Q4 market outlook: Will stocks finish the year strong?

Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

Oct. 14, 2024

Stocks climbed to new highs in the third quarter of 2024, bolstered by interest rates cuts and increasing investor optimism that the U.S. economy can avoid a recession. But can stocks keep climbing through year-end?

Below, we explore what could keep the momentum in the market going — and what could stand in its way. Here’s our Q3 recap and Q4 outlook:

A look back at Q3: Impressive gains in a tough landscape

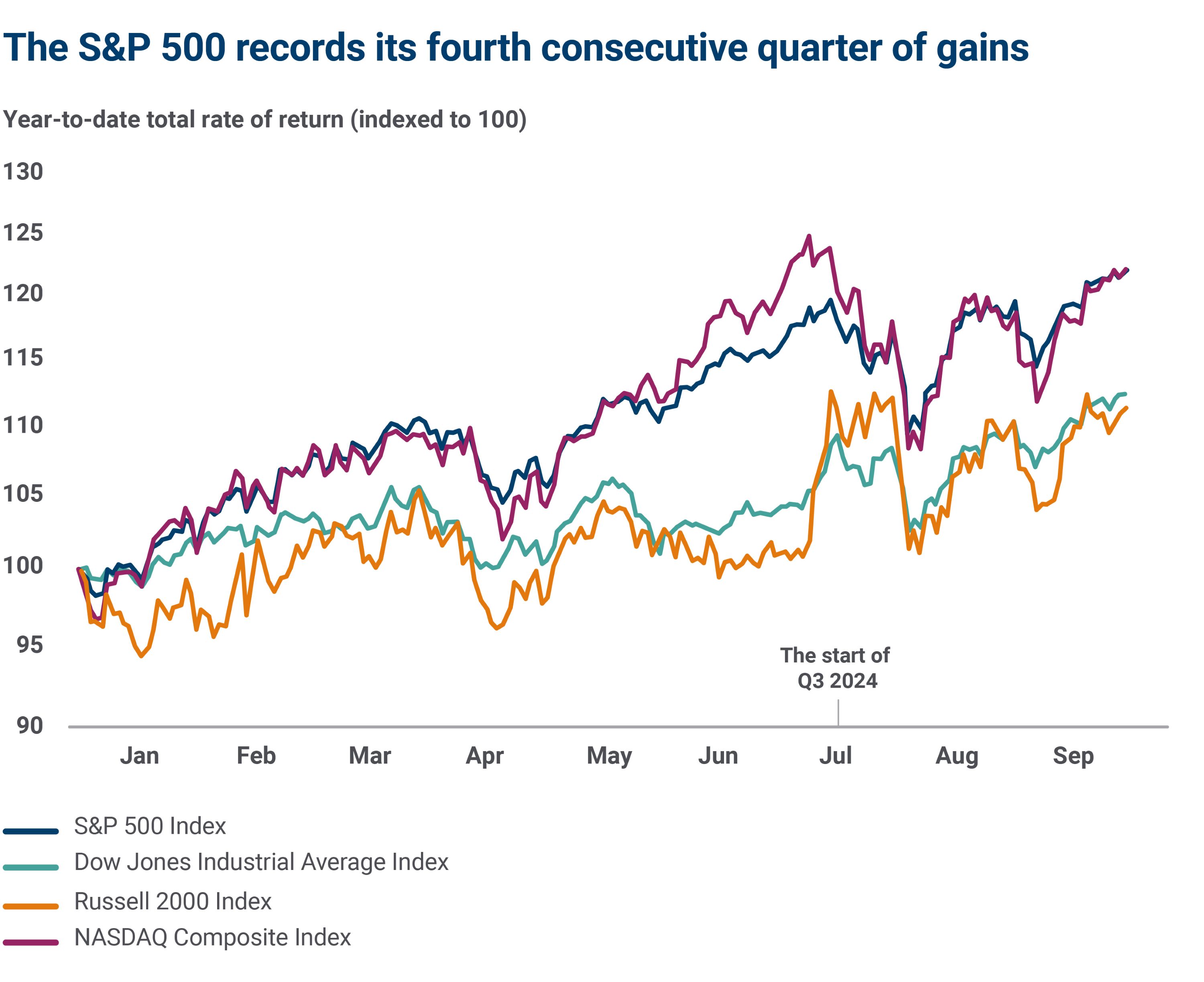

Source: FactSet, data as of Sept. 30, 2024. This example is shown for illustrative purposes only and is not guaranteed. Past performance is not a guarantee of future results. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Overall, the stock market continued to climb in Q3, although there were a few market surprises along the way. In particular, stocks remained resilient during the month of September, which is historically a more volatile period for equities.

Here’s a look back at the highlights:

- Major U.S. stock averages faced two bouts of volatility, both in July and August. In July, weaker-than-expected jobs data accelerated concerns that U.S. labor trends were slowing more rapidly than many assumed, causing some investors to fear the Federal Reserve might have left interest rates too high for too long. In August, an aggressive unwind of some institutional carry trades, driven by an unexpected rate hike from the Bank of Japan, disrupted global stocks for a brief period.

- The drawdowns were temporary, with both the Dow Jones Industrial Average and the S&P 500 Index bouncing back quickly and impressively. The S&P 500 Index finished the third quarter higher by +5.5%, notching its fourth consecutive quarter of gains and the seventh positive quarter in the last eight. Overall, the S&P 500 ended September higher by over +20% year-to-date. Notably, the broad-based U.S. stock benchmark finished its best first nine months of the year (in an election year), going all the way back to 1950. Meanwhile, the Dow Jones Industrials Average outperformed the S&P 500 in Q3, rising a healthy +8.2%. The S&P 500 and Dow finished September higher for the fifth straight month, with the S&P 500 logging its first positive September since 2019.

- More companies outside of tech began to participate in the stock market rally. The NASDAQ Composite rose +2.6% in the third quarter and finished September higher by nearly +22% year-to-date. Although the tech-heavy index performed well heading into the end of September, it was unable to reclaim its early July peak by the end of the third quarter. Interestingly, the narrow leadership of Big Tech, which drove equity markets higher through much of the first half, began to broaden in the third quarter, marked by a shift in stock leadership to cyclical/defensive areas outside of technology, including utilities, real estate, industrials and financials.

- The Fed’s September rate cut was a bright spot for the market — particularly for small-cap stocks. The Russell 2000 Index rose nearly +9% in Q3, finishing higher by over +12% year-to-date through September. A broadening stock rally, lower interest rates and growing prospects for an economic soft-landing helped increase optimism for small-cap companies in Q3, which have notably trailed their larger-cap/growth-focused peers this year.

A look ahead at Q4: Cautious investor optimism

Looking ahead to the rest of the year, here’s an overview of the tailwinds and headwinds that could support or detract from the durability of the recent market rally:

The bull case

- The U.S. economy and corporate profits should continue to grow through the rest of 2024. Economically, U.S. consumer and business activity continued to show signs of healthy moderation in Q3, with inflation ebbing lower and labor/spending/savings trends slowing but remaining on firm footing throughout the quarter. Importantly, corporate profits grew at a healthy clip in the first half and are expected to continue to grow in the second half. Notably, labor conditions should remain healthy, implying rapid changes in consumer spending are unlikely to occur outside of an unforeseen event shock. Bottom line: The macroeconomic backdrop could remain solid and supportive for asset prices in Q4, outside of periods of brief volatility, in our view.

- Inflation and interest rates are on a trajectory to move lower. After lowering its policy rate by a “jumbo sized” 50 basis points in September, the Federal Reserve is likely to cut its policy rate by at least another 50 basis points before year-end. The recent rate cut was the Fed’s first since 2020 and likely ends an aggressive rate-hiking cycle designed to tamp down elevated inflation. Based on Fed projections, policymakers are likely to continue cutting rates through year-end and into next year, which could be supportive for growth and labor moving forward.

- Average monthly returns for the S&P 500 in Q4 are some of the strongest of the year. While some weak seasonality factors can play out early in the quarter, the S&P 500 has averaged a +4.2% return in the fourth quarter since 2000 and averaged a +9.8% Q4 return over the last five years.

The bear case

- The risk of an unexpected economic downturn has not gone away. While the prospects of a negative economic surprise ebbed lower in Q3 quarter, they were not eliminated given still-stressed consumer and small business conditions. For example, spending has become more discerning among consumers and high interest rates continue to weigh on small businesses.

- Stock valuations are near the top of their historical range. While areas outside of Big Tech have valuations that are less stretched, we believe a lot of the good news about the economy, interest rates and profits are priced into expectations. Moving forward, fundamentals may need to catch up with expectations, which could leave some room for disappointment in Q4 if conditions don't align with the outlook.

- Political uncertainty can bring market uncertainty. Several asset categories, including stocks, are currently priced for divided government following the Nov. 5 U.S. elections. While the odds are low, one-party control in Washington post-election could increase market volatility, as well as uncertainty around the results of the presidential race and down-ballot contests. A close election where winners are not immediately known, or legal battles that keep the future makeup of Washington in question for a period, also have the potential to increase market volatility post-election. Importantly, investors should be aware that these types of scenarios are likely to have only a temporary impact on markets. Once results are final, the market will likely shift its focus back to the fundamental factors that move stock prices longer-term (e.g., economic growth, corporate profits and the level of interest rates).

- Middle East tensions could continue to escalate, which exposes the market to elevated "event shock" risk. For example, an unexpected and sudden spike in oil prices (potentially caused by supply disruptions in the Middle East) could suddenly slow global economic growth more than expected, causing corporate profits to fall, which then leads to lower stock prices as profit forecasts for the future decline. While this type of geopolitical event can't be planned for and seldom is discounted into stock prices prior to occurring, it's a risk investors should understand, given U.S. stocks sit near all-time highs.

Bottom line

In our view, investors should maintain a somewhat optimistic view of the U.S. economy and financial markets heading into year-end, while also recognizing that risks to growth remain somewhat elevated despite stable economic and corporate profit conditions today. As investors navigate the final months of the year, they may want to consider consulting with their Ameriprise financial advisor on the following strategies:

- Investing in opportunities across cyclical areas inside/outside of technology

- Putting excess cash back to work in the market during potential periods of market stress

- Locking in higher interest rates across bond allocations

High interest rates, elevated inflation, slowing activity and rising geopolitical frictions leave little room for error and, in our view, call for a balanced/well-diversified portfolio approach heading into the end of the year.

Meet with your financial advisor before year-end

The final months of the year are a smart time to connect with your Ameriprise financial advisor, who can help you stay on track with important year-end financial tasks. They can help identify investment opportunities (like the ones mentioned above) that may benefit you and help you appropriately position your portfolio for the year ahead.