Your portfolio doesn't care about who wins the White House or controls Congress longer-term

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — November 6, 2024

Trump wins the White House (again); Senate flips to Republicans; House still in limbo.

Before we dig into the U.S. election and initial market reactions, we want to highlight an important point at the top of this morning's commentary: Your portfolio doesn't care about who wins the White House or controls Congress longer-term. From a market perspective, investors are well-served by looking past the election results and remaining focused on the longer-term drivers of asset prices, such as growth in the economy, the level of interest rates, and trends in corporate profits. In our view, each of these factors stands on firm ground today and should continue to do so into next year.

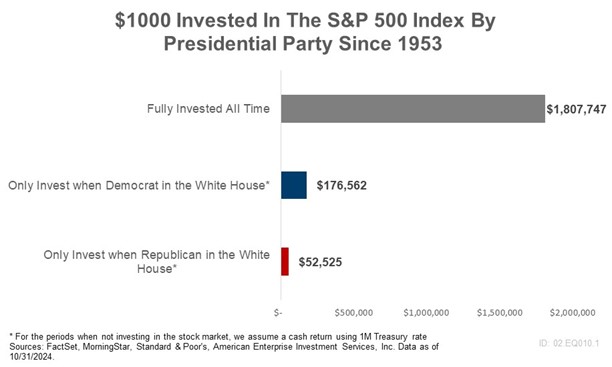

As the Ameriprise chart below shows, investing in stocks throughout the changes in administrations since President Eisenhower was inaugurated in 1953 has produced, BY FAR, the best result for investors versus only investing when your preferred party sits in the White House.

And while you may not agree with the President and the fiscal policies of an opposing party, history clearly shows politics is seldom a reason not to invest in stocks. In our view, this is just another way to show the importance of adhering to a well-diversified investment approach while avoiding the temptation to let the concerns of the day (in this case, who occupies the White House for the next four years) detract from your chances of achieving your financial goals. Please reach out to your Ameriprise financial advisor if you have concerns about the financial market impacts of the election or would like to discuss your portfolio.

“And while you may not agree with the President and the fiscal policies of an opposing party, history clearly shows politics is seldom a reason not to invest in stocks. In our view, this is just another way to show the importance of adhering to a well-diversified investment approach while avoiding the temptation to let the concerns of the day (in this case, who occupies the White House for the next four years) detract from your chances of achieving your financial goals.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. Past performance is not a guarantee of future results. An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

With that public service announcement out of the way, below is a bulleted view of what we know about the election thus far and initial market reactions.

- President-elect Trump will become the 47th President of the United States. NBC News projects that Trump has won 276 electoral college votes, including those from the swing states of Wisconsin, Pennsylvania, North Carolina, and Georgia. According to FactSet, Trump could secure as many as 312 electoral college votes (270 is needed to win), which would be the largest margin of victory since Obama in 2012. President-elect Trump became the second president to win two nonconsecutive terms, following Grover Cleveland in 1892.

- Republicans will win control of the Senate by picking up seats in West Virginia and Ohio and successfully defending their seats in Florida, Nebraska, and Texas. While Republicans could still pad their margins with additional seats depending on how results go in five battleground states, their control in the Senate paves the way for Trump to more easily secure his executive and judicial nominations. And from a market perspective, Republican control in the Senate likely removes any chances of sweeping tax law changes on corporations and wealthy individuals. Depending on the makeup of the House of Representatives, Republicans have vowed to chip away at President Biden's green energy policies/laws, roll back regulations on energy production, strengthen the U.S./Mexico border, and extend the 2017 Tax Cuts and Jobs Act.

- Control for the House of Representatives remains in limbo as some key races remain tight and vote counting continues. Democrats are looking to find a silver lining in an otherwise pretty tough election by flipping the House to force Republicans to negotiate on expiring provisions in the 2017 tax law and help place a "check" on Trump's policy agenda.

- Fairly early in the night on Tuesday, stock prices in overnight trading began to react favorably to incoming results across battleground states that showed a tight presidential race and following former President Trump running up the electoral college count in states he was expected to carry. By 11pm EST last night, the S&P 500 Index, Dow Jones Industrials Average, and NASDAQ Composite were all trading higher by over +1.0% in futures trading.

- In overnight trading, government bond prices came under pressure across the curve as yields rose and markets began to price in the potential for additional tariffs (possibly inflationary) under a second Trump term, as well as higher deficit spending and the potential for higher U.S. debt loads. In addition, bitcoin marched to a record high, while the Russell 2000 Index was up nearly +6.0% in the futures market. The U.S. dollar strengthened against several major world currencies.

- This morning, pre-market activity in the U.S. indicates a very strong open, with the S&P 500 and Dow each indicating they could open higher by more than +2.0%. The Russell 2000 Index and NASDAQ Composite also point to strong gains when U.S. markets open. In addition, bank stocks look to open higher, clean energy stocks should trade lower, and U.S. Treasury yields are pointing higher, with the 10-year up to 4.45%.

- In our view, markets have traded over recent days and weeks with somewhat of a cautious undertone. Uncertainties about how soon an election result would develop, if clear margins of victory would be present, the shape of Congress, and if there would be issues post-election modestly stalled stock momentum. This morning, we believe investors now have the clarity they need on these subjects, which should allow markets to discount expected outcomes/opportunities/risks and put the election behind it.

- Quick takes on potential market reactions over the coming days and weeks include: 1) Small caps could see improved sentiment on the potential for lower taxes, increased domestic production, and better trends in regional banking. 2) Speaking of banks, the backdrop for Financials could improve, as less regulation and the potential for merger/acquisition and capital market activity accelerate. 3) Animal spirits through year-end could push major averages higher as the overhang of the election is removed and investors look to put excess cash to work in stocks.

- Finally, U.S. stocks may see tailwinds from not only the election results but a retreat in volatility hedging, corporations moving out of their buyback blackout periods as the earnings season winds down, and strong Q4 seasonality factors (particularly in election years).