Potential impacts of Israel-Iran conflict on markets and investments: What investors need to know

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 23, 2025

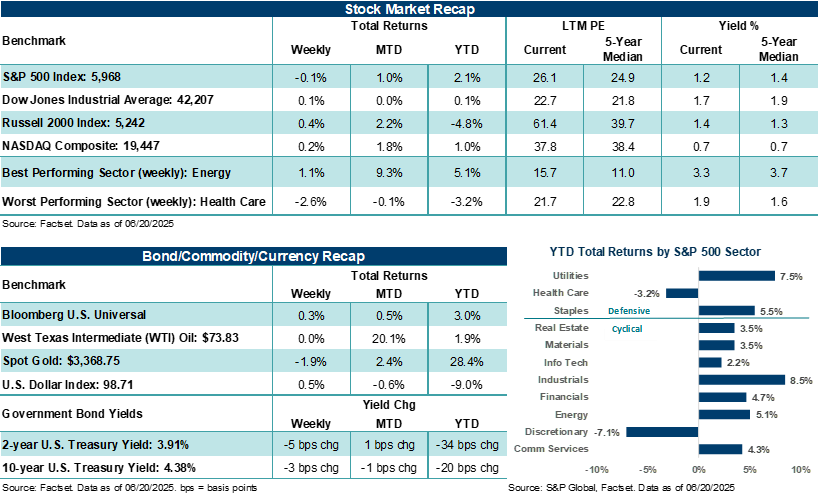

Major U.S. stock averages finished last week mixed. As expected, the Federal Reserve left interest rate policy unchanged, and the Israel-Iran conflict continued to weigh on investor sentiment.

This week, investors will receive preliminary looks at June manufacturing and services activity as well as a host of data on housing, consumer confidence, and the Fed's preferred inflation measure. Overseas, ongoing developments in the Middle East, including potential responses to the U.S. striking Iran's nuclear facilities on Saturday, will be carefully watched.

Last week in review:

- The S&P 500 Index, as well as the Dow Jones Industrials Average, closed essentially flat on the week. The NASDAQ Composite and Russell 2000 Index eked out fractional gains.

- U.S. Treasury prices were firmer across the curve as yields dipped lower.

- The U.S. Dollar Index notched higher, Gold moved lower, and West Texas Intermediate (WTI) crude ended flat after last week's +13% lift following Israel airstrikes on Iran.

- The Federal Reserve left its policy rate unchanged at 4.25% - 4.50%, which was widely expected. The Fed held its policy rate steady for the fourth straight meeting. In its latest economic projections, the Fed forecasts GDP growth this year to slow more than expected versus its March projection. The Committee also sees inflation rising this year more than previously thought due to tariffs. Fed Chair Powell noted that economic conditions remain solid, and that the Fed has time and space to monitor trade impacts, including ample room to support growth if needed.

“We have seen no evidence thus far that the Israel-Iran conflict, even with limited American involvement, would contradict decades of precedent. In our view, when geopolitical events cause investor anxiety to rise, the most prudent course of action is often do nothing and lean on a well-constructed, well-diversified portfolio.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- May retail sales came in below estimates, driven by weaker new car sales (due to front-loading ahead of tariff announcements) and a drag from lower gasoline prices.

- Trade discussions between the U.S. and European Union (EU) have intensified ahead of the July 9 deadline. Reports noted that EU officials appear broadly resigned to accepting the 10% baseline reciprocal tariff rate as a strategy to avoid higher duties on critical exports, such as autos, pharmaceuticals, and electronics. However, EU officials pushed back on those reports, highlighting a still uncertain trade environment heading into the July deadline.

What investors need to know regarding the Israel-Iran conflict after the U.S. strikes key Iranian nuclear installations.

On June 12, Israel launched Operation Rising Lion, a campaign designed to cripple Iran's nuclear and military infrastructure. Prior to Israel's air attack on Iran, military intelligence suggested Tehran was close to acquiring the capabilities to enrich uranium to levels that could be weaponized. However, since the campaign's launch, Israel has severely dismantled Iran's air defenses, killed top military commanders and nuclear scientists, likely set back Iran's nuclear program several years, undermined Iran's regime economically, and, on Saturday, further entangled the U.S. into Middle East tensions.

Until Saturday, U.S. intervention in the Israel-Iran conflict had been limited to helping Israel defend itself from incoming missile and drone attacks from Iran and its proxies in the area. Last week, President Trump approved a plan that would involve the U.S. assisting Israel militarily in further dismantling Iran's nuclear capabilities but stopped short of making a final decision on whether to attack and instead opt to allow more time for peace talks and negotiation. Yet, on Saturday, President Trump launched Operation Midnight Hammer, using American military air superiority to bomb three of Iran's key nuclear sites. From the American perspective, an outcome that eliminated Iran as a nuclear threat and did not require the U.S. to get involved militarily was most preferable. However, Iran vowed not to surrender, and meaningful peace talks over recent days seemed out of reach based on various reports. In addition, Israel was unlikely to stop short of fully dismantling Iran's nuclear capabilities (even if they had to do so alone), given it had already crossed several previous barriers of attack that just a few years ago would have been unimaginable to most geopolitical experts. Bottom line: President Trump opted for a military solution on Saturday that would further disarm Iran's nuclear capabilities that only America's military could provide, and possibly, as a means to reduce Israel's need to continue its air attack on Iran, which could further destabilize the region over time.

While evolving conditions in the Middle East are very difficult to predict, we believe investors should have a working understanding of how the Israel-Iran conflict, and now with American involvement, might affect the broader market and underlying investments over the very near term and longer term.

- Through the end of last week, the U.S. stock market appeared to be in a state of withholding judgment on a variety of issues, including tariffs, trade, economic and profit impacts, and, most recently, the Israel-Iran conflict. Although the S&P 500 Index appeared poised to approach its February high earlier this month, Israel's attack on Iran had stalled its approach. Nevertheless, historically, investors tend to take geopolitical events, like war and acts of violence, in stride if they have limited global economic impacts. As of last Friday, impacts from the Israel-Iran conflict on oil supply had been limited (e.g., Iran produces just 3% - 4% of the world's oil supply), and attacks remained contained and mostly focused on strategic targets. Moving forward, if Iran chooses to retaliate by attacking American interests, oil facilities in the region, and/or the conflict escalates into a broader campaign, stocks could see temporary pressure, and oil prices would likely rise meaningfully.

- Importantly, disruptions to the supply of oil, including Iran aggressively targeting the Strait of Hormuz, could see global markets, including in the U.S., react much more negatively for a period. Notably, one in five barrels of the world's oil supply runs through the Strait of Hormuz. In a more extreme scenario, where Iran's regime believes there is an existential threat to its survival, Tehran may choose to aggressively attack the Middle East's most strategically important shipping lane. Shipping rates across the narrow waterway had already doubled before American involvement. From Iran's perspective, drone and missile attacks and other disruptive techniques across the Strait of Hormuz are a low-cost, highly effective way to destabilize the region. Under such a scenario, we believe crude prices would temporarily accelerate higher and could briefly threaten global growth. That said, such a provocative action from Iran (if sustained) would likely come at a high cost and increase the odds that the U.S. military becomes more deeply involved. Such events could actually speed up the demise of Iran's centralized leadership, which is why Tehran and its proxies often stop short of causing more disruption in the Strait of Hormuz when Middle East tensions rise. Yet, with Iran, Hamas, and Hezbollah severely weakened by Israel over the last few years and Iran's nuclear capabilities under extreme threat, conventional wisdom applied in this unique circumstance might not wholly apply.

- Speaking of U.S. involvement, military intervention appears limited for now and specifically tailored to Iran's nuclear capabilities. Direct U.S. military involvement certainly ups the stakes in the Israel-Iran conflict. It could temporarily increase stock volatility should investors believe the odds of the conflict broadening across the Middle East are on the rise. That said, a limited, one-time strategic U.S. military attack on Iran's nuclear facilities, like seen on Saturday, might not have a dramatic effect on U.S. stock prices longer-term, particularly if Iran and regional responses are limited and do not elicit further military action from the U.S. The best-case option for the market and investors over the near term is that Israel-Iran violence soon ends, some form of an Israel-Iran truce or peace agreement is brokered, and the U.S. avoids getting further involved militarily.

- Finally, outside of some very dire outcomes from the latest Middle East flare-up, investors should avoid making large changes to their portfolio based on the current Israel-Iran conflict. Stocks have a long history of eventually looking through Middle East violence (sometimes quickly), even when the U.S. gets involved. The Gulf War, Afghanistan War, Iraq War, and the ISIS conflict provide decades of examples that include heavy U.S. military involvement in the Middle East. In every instance, markets persevered, eventually re-focusing on what matters most to investments – that is the level of growth in the economy and corporate profits as well as the level of interest rates. We have seen no evidence thus far that the Israel-Iran conflict, even with limited American involvement, would contradict decades of precedent. In our view, when geopolitical events cause investor anxiety to rise, the most prudent course of action is often do nothing and lean on a well-constructed, well-diversified portfolio.

The week ahead:

- A heavy week of economic data should show a slowing U.S. economy with little effect from tariffs thus far. Preliminary looks at June manufacturing and services activity (Monday) are expected to decelerate slightly from May levels, while a final look at Q1 GDP (Thursday) is expected to remain unchanged at -0.2%.

- The May Personal Consumption Expenditure (PCE) Price Index (the Fed's preferred inflation measure) should show benign levels of inflation following already released CPI and PPI reports for last month.

- Fed Chair Powell returns to Capitol Hill this week for his semiannual testimony to Congress on Tuesday and Wednesday. Yet, fresh off last week's policy meeting and updated economic projections, Powell will likely spend his time reiterating key messages from last week, which are largely already priced into the market.