Have subdued inflation readings changed the market narrative?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — November 20, 2023

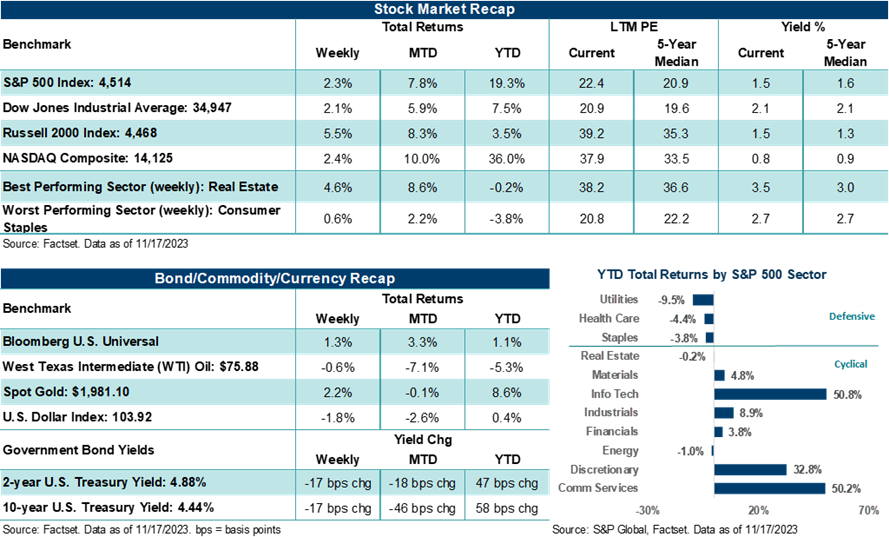

U.S. stocks strung together their third straight week of gains last week, with the S&P 500 Index (+2.3%) and Dow Jones Industrials Average (+2.1%) accomplishing the feat for the first time since July. The NASDAQ Composite gained +2.4% on the week, notching its first 3-week winning streak since June. Lower-than-expected inflation in October and growing odds that the Federal Reserve is finally done lifting interest rates were the main catalysts for driving stock momentum higher last week. Further, the Russell 2000 Index soared higher by over +5.0% (its second-best week of the year) as a soft-landing scenario for the U.S. economy now looks more achievable if inflation can continue to moderate in the months ahead and interest rates stabilize.

All eleven S&P 500 sectors finished the week positively. Notably, major sector outperformance came from the deeper cyclical areas of the market, which have substantially trailed mega-cap Tech all year. Real Estate (+4.6%), Materials (+3.7%), and Consumer Discretionary (+3.4%) led stocks higher last week, as disinflationary trends currently running across the economy relieved some of the lingering recessionary concerns that had weighed on stock prices since late July. Simply, U.S. stock averages are seeing their best month in over a year because disinflation trends are beginning to look more obvious to a greater number of investors. After three months of fretting over lingering inflation fears, higher interest rates, and looming recession risks, investors received several economic updates last week suggesting those concerns may have been overstated.

“After three months of fretting over lingering inflation fears, higher interest rates, and looming recession risks, investors received several economic updates last week suggesting those concerns may have been overstated.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Importantly, consumer inflation fell more than expected in October and sits at levels not seen in more than a year. Whether measured monthly or annually, consumer inflation continues to fall towards the Fed’s desired targets. Notably, core inflation (ex-food and energy) is moderating across a host of areas, helping to relieve price pressures across a range of goods and services. On the wholesale side, producer price inflation continued to fall last month, while October retail sales fell slightly month-over-month, with notable drops in auto sales, furniture, department stores, and sporting goods and hobbies. Here, continued easing of wholesale price inflation could translate into lower consumer price inflation in the coming months. Combined with slowing but healthy consumer spending trends, the inflation updates added evidence that Fed actions over the last several quarters are slowly but surely having their intended consequence of helping curb price pressures while cooling demand. And while employment trends remain firm in the U.S., continuing jobless claims last week hit their highest level since November 2021, adding further evidence the job market is cooling off gradually. Whether across employment, retail sales, CPI, or PPI, the story is becoming clearer — the trend across each continues to paint a picture of moderation and a steady decline toward normalized levels. In our view, this is exactly what policymakers and bullish investors want to see if a soft landing remains in the cards and why U.S. stock averages again moved higher last week.

As one might expect, with last week’s data pointing to easing inflation pressures and a still healthy economic backdrop, U.S. Treasury yields moved lower. Both 2-year and 10-year U.S. Treasury yields retreated last week, with the inverted spread between each now un-inverting by more than 50 basis points since late July. Helping ease rate pressures on the short end of the yield curve last week was decreasing odds the Fed would raise rates in the months ahead, and policymakers could cut rates sooner than expected, given recent economic trends. The market now sees the current fed funds rate of 5.25% - 5.50% as this cycle's highwater mark. But after last week’s economic prints, Fed watchers now see a nearly 30% chance Fed Chair Powell and company could cut rates by 25 basis points at the March meeting, up from 7.0% one month ago.

Interestingly, over 80% of the market now believes rates will be lower by June next year, with a nearly 40% chance the fed funds rate will stand at 4.75% - 5.00% or lower by the middle of 2024. Bottom line: We believe easing inflation and slower economic growth in the coming months and quarters will likely take pressure off the Fed to keep pressing rates higher. Such a soft-landing scenario may even allow policymakers to take back some of their recent rate hikes next year to relieve slowing momentum across the economy should inflation continue to decline. In our view, such a scenario built a little more credibility last week, even though we would caution that expecting rate cuts in the early part of next year still seems like a stretch. Nevertheless, it is becoming more obvious that the delayed effects of higher rates are starting to kick in, inflation is trending lower, and the economy is slowing yet remains on firm ground. And although it remains a big ask of the Fed to land a nearly $28 trillion U.S. economy into a soft landing with the blunt instrument of rate policy, and without causing a downturn, that’s exactly what investors appeared to be banking on last week. Thus, stock prices moved higher, and bond yields fell.

In other items of interest last week, Gold ended higher by +2.2%, and West Texas Intermediate (WTI) crude dropped 0.6% for its fourth consecutive week of declines. Crude prices now sit at their lowest levels since early July. Additionally, the U.S. dollar lost ground against other major world currencies. On the corporate profit front, the Q3 earnings season largely ended with retailers like Walmart and TJX pointing to a cautious consumer, increasingly becoming more cost-conscious and sensitive to discounts. Notably, Walmart pointed to ebbing inflationary pressures, which could prompt lower prices in some categories in the months ahead. In Washington, the House and Senate passed a novel two-step stop-gap measure that avoids a U.S. government shutdown and funds agencies into early next year. And finally, President Biden and China President Xi Jinping met face-to-face last week for the first time in a year. Both men agreed to restore military communications and cooperate in areas of AI, climate change, and curbing fentanyl. While the dialogue between both didn’t break new ground, they engaged in dialogue, nonetheless. Open communication has been lacking between the two economic superpowers for several years, and more open and frequent dialogue (which both sides agreed to pursue) may open the door for more groundbreaking cooperation in the future.

The week ahead

Over the shortened Thanksgiving holiday week, investors will receive updated looks on October Leading Indicators (Monday), October Existing Home Sales (Tuesday), preliminary October Durable Orders (Wednesday), the latest FOMC Minutes (Wednesday), and looks at preliminary November manufacturing/services activity (Friday). Note: U.S. markets will be closed for Thanksgiving on Thursday and will see abbreviated sessions on Friday.

On the market and positioning side, the S&P 500 Index starts the week above all its major moving averages and currently sits at its highest levels since early September. Notably, the Index is up nearly +10.0% from its late October low and is now just 2.0% away from its 52-week high touched in late July. And while the market’s good vibes over the last few weeks are certainly a welcome break from the downtrend in the prior three months, stocks have quickly moved from a near-term oversold condition to overbought. For example, Bespoke Investment Group recently noted that the NASDAQ Composite has made a four standard deviation move from being extremely oversold to extremely overbought in a matter of just fifteen trading days. There have been only fifteen other such occurrences for the NASDAQ since 1972. Notably, the Index’s historical performance after such events has generated significant above-average returns over the next one-month, three-month, six-month, and one-year periods. Though history is not an indication of future returns, we would argue that the current macroeconomic narrative has quickly shifted from extreme pessimism to something far less ominous for the markets, economy, and profits. Hence, there has been a quick shift in stock prices over the last handful of trading days.

Granted, incoming data that reflects inflation unexpectedly breaking its downward-sloping trend or the U.S. economy falling off more severely than expected could quickly shift sentiment back to a pessimistic tone. This would likely again weigh on stock prices. Yet, trends across inflation, employment, economic activity, and corporate profits have generally supported taking a more balanced view of macro conditions this year and one that has forced bearish investors to reassess their views. In our eyes, digging in on the narrative that it’s only a matter of time before the sky falls is becoming harder to justify, particularly against increasing data showing the economy remains firmly on a normalization trend. And if one’s allocation and positioning has become so defensive (e.g., too much cash) over the course of the last nearly 24 months that they cannot participate in anything but a downdraft in the economy and markets, they are not positioned correctly, in our view. As such, these investors should work with their financial advisors to realign their portfolios with their goals, risk tolerance, and time horizon. It’s a good time to start thinking about next year and at least begin to formalize a strategy to get back on side if concerns about the future have taken your portfolio off track.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.