Yes, the outlook for stocks looks favorable. But let's avoid getting out over our skis.

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — November 18, 2024

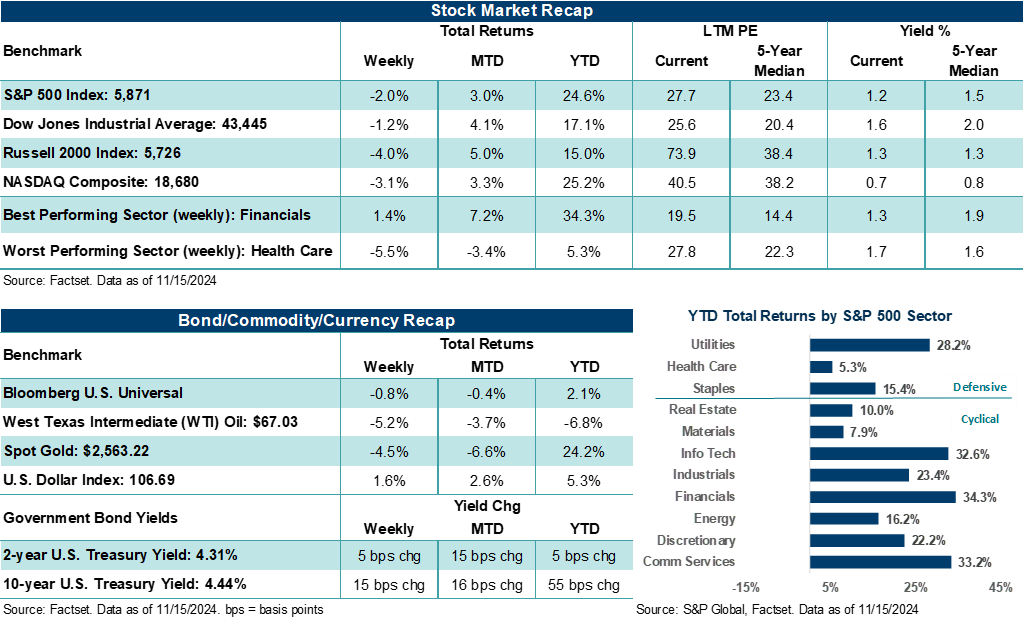

Stocks fell on the week, coming off their post-election highs, as investors refocused their attention on inflation, the Federal Reserve, and stretched valuations and near-term trading conditions. Notably, the Russell 2000 Index gave back almost half of its +8.6% election week gain last week. Healthcare was the week's biggest loser as pharmaceutical makers saw their stocks fall aggressively after President-elect Trump nominated Robert F. Kennedy Jr. as Secretary of the U.S. Department of Health and Human Services (HHS). U.S. Treasury prices ended the week mixed, while Gold moved lower.

Last week in review:

- The S&P 500 Index dropped 2.1%, posting its largest weekly decline since September 6, 2024. The Index is down in three of the last four weeks. However, since the close of Election Day, the Index is higher by +1.5%.

- The NASDAQ Composite finished lower by 3.2%. Notably, the NASDAQ 100 Index fell every day last week, falling by more than 3.0%.

- As noted above, the Russell 2000 Index gave back a good share of its post-election bounce, falling 4.0%. Overbought trading conditions following steep post-election gains and concerns about lingering inflation and the trajectory for growth helped cool momentum on the domestically focused group.

- The Dow Jones Industrials Average fell a more modest 1.2%, propped up by gains in Financials (+1.4%) and Home Depot, which posted strong third quarter profit results due to hurricane demand and lifted earnings guidance.

“While stock prices have gyrated around since Election Day, the general market assessment is that less regulation, lower taxes, and growth-focused fiscal policies could be additive to a U.S. economy that is already growing above trend and where corporate profit growth is healthy. However, that assessment simplifies other factors that may be more disruptive to growth and less supportive of stock prices next year.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- Healthcare fell 5.5%, driven lower by stocks such as Amgen (-12.9%) and AbbVie (-17.3%). The sector was weighed down by concerns that the appointment of Kennedy to HHS could lead to major shifts in vaccine requirements and policies if he is confirmed.

- October inflation reports showed signs of stickiness, though they came in mostly as expected. The Consumer Price Index was in line with expectations both on core (ex-food and energy) and headline measures. However, services inflation rose last month, and shelter costs (which is a large part of why core inflation remains sticky) provided upside pressures. On the wholesale side, the October Producer Price Index also came in mostly as expected on headline and core measures, with some upside pressures from services and goods demand. Bottom line: The latest inflation updates showed little signs that prices are reaccelerating. That said, disinflationary progress appears to have slowed.

- October retail sales beat on the headline figure, but "ex-autos and gas" was weaker than expected. Notably, September's report was revised higher, doubling the original estimate. Sales across electronics and appliances, autos and parts, bars and restaurants, and building materials fueled retail gains in October. Bottom line: The U.S. consumer remains on firm footing and is willing to spend. In addition, the post-election sentiment bounce could bode well for consumer spending and holiday sales through year-end.

- More hawkish commentary from Federal Reserve officials dialed back interest rate cut expectations for December. Several Fed officials noted that a December rate cut is not a done deal. Importantly, Fed Chair Powell said that strong U.S. economic growth will allow officials to take their time when deciding how far and how fast to reduce rate policy. Bottom line: Powell opened the door to a December pause. As a result, odds modestly slipped lower for an additional 25-basis point rate cut at its December 17-18 meeting.

- U.S. Treasury prices moved modestly lower as yields rose across 2-year and 10-year maturities. Despite expectations for lower Treasury yields this year, the 10-year yield has risen over 50 basis points in 2024. Stronger-than-expected economic growth and concerns about increased deficit spending and debt leading to higher longer-term inflation have weighed on Treasury prices as of late.

- The U.S. Dollar Index ended higher for the seventh straight week, Gold ended lower by 4.5%, and West Texas Intermediate (WTI) crude fell by over 5.0%. Notably, investors appeared willing to relax Middle East concerns and refocus their attention on potential Trump energy policies that could lead to an oversupply of oil.

Yes, the outlook for stocks looks favorable, but let's avoid getting out over our skis.

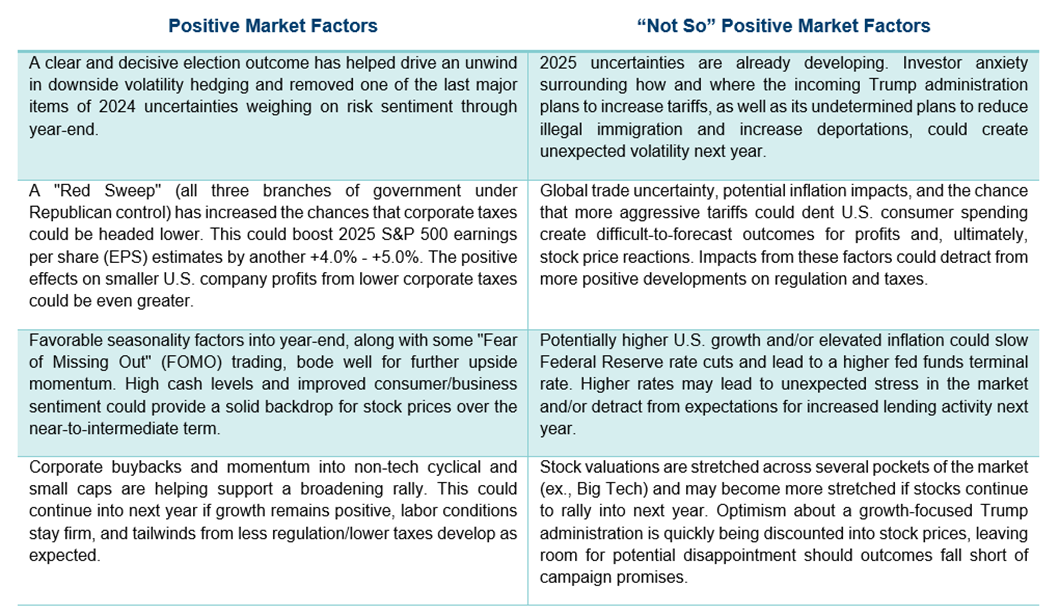

While stock prices have gyrated around since Election Day, the general market assessment is that less regulation, lower taxes, and growth-focused fiscal policies could be additive to a U.S. economy that is already growing above trend and where corporate profit growth is healthy. However, that assessment simplifies other factors that may be more disruptive to growth and less supportive of stock prices next year. Bottom line: Continue to take a balanced portfolio approach, keep political emotion out of your investments, and maintain a pragmatic outlook for next year. Below is a quick snapshot of some key market factors we’re currently watching as the year winds down.

The week ahead:

Investors will turn their attention to the final stretch of third quarter earnings reports this week, which include key updates from retailers as well as the company that is currently the face of the artificial intelligence boom. Key reports this week may contribute to the S&P 500's potential for positive year-over-year earnings growth.

- Walmart and Lowes will report their earnings results and outlooks on Tuesday. Target and TJX Companies will release their results on Wednesday, with Ross Stores out on Thursday. Each company update should help investors further gauge the state of consumer spending in the U.S. and provide a glimpse into potential holiday spending trends.

- The world's number one AI semiconductor maker, NVIDIA, reports their profit results on Wednesday. With the stock up nearly +187% as of the date of this writing and previous profit updates easily surpassing analysts’ lofty expectations, investors will be closely parsing not only its latest results but what CEO Jenson Huang has to say about AI demand moving forward.

- Several updates on housing and preliminary looks at November manufacturing and services activity line the week's economic calendar.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet and Bloomberg. FactSet and Bloomberg are independent investment research companies that compile and provide financial data and analytics to firms and investment professionals such as Ameriprise Financial and its analysts. They are not affiliated with Ameriprise Financial, Inc.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

This market commentary is intended to provide perspective on how potential election outcomes may impact financial markets and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

Investments in small cap companies involve risks and volatility greater than investments in larger, more established companies.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

The products of technology companies may be subject to severe competition and rapid obsolescence, and their stocks may be subject to greater price fluctuations.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The S&P 500 Index is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value (shares outstanding times share price), and its performance is thought to be representative of the stock market as a whole. The S&P 500 index was created in 1957 although it has been extrapolated backwards to several decades earlier for performance comparison purposes. This index provides a broad snapshot of the overall US equity market. Over 70% of all US equity value is tracked by the S&P 500. Inclusion in the index is determined by Standard & Poor’s and is based upon their market size, liquidity, and sector.

The S&P 500 Information Technology Index comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard (GICS) information technology sector.

The NASDAQ Composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Dow Jones Industrial Average (DJIA) is an index containing stocks of 30 Large-Cap corporations in the United States. The index is owned and maintained by Dow Jones & Company.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

West Texas Intermediate (WTI) is a grade of crude oil commonly used as a benchmark for oil prices. WTI is a light grade with low density and sulfur content.

The US Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. This is computed by using rates supplied by approximately 500 banks.

The ISM Services is compiled and issued by the Institute of Supply Management (ISM) based on survey data. The ISM services report contains the economic activity of more than 15 industries, measuring employment, prices, and inventory levels; above 50 indicating growth, while below 50 indicating contraction.

University of Michigan Consumer Sentiment Survey is a rotating panel survey based on a nationally representative sample of households in the U.S. that measures how consumers feel about the economy, personal finances, business conditions, and buying conditions.

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.