The uneasy dance between The Fed and markets continues

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — September 25, 2023

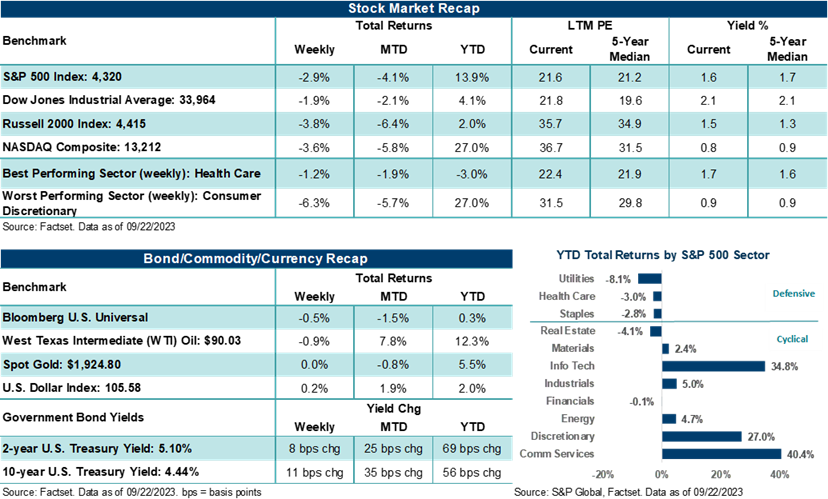

The S&P 500 Index and NASDAQ Composite finished lower for the third straight week. A hawkish rate message from the Federal Reserve sent government bond yields higher and stock prices lower. Last Thursday, the 10-year U.S. Treasury yield spiked to its highest levels since 2007 (crossing 4.50%), fueled by weaker-than-expected jobless claims and concerns a Fed committed to leaving rates higher for longer would ultimately lead to a recession. Shorter-term rates also spiked higher last week, with the 2-year U.S. Treasury yield hitting its highest level since 2006. As a result, the S&P 500 finished the week down nearly 3.0%, while the NASDAQ ended lower by 3.6%, their worst week since March.

Notably, the weakness in the S&P 500 sent the Index below its 100-day moving average for the first time since March, causing the benchmark to retest its June lows just above the 4,300 level. Although all eleven S&P 500 sectors closed the week lower, Consumer Discretionary (-6.4%) and Real Estate (-5.4%) felt outsized selling pressure. In a slight positive, Healthcare (-1.2%) and Utilities (-1.7%) also closed lower but helped mitigate losses. Similarly, the value-focused Dow Jones Industrials Average took less of a hit last week, closing down 1.9%. However, the small-cap-focused Russell 2000 Index finished lower by 3.8% last week, as increasing concerns of a recession next year weighed more heavily on domestically focused stocks. And in the background, an ongoing United Auto Workers (UAW) strike and growing odds of a U.S. government shutdown starting on October 1 sapped stock sentiment.

Outside of stocks and bonds, West Texas Intermediate (WTI) crude dropped less than 1.0% on the week, ending three consecutive weeks of gains, though it remained above $90 per barrel. Gold finished the week fractionally lower, and the U.S. Dollar Index rose slightly against the major currencies.

“The Fed typically uses the stairs when lifting rates higher and takes the elevator down when cutting rates.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Perspectives on the September Federal Reserve meeting

In a widely expected, unanimous decision, the Federal Open Market Committee (FOMC) held its fed funds target rate steady at 5.25% - 5.50%. September’s policy statement offered very few changes from July’s release, and none of the changes were very meaningful, in our view. In the Fed’s updated Summary of Economic Projections (SEP), policymakers generally believe growth in the U.S. will likely expand through 2025, inflation will moderate slowly over the next few years toward target, and unemployment levels will remain benign. This soft-landing scenario plays out across the Fed’s projections, and at the same time, the committee further stressed that rates would likely need to be held higher for longer. Notably, the Fed removed two fed fund rate cuts from its 2024 projections and now only sees two rate cuts next year. And by the end of 2026, the median fed funds rate is projected to stand at 2.9% — above the Fed’s 2.5% neutral rate. Bottom line: While the updated SEPs suggest a higher-for-longer rate environment, officials (in aggregate) are penciling in a soft-landing scenario where growth normalizes over time, and the economy potentially avoids a recession.

However, history is generally very unkind to the Fed’s anticipated scenario. The Fed typically uses the stairs when lifting rates higher and takes the elevator down when cutting rates. Meaning history suggests the Fed may leave rates high for too long and ultimately need to cut them quickly to help stabilize growth. And while last week’s Fed message and projections sync with a higher for longer rate environment and slowly normalizing economic conditions (i.e., the soft-landing scenario), Fed Chair Powell made it clear the setting outlined in the SEP is not necessarily the base case or how policy will evolve as the data changes. Instead, the SEPs reflect a plausible environment based on conditions as they stand today.

So, where does this leave investors and the market? At this point, Fed officials will proceed “carefully” when adjusting policy from here. Asset prices tend to do well when the Fed is finally done raising interest rates, particularly bonds, and if a recession is ultimately avoided. Importantly, we believe rates are at or near sufficient levels to curb inflation back to trend over time. Most, if not all, FOMC members consider this to be the case today. But inflation isn’t the big overarching issue for the market anymore like it was a year ago. At this point, we believe the Fed itself is the main obstacle for markets and the economy heading into next year. The trick for the Fed now is all about messaging and the duration of a higher-for-longer rate environment. Back off the jawboning too soon or lower rates too quickly, the Fed risks stoking inflation pressures again and probably loses a ton of credibility in the process. Yet, if the Fed keeps pressing the higher-for-longer messaging without recognizing changing conditions or leaves rates too high for too long, it risks the very scenario it is hoping to avoid — causing a recession.

Landing a $25 trillion-plus economy into a soft landing after one of the most challenging economic periods in modern history, with basically only the blunt instrument of rate policy, is asking a lot from policymakers. And while history suggests the task will be difficult to achieve, that’s exactly what market bulls expect. We advise investors to remain cautiously optimistic about a solid economy and a Fed close to moving to the sidelines. However, we believe the real work for the Fed is now beginning. It’s easy to raise rates when it's clear policymakers need to pump the breaks on the economy. The other side of that trade tends to be far opaquer, catalysts are less obvious, and crosscurrents in the data (and that’s before revisions) are difficult to read. Bottom line: A data-dependent approach (which officials will take moving forward) depends heavily on how the data is interpreted. Unfortunately, interpretation can leave a lot of room for error. History is littered with examples of policy mistakes, and not when the Fed was lifting rates but when rates finally hit their apex and officials proved too slow to adjust policy to the shifting winds.

In other items that moved markets last week, the Bank of England and Bank of Japan left rate policy unchanged, and the Organisation for Economic Co-operation and Development (OECD) raised their global growth outlook for this year while cutting their global growth forecast for next year. Preliminary September looks at U.S. manufacturing and services activity showed broad stagnation while input prices increased. Initial jobless claims came in at their lowest levels since January, and the United Auto Workers (UAW) expanded their strike to 38 more General Motors and Stellantis parts-distribution centers across twenty states. The move brings UAW members on strike to more than 18,000. Finally, Congress failed to make much progress on forming a temporary budget agreement, increasing the odds of a U.S. government shutdown next week.

The week ahead

After looking like equities might get out of September without facing significant damage, recent Fed messaging and rising yields this month look to have derailed stock momentum heading into the fourth quarter. With the S&P 500 down 2.6% quarter-to-date, stocks are on track to post their first losing quarter since Q3’22. And while higher crude prices (up over +30.0% in Q3) have driven stocks in Energy higher, several S&P 500 sectors are on pace for a quarterly loss. Yet, the story isn't much better on the bond side of the ledger. The backup in rates during the third quarter has put downward pressure on intermediate-to-long duration fixed income prices, contributing to losses across diversified portfolios in Q3.

Unfortunately, markets and investors sit at a crossroads heading into year-end, and the outlook for asset prices remains cloudy at best. Stroger-than-expected economic growth in the third quarter, declining inflation pressures, improving corporate profit conditions, and a healthy consumer are reasons to be positive that asset prices could see better trends in the fourth quarter. Notably, stocks will soon move out of their seasonally weaker pattern and into a generally more favorable trading pattern in the year's final two months. Investors must now ask themselves, are stocks just moving through a typical and healthy correction after a strong first half of performance? And could better seasonality factors in Q4 finally bring some investors caught offside by the rally in stocks this year back into the market to play catchup? These conditions could help stocks finish the year on a strong note and help reverse the lull seen in Q3.

The obvious issue with that more bullish view of market conditions is that the assessment glosses over the point that interest rates currently sit at extraordinarily high levels versus history. Simply, higher interest rates create headwinds for stocks. According to Bespoke Investment Group, global monetary policy rates from 38 different central banks stand at their highest levels since 1995, when adjusted for GDP. Further, economic growth is expected to slow in Q4, corporate profit growth remains weak versus history, and while consumers and businesses remain in good shape, higher prices and spending fatigue is beginning to set in. Given current stock valuations, these conditions are unfavorable to further upside in equity prices. Slowing growth in Europe and China, a United Auto Workers strike, a potential U.S. government shutdown, and the resumption of student loan payments in October are other issues that could weigh on stock momentum at the start of Q4.

Importantly, as the year winds down, we suspect investors will increasingly begin to price in the 2024 environment and whether it looks like the U.S. economy will enter or avoid a recession next year. Thus, we suspect volatility could bounce around a bit in the final months of this year. Yet, we believe investors should hold a positive yet guarded view of how markets could perform heading into year-end. Remaining well-diversified, hewing allocations slightly toward fixed income and cash-like investments and holding positions that are up in quality should provide a prudent way to position for a still cloudy environment.

This week, September consumer confidence and August new home sales on Tuesday, as well as August pending home sales and weekly jobless claims on Thursday, will likely receive some focused attention. August PCE on Friday will also be closely watched for hints into how Fed policy may evolve into the fourth quarter.

Sources: FactSet and Bloomberg. FactSet and Bloomberg are independent investment research companies that compile and provide financial data and analytics to firms and investment professionals such as Ameriprise Financial and its analysts. They are not affiliated with Ameriprise Financial, Inc.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

There are risks associated with fixed-income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer term securities.

A rise in interest rates may result in a price decline of fixed-income instruments held by the fund, negatively impacting its performance and NAV. Falling rates may result in the fund investing in lower yielding debt instruments, lowering the fund’s income and yield. These risks may be heightened for longer maturity and duration securities.

The fund’s investments may not keep pace with inflation, which may result in losses.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The Standard & Poor’s 500 Index (S&P 500® Index), an unmanaged index of common stocks, is frequently used as a general measure of market performance. The index reflects reinvestment of all distributions and changes in market prices but excludes brokerage commissions or other fees. It is not possible to invest directly in an index.

The NASDAQ composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Dow Jones Industrial Average (DJIA) is an index containing stocks of 30 Large-Cap corporations in the United States. The index is owned and maintained by Dow Jones & Company.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

The US Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. This is computed by using rates supplied by approximately 500 banks.

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial Services, LLC. Member FINRA and SIPC.