For now, markets appear comfortable placing tariff risks to the side

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — August 11, 2025

Major U.S. stock averages advanced higher last week, with the S&P 500 Index pressing toward another new high. The U.S. imposed higher tariff rates on imported goods, with some exemptions, while second quarter corporate earnings continued to surpass analyst expectations.

Key inflation data this week, along with an updated look at retail sales and University of Michigan consumer sentiment, will provide further insight into the health of the U.S. economy amid building concerns regarding slowing growth and tariff pressures.

Last week in review:

-

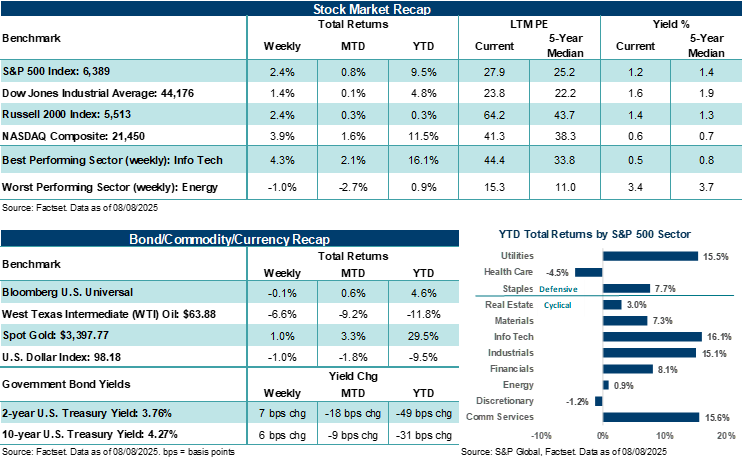

The S&P 500 gained +2.4%. Strength was broad-based, led by Information Technology, Consumer Staples, and Materials.

- The NASDAQ Composite rose +3.9%, outperforming major indexes as Big Tech rebounded sharply.

- The Dow Jones Industrials Average rose +1.4%, while the Russell 2000 Index climbed +2.4%.

- U.S. Treasury prices faced pressure amid supply concerns, with three consecutive disappointing auctions and record issuance in four-week bills. West Texas Intermediate (WTI) crude fell after OPEC+ announced a full unwinding of voluntary cuts. Gold rose to a record high before paring gains on tariff guidance, and the U.S. Dollar Index declined.

- Market sentiment was buoyed by dovish Federal Reserve commentary from some members, which helped lift odds of a September rate cut to near 90%. However, sticky inflation and Treasury supply concerns kept a floor under rates.

- Economic data was mixed. July ISM services missed expectations, inflation expectations ticked higher in the New York Fed survey, while jobless claims showed signs of labor market softening.

- Tariff headlines leaned dovish despite new rates taking effect, with exemptions for U.S.-based chipmakers and pharmaceutical tariffs previewed. Uncertainty remains elevated around implementation, with concerns growing about investment and hiring impacts.

- Corporate earnings continued to support a largely bullish narrative, with stronger-than-expected second-quarter profit growth and AI momentum seemingly trumping growing tariff headwinds and weakening consumer trends. However, earnings beats have been rewarded less than usual this season, while misses have been punished much more severely. To us, this suggests already lofty expectations and stretched valuations could act as a governor on the broader averages moving forward if profit expectations are not met.

“At present, the U.S. stock market is navigating a complex macroeconomic environment of strong corporate earnings and AI-driven optimism tempered by inflationary pressures and tariff uncertainties. But, for now, investors are choosing to focus on what they can see in front of them, which is stronger-than-expected earnings growth, a durable AI secular theme, and a still firm economic backdrop.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Markets appear comfortable placing tariff risks to the side, for now.

U.S. major averages experienced solid gains last week, with the S&P 500 Index and Nasdaq Composite reversing the previous week's declines, posting their best week since late June.

Big Tech stocks again led the rally, notably Apple, which jumped +13.3% last week – its best week since July 2020. The iPhone maker announced a $100 billion investment in U.S. production (on top of its previously announced $500 billion), which helped secure exemptions from White House section 232 semiconductor tariffs.

In our view, investors' bullish sentiment last week was supported by several factors, including "buy-the-dip" trading activity after the post-nonfarm payrolls selloff, dovish Fed commentary suggesting a high probability of a September rate cut, speculation over Fed Governor Chris Waller as a front-runner successor to Fed Chair Powell, and further clarity around tariff carve-outs – especially for semiconductor manufacturers investing in the U.S.

Notably, corporate earnings have shown remarkable strength during the current earnings season, with over 81% of S&P 500 companies surpassing analyst estimates. The S&P 500 Q2'25 blended earnings per share (EPS) growth rate of +11.8% year-over-year has far exceeded the +4.7% growth rate analysts expected at the end of June. In addition, we believe solid ongoing share buyback announcements and the AI secular growth narrative continue to underpin investor confidence and the overall U.S. stock market despite other macroeconomic uncertainties. Yet, at the heart of those uncertainties are growing concerns about stagflation (i.e., slowing growth and rising inflation) due to labor market anxiety, rising inflation expectations, weakening consumer signals, and ongoing tariff frictions.

On the economic front, July ISM services data missed expectations, showing contraction in employment and an increase in prices paid rising to the highest levels since October 2022. The latest New York Fed Survey of Consumer Expectations revealed rising inflation expectations at both the one-year and five-year horizons. And while initial jobless claims last week were lower than expected, continuing claims reached their highest level since November 2021, reinforcing concerns about a slowing labor market.

Importantly, we believe tariff policy out of Washington remains a significant wildcard dynamic for markets at the moment. New (higher) tariff rates on goods headed to American shores from a host of countries took effect last week and will likely push the U.S. effective tariff rate to its highest levels in nearly a century. According to June International Trade Commission data, the average U.S. tariff rate stood at 9.0%, up 6.8% since December. That's the fastest pace of increase on record, including during the Smoot-Hawley tariff era in the early 1930s.

More acutely, President Trump announced a 100% tariff rate on semiconductor imports, but promised exemptions for companies investing in U.S. production, benefiting firms like Apple and NVIDIA. Additionally, a phased-in pharmaceutical tariff was previewed, potentially rising to as much as 250% over the next one to one-and-a-half years. Despite these measures, details on implementation and exemptions remain clouded, contributing to ongoing uncertainty that is likely to keep affecting business investment and hiring decisions outside of AI growth. Hence, the "wildcard" dynamic that trade and tariffs could play on markets and the economy over the intermediate term. And finally, on the tariff front last week, President Trump also imposed an additional 25% levy on goods coming from India, bringing total tariffs to 50%, citing India's purchases of Russian oil, which has strained US-India trade relations.

Bottom line: At present, the U.S. stock market is navigating a complex macroeconomic environment of strong corporate earnings and AI-driven optimism tempered by inflationary pressures and tariff uncertainties. But, for now, investors are choosing to focus on what they can see in front of them, which is stronger-than-expected earnings growth, a durable AI secular theme, and a still firm economic backdrop. However, there is growing evidence that tariff-related pressures are beginning to form under the surface. This week's key inflation data and reads on the consumer could challenge investors' rather complacent view of the potential risks to growth. Yet, until there is more concrete evidence of tariff impacts, investors appear comfortable putting those risks to the side for now.

The week ahead:

-

U.S. consumers likely faced rising prices in July. Tuesday's July Consumer Price Index is expected to show core consumer inflation ticked higher on a month-over-month basis versus June, with the year-over-year rate expected to climb to +3.0%, the highest level since February and a full percentage point above the Fed's +2.0% target. The headline reading is expected to tick lower, helped by easing gasoline prices. The July Producer Price Index will be released on Thursday.

-

On Friday, July retail sales and preliminary August University of Michigan (U of M) consumer sentiment reports are due. Retail sales could see a lift from Amazon Prime Day but could be constrained by a decline in gasoline sales. Consumer sentiment is expected to rise versus July levels.

- With 90% of second quarter S&P 500 earnings reports complete, the earnings season will substantially slow this week, with just eight companies scheduled to report results. Cisco Systems, Deere & Co., and Applied Materials will be some of the week's key reports.