The overlooked opportunity in India?

Bishnu Dhar, Senior Analyst – Ameriprise Financial

Nov. 11, 2024

As the world’s most populated country, India has long been considered a top emerging market to watch. Still, it has often been overlooked by investors in favor of other developing nations.

Now, the country may be poised to enter a new era: Investors’ perspectives on India have begun to change and its equity markets are becoming more sought-after.

What’s driving this shift? Below, we explore the five key factors underpinning this renewed interest and share why the potential growth opportunity in India shouldn’t be overlooked.

1. A strong record of economic growth

Over the past two decades, India's real gross domestic product (GDP) growth rate has averaged 6% to 7% annually, per the Reserve Bank of India (RBI), the country’s central bank. This growth rate surpasses that of many developed and emerging markets and the trajectory is projected to persist, providing a stable platform for investment.

According to the World Bank, India's GDP reached $3.55 trillion by the end of 2023. The bank's estimates suggest that the economy will grow at an average annual growth rate of 6.7% over the next three years, potentially increasing its size to $5 trillion by 2026. At this pace, India’s economy could surpass Japan and Germany to become the world's third-largest economy from the sixth largest in 2023.1

2. Pro-growth government policies

The Indian government has prioritized supporting economic growth, reducing the fiscal deficit and enhancing the ease of doing business for companies. For example:

- Pro-growth policies have resulted in bankruptcy code reform, corporate tax reductions and decreased caps on foreign ownership in major sectors.

- Improving outdated infrastructure has also been a key focus area for investment. Increased tax collection has facilitated investment in high-speed rail, subways and port-to-railway connections to propel economic growth further.

- Monetary policy has been overhauled by the RBI to concentrate on mitigating risks to the Indian rupee and stabilizing inflation, measures designed to enhance macroeconomic stability and bolster growth.

3. Favorable demographics

India's expanding working-age labor force could also catalyze the next phase of economic development. The favorable demography, with a relatively young population and a median age of 28.4 years, makes India an appealing destination for domestic and foreign companies. The country's efforts to build digital, regulatory, financial and physical infrastructure over the last decade, combined with its growing population, are expected to accelerate growth over the next decade.

4. Underrepresentation in the global markets

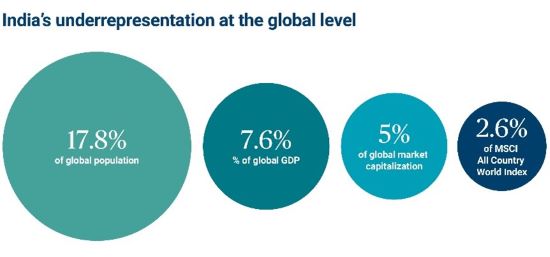

Given this growth potential, we believe Indian equity markets are underrepresented globally, leaving ample room for continued outperformance vs. other large emerging and developed markets.

With a size of $5.5 trillion, India’s equity markets rank fourth in global market capitalization after the U.S., China and Japan. In the realm of emerging market equities, it's important to highlight that India’s representation in major indices appears lower than what its GDP size and growth potential would indicate. As of the end of September, India comprised ~20% of the MSCI Emerging Markets Index, compared to Taiwan at 17.6% and South Korea at 10.5%. However, given that India’s GDP is five times larger than both Taiwan and South Korea, this discrepancy suggests that foreign investors, who often rely on index providers for fund allocation, are significantly underweight in India.

Source: World Bank; MSCI ACWI Index Factsheets, AEIS

5. Diversified equity markets

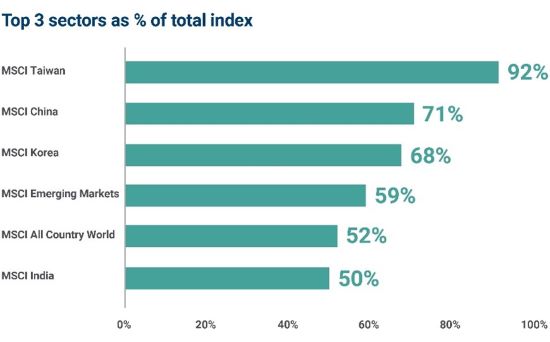

Within India, the headline indices are characterized by their diversification, effectively mitigating concentration risk — the likelihood that a few large stocks will dominate market movements. Given that India's economy is domestically focused, the country’s stock markets have traditionally demonstrated a weak relationship with the fluctuations of other major global stock markets. This means that movements in Indian stocks often do not closely mirror those in developed markets. Additionally, India's stock markets show moderate correlation with developed economies and exhibit low, or sometimes negative, correlations with various components of the MSCI Emerging Markets Index. This unique aspect may underscore India's position as a distinct investment landscape, providing investors with potential opportunities that may not be closely tied to global economic trends.

A closer look at the data reveals an important distinction: The top three sectors within MSCI’s India index constitute only 50% of its total weighting. In contrast, the MSCI Taiwan index has a significant 92% concentration in its top three sectors, while the MSCI China index follows closely with 71%. This relatively lower sector concentration in India suggests a more balanced distribution of investments across various industries. Such diversification potentially mitigates risk and lessens cyclicality, meaning that fluctuations in one sector are less likely to impact the overall portfolio. This makes Indian equities appealing to investors seeking to stabilize returns in an increasingly interconnected global market.

Source: MSCI Index Factsheet/AEIS

*ACWI: All Country World Index

For illustrative purposes only. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Bottom line

India's economy stands out with its favorable demography and underrepresented equity markets, making it a potential attractive growth opportunity for investors. If you’d like guidance on whether exposure to emerging markets, like India, is appropriate for your investment portfolio, reach out to your Ameriprise financial advisor.