Your “North Star” post-election: strong U.S. fundamentals

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — November 4, 2024

In a fast-paced, data-driven, earnings-popping week, the S&P 500 Index dropped for its second consecutive week following a six-week winning streak. At the start of last week, the NASDAQ Composite finally hit a fresh all-time closing high, its first since July, but finished the week lower. Last week's decline in the NASDAQ broke seven straight weeks of gains for the tech-heavy index. During the week, Big Tech stocks acted as a drag on major indexes post-earnings releases, a resilient consumer helped lift Q3 GDP, employment trends showed effects from Boeing strikes/hurricanes, and U.S. Treasury yields continued to move higher. And across all the week's events, the fast-approaching U.S. election remained front-and-center, helping shape market reactions while keeping investor anxiety elevated.

Last week in review

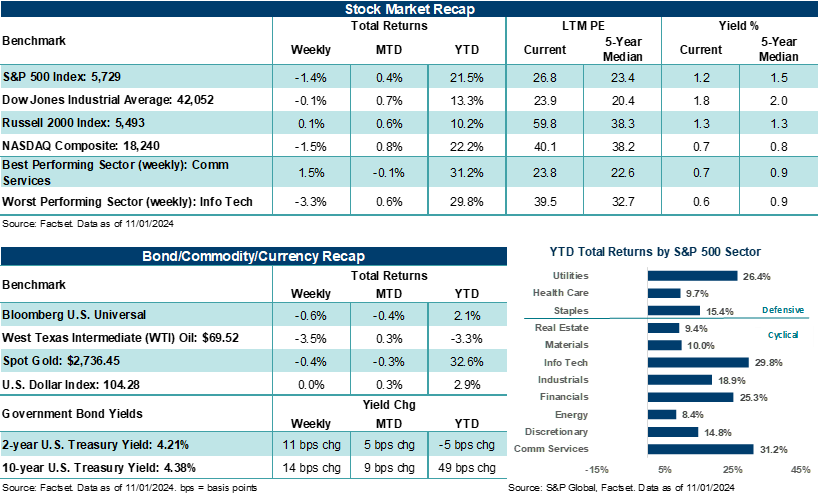

- The S&P 500 Index fell 1.4%. Information Technology (-3.3%), Real Estate (-3.1%), and Utilities (-2.8%) weighed on the U.S. stock benchmark. Communication Services (+1.5%) and Consumer Discretionary (+0.5%) were the only S&P 500 sectors to finish the week higher.

- Five of the Magnificent Seven reported earnings results, which added to last week's volatility given their size and influence on major stock averages. Overall, profit results from each were solid, though stock reactions were mixed. Apple beat expectations on iPhone sales but underwhelmed with Services results and provided ho-hum guidance for the December quarter. Microsoft and Alphabet each reported strong growth trends in artificial intelligence (AI), while Amazon highlighted margin expansion and record profitability in AWS. Finally, Meta Platforms noted positive traction in key initiatives, including in AI, but said capex will continue to grow into 2025. Bottom line: Revenue from cloud services for Amazon, Microsoft, and Alphabet totaled $62.9 billion last quarter, up +22% from a year ago, and the fourth straight quarter that combined revenue has increased. Notably, while the three companies spent nearly $51 billion on property and equipment last quarter, much of that money went to building the infrastructure that powers AI. Although investors should carefully monitor how much money Big Tech is spending on these new initiatives moving forward, last quarter's results show the investment in AI is beginning to pay dividends for those companies helping build the infrastructure and backbone behind computing in the 21st century.

“While several post-election scenarios could influence financial markets in varying ways over the very near term, the more extreme policy proposals and campaign promises of each presidential candidate are unlikely to see a ton of daylight in the next administration. All else being equal, this could be a positive for stocks in the long term, particularly if Congress is divided. And should a result that leads to one-party control in Washington develop, it's likely to be a slim majority, which makes passing sweeping changes to legislation/current rules of the road still difficult to accomplish.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- With roughly 70% of S&P 500 third quarter reports complete, blended earnings per share (EPS) growth is higher by +5.1% year-over-year on revenue growth of +5.2%. The Index is well on pace for its fifth straight quarter of positive EPS growth and sixteenth consecutive quarter of positive revenue growth. Bottom line: Higher stock prices this year have been partly fueled by a very healthy corporate earnings backdrop.

- The NASDAQ Composite dropped 1.5%, the Dow Jones Industrials Average ended fractionally lower, and the Russell 2000 Index ended fractionally higher.

- U.S. Treasury yields bumped up across the curve, with the market absorbing $183 billion in new Treasury issuance.

- The U.S. Dollar Index was unchanged, Gold ended slightly lower, breaking a three-week winning streak, and West Texas Intermediate (WTI) crude settled lower, despite late-week concerns Iran was planning to attack Israel again.

- On the U.S. economic front, October nonfarm payrolls rose a paltry +12,000, underwhelming expectations for roughly +120,000 new jobs last month. However, much of that miss was due to the ongoing Boeing labor strike and hurricanes Helene and Milton. Importantly, the unemployment rate remained unchanged last month at 4.1%, while average hourly earnings came in as expected on an annualized basis. Open roles in the U.S. remained above pre-pandemic levels, and private payrolls in October came in well above expectations — its highest monthly print since July 2023. Bottom line: The labor market in the U.S. remains healthy and near-term effects from temporary pressures should dissipate in upcoming reports.

- Elsewhere across the economy, Q3 GDP came in at +2.8%, ahead of the +2.6% expected, driven by strong consumer spending, increased export activity, and additive federal spending. Also, October consumer confidence came in ahead of expectations with a notable improvement in respondents' labor-market outlook. And finally, October ISM manufacturing came in below consensus estimates, with new orders remaining in contraction.

Election Day in America has finally arrived. Let strong U.S. fundamental conditions be your "North Star" post-election.

On Tuesday, Americans will head to the polls and cast their ballots for the national and local representatives they believe are best suited to manage the country and local governments moving forward. Roughly 76 million Americans have already cast their ballots across the country, leaving voter turnout and candidates convincing the small sliver of the electorate left undecided in key swing states to finally make up their minds about the only factors left that will push the needle on this election. National polls continue to show a "toss-up" presidential race, with Vice President Harris and former President Trump neck and neck in most battleground states. Notably, polling leads between the two candidates are usually within the margin of error. Whether the presidential race is called quickly, decided by a narrow margin with recounts taking a few days, or must be decided by the Supreme Court, the 47th President of the United States will be sworn into office on January 20th, 2025, come rain or shine.

From a market perspective, investors should feel pretty good about the macroeconomic backdrop heading into Election Day. Stocks are sitting on very healthy year-to-date gains, with nine of eleven sectors expected to post positive year-over-year earnings growth in 2024 and all sectors expected to grow profits in 2025. Bottom line: Corporate fundamentals are on solid ground, profits are expected to grow over the coming quarters, and stock prices reflect a healthy environment.

From an economic standpoint, inflation has ebbed lower all year, the Federal Reserve is in the process of lowering its policy rate, and government bond yields should move lower over the next six to twelve months, in our view. Bottom line: Normalized inflation levels should continue to relieve pressures on consumers and businesses over time. Notably, lower interest rates could help add support for lending activities, business investment, and improve affordability across larger-ticket consumer items, such as homes and autos.

Additionally, labor conditions in the U.S. remain on firm ground, and the U.S. economy is growing. In fact, U.S. GDP has grown in 16 of the last 17 quarters, with the Atlanta Federal Reserve's GDPNOW forecast projecting U.S. growth of +2.3% in the fourth quarter, following the +2.8% pace recorded in the third quarter and +3.0% level seen in the second quarter. Bottom line: America is working, and consumers/businesses are spending. As a result, U.S. growth trends remain the envy of the world.

While several post-election scenarios could influence financial markets in varying ways over the very near term, the more extreme policy proposals and campaign promises of each presidential candidate are unlikely to see a ton of daylight in the next administration. All else being equal, this could be a positive for stocks in the long term, particularly if Congress is divided. And should a result that leads to one-party control in Washington develop, it's likely to be a slim majority, which makes passing sweeping changes to legislation/current rules of the road still difficult to accomplish.

Importantly, investors should keep these strong fundamental factors at the forefront of their minds over the coming days and weeks, particularly if election noise and rhetoric increase stock and bond volatility post-election. In our view, a diversified portfolio should help weather any potential volatility that arrives after the election. Our advice is to stick with a disciplined investment strategy and use any potential volatility between now and year-end to your advantage by deploying a systematic dollar-cost-averaging approach into stocks and bonds with excess cash earmarked for investments. Also, take some time to review your risk tolerance with your Ameriprise financial advisor as the year winds down, and make sure your portfolio has the right balance of stocks/bonds/cash/alternatives based on your goals. Sometimes, it's that simple.

Finally, we will be monitoring market reactions to this week's election on a daily basis in our Before the Bell report and, if necessary, our After the Close report, if volatility ramps higher. Please reach out to your Ameriprise financial advisor for a copy of these reports as we move through Election Day and post-election market impacts.

The week ahead:

Of course, the U.S. election will play a prominent (and possibly dominant) role in moving financial markets around this week. However, a Federal Reserve policy decision on Thursday, some light economic releases throughout the week, and roughly 20% of the S&P 500 scheduled to report third quarter results should also have their fair share of sway on directing stock traffic.

- While some traders may be positioning for elevated election volatility through volatility-based option strategies, stock positioning based on a particular election outcome does not appear very strong, given the tight presidential race.

- The Federal Reserve will meet on Wednesday and Thursday, and the market is almost unanimously positioned for a 25-basis point rate cut at the conclusion of the two-day meeting. Any outcome that doesn't include a 25-basis point cut in the policy rate this week (either a hold or larger cut) would likely fuel additional market volatility outside of election outcomes.

- October nonmanufacturing ISM (Tuesday) and a preliminary look at November Michigan Sentiment (Friday) will be the economic highlights of the week, though their impact on markets will likely be overshadowed.

- Earnings reports will keep rolling in this week, keeping stock reactions post-reports influenced by a mix of fundamental updates and macro headlines (i.e., the election and Fed).