backdrop of growing extremes between U.S. mega caps and just about everything else. As most know by now, the strength of Big Tech has accelerated significantly in the second quarter. At the same time, sectors like Financials, Industrials, and Materials have seen their performance stall, particularly following the broader market strength experienced in the first quarter. Notably, the S&P 500 Equal Weight Index and Russell 2000 Index have traded lower in seven of the last ten trading days this month, while the S&P 500 has traded higher in seven of the last ten. At the moment, it’s a market of the “haves” and “have-nots,” and Big Tech is the only game in town.

- U.S. markets will be closed on Wednesday in observance of Juneteenth.

- The May retail sales report on Tuesday will provide more color on consumers’ willingness to spend against weaker sentiment and elevated prices. Lower gasoline prices last month should keep a lid on the headline figure.

- May industrial production, housing starts, and existing home sales are other key items on the economic calendar this week, as are several speeches from Fed officials.

Return to My Accounts

Return to My Accounts