Stocks had begun to price in a “10/30 World” until U.S. courts got involved. Now what?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 2, 2025

U.S. stock averages advanced higher last week and finished May with strong gains. NVIDIA posted impressive results for the prior quarter and emphasized it sees strong structural demand for its suite of artificial intelligence products moving forward. Notably, a U.S. court struck down President Trump's sweeping tariff strategy, casting doubt on how the White House plans to proceed.

Jobs. Jobs. Jobs. That's the focus for this week, with incoming employment data providing an important check-in on the health of U.S. labor conditions following weeks of market volatility and trade and economic uncertainty.

Last week in review:

-

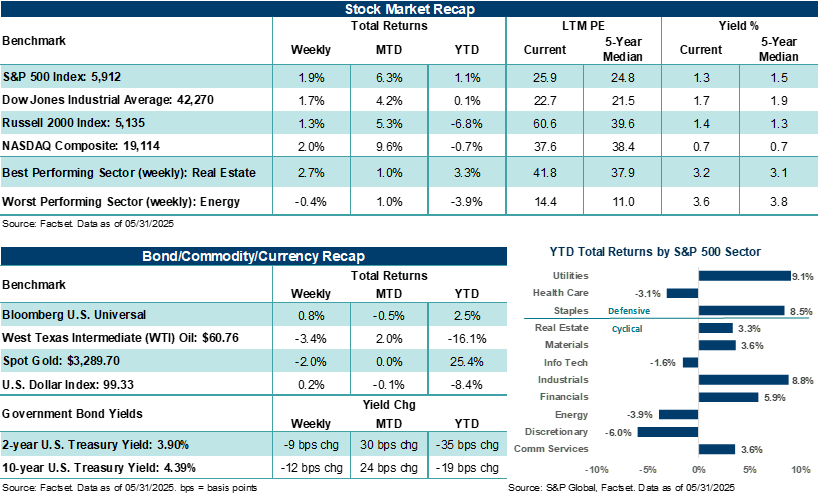

The S&P 500 Index rose +1.9% last week and finished higher by +6.3% in May. The Index posted its best month of performance since November 2023 and its best May since 1990.

- The NASDAQ Composite rose +2.0% on the week and advanced by +9.6% in May. A strong rebound across Technology and tech-related areas fueled gains last month.

- The Dow Jones Industrials Average and Russell 2000 Index posted solid gains last week as well as for May.

- U.S. Treasury yields slipped lower last week. However, Treasury yields across the curve were sharply higher in May as Fed rate cut expectations softened and concerns about longer-term deficit spending increased.

“Whether or not one agrees with the approach, the Trump administration believes that the use of tariffs is its silver bullet. Thus, the overhang of tariffs, ongoing trade frictions with key trading partners, and increased use of less understood workarounds by the White House to implement pressure are areas of uncertainty that are likely to stick around over the intermediate term.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- In May, The U.S. Dollar Index and Gold ended essentially flat, while West Texas Intermediate (WTI) crude gained +2.0%.

- Earnings reports from NVIDIA and Salesforce mostly impressed last week, while a batch of retail earnings came in mixed, with some retailers cutting guidance given tariff headwinds.

- Lastly, a second look at Q1 GDP was revised higher to -0.2% from -0.3%, April core PCE came in as expected, and Consumer Confidence jumped higher in May, increasing for the first time in five months. The May FOMC minutes offered few surprises, indicating the Fed will take a cautious approach when determining forward rate policy.

Stocks were beginning to price in a "10/30 World", that is, until U.S. courts became involved. Now what?

As we noted above, U.S. stocks posted impressive returns in May. Easing trade tensions (e.g., the U.S. and China temporarily halting their trade embargo on one another), solid Q1 earnings report with mostly better-than-expected outlooks, and an improvement across investor and consumer sentiment all contributed to helping lift stock prices last month.

Yet, since President Trump made his first tariff announcement on Canada and Mexico in February, a predictable pattern of behavior from the President has emerged, and one that investors finally figured out last month. As it pertains to tariffs, the script largely goes like this. First, President Trump puts out an aggressive tariff threat, often through social media, that contains a confusingly large levy against a country or countries, combined with an effective date that is usually right around the corner. Second, markets react, often negatively, which typically helps elicit dialogue with interested parties. Third, some temporary arrangements are struck between the U.S. and said interested party or parties so dialogue can continue, and the tariff threat is either rolled back or delayed for a stated period. Bottom line: This 1,2,3 step script quickly became a dynamic that investors began to count on when it came to Trump and tariffs.

Whether right or wrong, investors had become comfortable (possibly complacent) with the idea that the new 10% universal tariff rate that was put in place in April was likely to remain in place for most of the world, outside of China, which would see an additional 30% tariff rate — hence a new 10/30 World. Under this construct, the global economy would likely see reduced odds of a recession versus what the Trump administration originally proposed on April 2. Businesses would eventually find ways to operate around the tariffs that didn't entirely disrupt supply chains. And headwinds to growth, profits, and inflation would likely be manageable. The bonus? If bilateral trade negotiations between the U.S. and other countries eventually lead to tariff rates lower than what is currently in place — even better. Nevertheless, the general thinking among investors in May was that the current tariff landscape was likely as bad as it was going to get, outside of a few temporary bumps as talks played out. Under the surface of the market-moving tariff headlines and barrage of earnings releases last month, we believe this idea of a "manageable tariff environment" also helped lift stock sentiment in May, that is, until last Wednesday.

Notably, the U.S. Court of International Trade struck down tariffs imposed under the International Emergency Economic Powers Act (IEEPA). The decision includes the 10% universal tariffs, the 20% incremental tariff rate on China, and the 25% tariff on non-USMCA-compliant imports from Mexico and Canada. The ruling does not include sectoral tariffs, such as the tariffs placed on steel, aluminum, lumber, and semiconductors. The Trump administration quickly filed an appeal, and the case could ultimately go to the Supreme Court for a final ruling. In the meantime, a federal appeals court has allowed for an administrative stay, which keeps all tariffs in place "as is" for the time being.

Moving forward, the Trump administration has several levers it can pull to keep tariff pressures in place (but with likely modifications), including using and broadening Sections 232, 301, 122, and 338. Notably, President Trump loves the use of tariffs and the unorthodox role they play in his economic strategy, as well as helping produce leverage with countries and companies when attempting to reshape trade practices and agreements. In our view, last week's court setback, or even if the Supreme Court eventually upholds the Court of International Trade decision, is not going to change this point.

Bottom line: President Trump is looking to rewrite the rules of global trade, has a vision for reviving manufacturing in the U.S., wants to pressure China, and needs to find revenue to pay for other fiscal priorities that are important to his administration (e.g., maintaining current tax policy for most, while lowering taxes in areas for some). On that last point, the Congressional Budget Office does not consider revenue raised from tariffs as helping pay for the House's recent One Big Beautiful Bill Act, which now sits in the Senate. However, revenue raised by increased tariffs has provided political cover for the GOP's proposal that could add nearly $3 trillion to the U.S. deficit over the next decade.

Whether or not one agrees with the approach, the Trump administration believes that the use of tariffs is its silver bullet to help accomplish all of the above. Thus, the overhang of tariffs, ongoing trade frictions with key trading partners, and increased use of less understood workarounds by the White House to implement pressure are areas of uncertainty that are likely to stick around over the intermediate term.

And while the U.S. may still ultimately be headed for some version of a 10/30 World, consisting of an increased but stable tariff environment, further legal challenges and a more complex trade road to navigate could prompt President Trump to make unexpected U-turns that challenge growth and profits over the intermediate term. Doubling steel tariffs to 50% from 25% starting on June 4 and Trump saying China is violating the temporary trade truce are just the most recent examples.

Outside of clear and visible drivers across Tech and the AI theme that could help buoy a small set of stocks moving forward, the broader market may continue to see a ceiling on how much higher it can run over the near term due to increased trade uncertainties and elevated stock valuations. That said, given solid overall economic and profit conditions in the U.S., we would be a long-term buyer of the broader market should stocks see increased volatility heading into quarter end.

The week ahead:

-

Friday's nonfarm payrolls report is expected to show that the U.S. economy added 127,500 jobs in May while the unemployment rate held steady at 4.2%. Tuesday's April Job Openings and Labor Turnover Survey and Wednesday's May ADP report will provide additional checks on the labor market, which has remained healthy in 2025.

-

May ISM manufacturing (Monday) and ISM nonmanufacturing (Wednesday) will provide notable updates on second quarter economic activity. Both measures are expected to increase from April levels.