Stocks climb wall of worry as investors reserve judgement on trade and tariffs (for now)

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 9, 2025

Stocks finished higher for the second consecutive week, with the S&P 500 Index closing Friday +20.0% above its April 8 post-Liberation Day low.

This week, fresh May looks at consumer and producer price inflation in the U.S. will help set the table for the Federal Reserve meeting the following week where policymakers are widely expected to leave rates unchanged.

Last week in review:

-

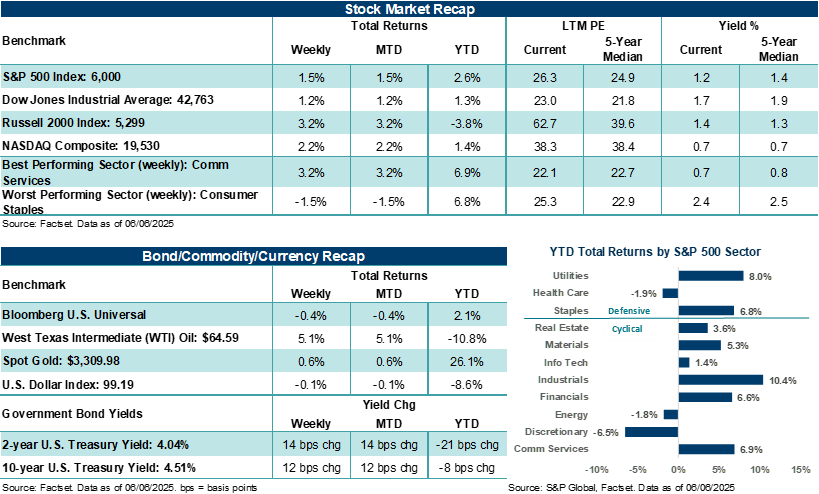

The S&P 500 Index and NASDAQ Composite gained +1.5% and +2.2%, respectively. The Dow Jones Industrials Average rose +1.2%, and the Russell 2000 Index advanced by +3.2%.

-

U.S. Treasury yields moved higher across the curve as prices fell. The 30-year Treasury yield finished just below 5.0%.

- Gold moved higher, and the U.S. Dollar Index finished essentially flat. West Texas Intermediate (WTI) crude ended higher by +5.1%, its best week since November, and after OPEC+ members raised output less than expected.

- President Trump and China President Xi Jinping spoke over the phone and agreed to begin a new round of trade talks.

- May nonfarm payrolls rose +139,000, stronger than the +130,000 expected. The unemployment rate held steady at 4.2% last month. However, April and March payrolls were adjusted lower by a combined 95,000. Job openings in April came in stronger than expected, while May ADP private payrolls materially missed estimates, growing at their slowest pace since March 2023. Though labor conditions in the U.S. sit on firm ground, trends are slowing.

“With corporate earnings reports out of the way and investors somewhat de-sensitized to trade headlines, at least until the July reciprocal tariff deadline comes into view, stock momentum might be tilted higher as the quarter comes to a close. That said, stretched valuations and overbought technical indicators in some areas suggest even if major averages were able to crack new highs soon, holding them may be difficult over the near term.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- ISM manufacturing and ISM services activity ended May in contraction. Services activity hit its lowest level since June 2024, while manufacturing activity weakened to November 2024 levels.

- Lastly, the Congressional Budget Office calculated that the GOP's One Big Beautiful Bill Act would add $2.42 trillion to U.S. budget deficits over ten years. The figure sparked a very public falling out between President Trump and Elon Musk.

Stocks climb a wall of worry toward new highs as investors decide to reserve judgment on trade and tariffs for now.

Conventional wisdom, including our own perspective, has pointed to the increasing difficulty major U.S. stock averages might face progressing toward previous all-time highs given the already strong gains seen since the April lows and still cloudy outlook for trade and growth. Not to mention all the crosscurrents currently moving through economic updates as of late. For example, manufacturing and services activity showed mixed results in May depending on the measure, employment trends remain solid but showed signs of weakening in both April and May, higher income consumers are turning more cautious, and retailers and auto companies are increasingly pointing to tariffs and higher costs as pending threats to their businesses in the second half. Did we mention that the Atlanta Federal Reserve's GDPNOW tracker is currently forecasting second quarter growth of +3.8%? Though the outsized growth estimate is largely due to extreme changes in imports, reading the tea leaves and making assumptions about where the economy is headed in the second half has become challenging and, dare we say, a little humbling.

Nevertheless, the S&P 500 Index finally broke out of its near-term trading range last week, crossed 6,000 for the first time since February 24, and is less than 3% away from its February 19 all-time high. Similarly, the NASDAQ Composite is also approaching its December all-time high, finishing last week roughly 3.0% below the threshold. Bottom line: With corporate earnings reports out of the way and investors somewhat de-sensitized to trade headlines, at least until the July reciprocal tariff deadline comes into view, stock momentum might be tilted higher as the quarter comes to a close. That said, stretched valuations and overbought technical indicators in some areas suggest even if major averages were able to crack new highs soon, holding them may be difficult over the near term.

Most would argue that the current macroeconomic environment (including outlooks for economic activity and corporate profits in the second half) looks a lot less certain than it did on February 19. So, why on earth would the S&P 500 trade near all-time highs today? Since we're also grappling with that question, we'll share our conclusion as it currently stands. In a nutshell, and after a rollercoaster ride for most of the first half this year, we believe investors have finally decided the best path forward is to reserve judgment on what all the White House trade situation and Washington wrangling over a reconciliation bill ultimately means for growth and profits. In our view, stocks largely reflect a let's wait and see what happens approach.

Despite growth trends slowing, most measures of economic activity, including employment, have shown incredible resilience through the first five months of the year. Inflation trends, outside of what we see in this week's May updates, have also been moving in the right direction in 2025. Importantly, first quarter profit growth among S&P 500 companies was almost double what analysts forecasted at the end of March. Yes, second and third quarter S&P 500 profit estimates fell meaningfully during the latest earnings season, and company outlooks were certainly guarded in several industries, including across travel, retail, auto, and certain cyclical areas. But strong and secular profit tailwinds across Technology and artificial intelligence were reaffirmed by key companies in April and May, leading to investors using this year's dislocation across Big Tech as a rare opportunity to buy high-quality assets with visible drivers to growth on sale. Over time, money generally moves to places where it will be treated best. Based on the latest earnings updates, Tech and tech-related areas appear where investors believe their money will be most loved and respected.

Not surprisingly, over the last month, Communication Services is higher by +11.6%, and Information Technology is up +10.1% – materially outperforming the +6.0% return in the S&P 500 over the same time frame. Bottom line: A rekindling of interest across Big Tech heading into quarter-end may prompt some investors and traders to chase gains, which could help propel major averages like the S&P 500 and NASDAQ Composite to new all-time highs this month. But then what?

In our view, that's really the most important question investors should be asking right now. If we do get to all-time highs this month, what comes next? As we mentioned, investors currently appear comfortable reserving judgment on trade and tariffs. Major U.S. stock averages are back to levels they were before the tariff drama began. As a result, stock valuations are also more or less back to pre-tariff levels, which are elevated again. Economic and profit forecasts for this year are mostly lower than where they were in February. Still, most see reduced odds of a recession compared to April forecasts, and profit growth is expected to remain positive in 2025. Thus, given the back-and-forth and unpredictability of the White House tariff strategy over recent months, it isn't unreasonable for investors to send stocks back to a neutral point and to a level before tariff conflicts ramped higher. Of course, not every market, sector, asset, or region falls under this construct, but we think readers catch our overall drift.

Bottom line: Evolving trade conditions over the summer, second quarter earnings updates starting in July, and whatever comes out of Washington will most likely create new bouts of volatility as we move through the third quarter. However, uncertainty about the future is a constant in the market. At some point in "high uncertainty environments," investors finally decide to discount the big market-moving unknowns of the day, assign reasonable growth expectations for the future based on what they can see at present, and then react to changes in those forecasts as more information becomes available. Given what markets have endured over the last five months and considering conditions in the U.S. still sit on firm ground, it becomes a little easier to see why investors have taken some major U.S. stock averages back near levels they sat before all the tariff drama began. Obviously, we'll have to see over the coming weeks and months if that was the right call. As we have noted many times in commentary over the last few months, following a balanced and well-diversified investment strategy is usually the best way to navigate through these types of periods.

The week ahead:

-

The U.S. and China will hold trade talks in London starting on Monday. Markets will be watching carefully for developments that can help de-escalate trade tensions and keep aggressive tariffs at bay.

-

Lower gasoline prices could help headline May Consumer Price Index (Wednesday) hold steady on a month-over-month basis. However, ex-food and energy, as well as annualized rates, are expected to move higher on base effects.

- A preliminary look at June University of Michigan consumer sentiment (Friday) is expected to move higher off its 34-month low seen in April and May. Markets will be looking to see if falling inflation and recession concerns in the latest Consumer Confidence report had knock-on effects in the Michigan survey.