The stock market sits at an inflection point

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 3, 2024

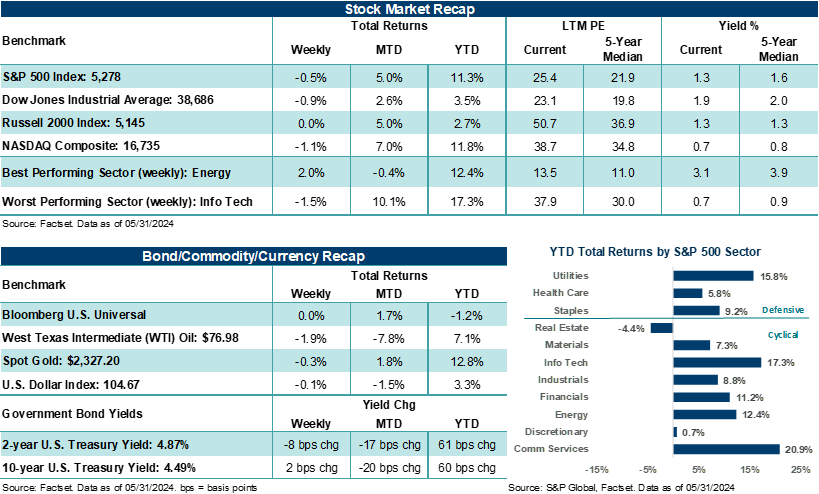

Stocks finished the shortened holiday week lower. The S&P 500 Index and NASDAQ Composite snapped five-week winning streaks, while the Dow Jones Industrials Average recorded its second straight week of losses. Much of investors’ attention last week centered on the recent loss of stock momentum despite the S&P 500 closing out May with its second-best month of the year and rebounding from April’s losses.

Warmer-than-expected economic data, Fed speeches pointing to a higher-for-longer policy stance, and still elevated services inflation have led to bond yields creeping higher since the middle of last month. With the S&P 500 Index touching new highs in May and recently tracing the psychologically significant 5,300 level, stocks began to back off the level as the month wound down. By the end of the month, only 36% of S&P 500 stocks were trading above their 50-day moving average, not far off the same level seen at the end of April.

“Stocks rallied higher on the final day of the month following data showing personal income remaining largely static versus month-ago levels, the Fed’s preferred inflation gauge coming in line with expectations, and spending trends cooling.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

In our view, some of the recent weakness across equities late last month came from the unexpected upward momentum across government bond yields. For instance, while the 10-year U.S. Treasury yield finished May lower than where it entered the month, it spent the back half of the month mostly moving higher. Thus, major U.S. stock averages struggled to meaningfully move higher, given the rate headwinds. While it’s not the majority opinion across the market, some continue to see a risk of persistent inflation, growing caution about the amount of new Treasury auctions to fund debt and deficit spending, and the Federal Reserve leaving its policy rate unchanged through 2024 as reasons government bond yields should remain elevated.

These are certainly valid concerns, and investors shouldn’t dismiss their influence on equity prices as we move through June. However, the stock market’s reaction to a recent uptrend in rates should be taken in stride and considered against the S&P 500 sitting less than 1.5% below an all-time high. We believe firm economic conditions (e.g., Atlanta Fed Q2 GDPNOW is tracking at +2.7%), Q2 S&P 500 profit growth expected to come in at above +9.0% year-over-year, and an unemployment rate below 4.0% are notable reasons to remain constructive on equities, despite the rate environment. And if rates remain elevated this year and inflation takes longer than expected to move to the Fed’s target, it’s likely because economic and profit growth is holding up better than expected. All else equal, that’s not a bad environment for stocks.

Last week’s inflation measures

Speaking of inflation, last week’s April Personal Consumption Expenditures (PCE) Price Index helped close out May on a high note. It showed that the Federal Reserve’s preferred inflation measure remained mostly in line with the market’s expectations. For example, core PCE (which excludes food and energy) rose +2.8% year-over-year, coming in as expected and matching March’s level. Notably, core PCE remained at its lowest level since March 2021. And in the bad news is good news department, April personal spending increased +0.2% month-over-month, below the +0.3% expected and well below the +0.7% level seen in March.

Bottom line: Stocks rallied higher on the final day of the month following data showing personal income remaining largely static versus month-ago levels, the Fed’s preferred inflation gauge coming in line with expectations, and spending trends cooling. Although we certainly wouldn’t make too much of last week’s data points on the economy, they did help reframe a potential soft-landing scenario that needed a little data support. Consequently, stocks reacted positively.

What shaped markets in May?

In other key items that helped shape markets last month, Big Tech was a big driver of stock momentum, with NVIDIA (+26.8%), Apple (+12.9%), Microsoft (+6.8%), and Alphabet (+6.0%) doing a lot of the heavy lifting in terms of returns. NVIDIA’s strong profit update and outlook helped fuel excitement around the AI theme, which extended into areas outside of Tech, including Utilities and Copper. Notably, when stripping out the Magnificent Seven from first quarter S&P 500 earnings per share (EPS) growth, Q1 S&P 500 EPS falls to a decline of 1.8% year-over-year from +6.0%. In our view, Big Tech’s influence on earnings growth and, subsequently, return performance cannot be understated at the moment. However, as the year moves forward, more S&P 500 companies, industries, and sectors are expected to contribute to earnings growth.

In addition, Fed commentary and speeches leaned more hawkish in May, helping reduce the odds of a September fed funds rate cut. ISM manufacturing and services activity weakened in April, while the most recent looks at consumer and producer price inflation measures came in mostly in line with expectations but pointed to still elevated services inflation. The labor market remained healthy, and consumers continued to spend (with some growing dispersion by income level). Also, further evidence of disinflation traction in the economy and weakening confidence helped color the edges of the macroeconomic narrative last month.

Finally, U.S. Treasury prices were firmer on the month as yields slipped, but as stated above, the back half of the month saw yields climb, which created some headwinds for stocks. The U.S. Dollar Index declined for the fourth straight month, Gold edged higher for the third consecutive month, and West Texas Intermediate (WTI) crude fell in May.

The week ahead

As the final month of the second quarter begins, the stock market sits at an inflection point, in our view. Investors will likely need to balance themes that point to solid economic conditions with themes that point to slowing growth, narrow market leadership, and a Federal Reserve that is highly likely to keep policy rates at elevated levels throughout the summer.

And with the second quarter earnings season weeks away, economic updates may play a more significant role in shaping stock traffic versus the last month or so. Notably, updated looks at employment trends, inflation, and activity levels across the economy over the next few months could help determine if the Fed even cuts rates in 2024.

Yet, as we move deeper into the year, we would argue that corporate profit growth and trends across consumer demand are the key factors that will likely play large roles in driving stock momentum versus the current state of rates and inflation being the main levers. Bottom line: Investors should remain cautiously optimistic about a Fed that is still hesitant to cut rates throughout the summer months. As long as the economy is performing well, profit growth is on an upward path, and consumers are working, stocks may look past a Fed willing to sit on the sidelines longer than most assumed at the start of the year. In fact, we would suggest such a backdrop could help stocks grind higher, all else being equal.

This week, there will be a host of data points that should provide greater clarity on where the economy stands at the moment. Notably, this week’s updates could provide crucial information to help shape the Fed’s Summary of Economic Projections, which will be updated at next week’s policy meeting. May ISM manufacturing and services updates this week should provide more color on economic activity. ISM manufacturing activity is expected to remain in contraction. In contrast, services activity is expected to rebound back into expansion after unexpectedly falling into contraction in April (the first monthly contraction since December 2022).

However, most of the economic focus this week will be on key employment updates, with the Job Openings and Labor Turnover Survey (JOLTS) report released on Tuesday. Job openings are expected to fall to 8.36 million in April from 8.48 million in March. Notably, job openings in the U.S. are down nearly 30% from their March 2022 high of over 12 million. On Wednesday, May ADP private payrolls are expected to also trend lower to +170,000 from +192,000 in April.

But all eyes will be on Friday’s May nonfarm payrolls report, with FactSet estimates showing jobs slightly increasing to +180,000 last month from +175,000 in April. The unemployment rate is expected to hold steady at 3.9%. Job growth has slowed from +315,000 in March and +236,000 in February. Notably, the unemployment rate has held below 4.0% since February 2022. In the background, this week, construction spending, auto sales, durable orders, and looks at consumer credit will be other items that help update the macroeconomic environment.

Return to My Accounts

Return to My Accounts