Magnificent 7: Too much of a good thing?

Justin Burgin, Vice President of Equity Research – Ameriprise Financial

April 21, 2025

Over the past few years, the seven largest market cap companies in the S&P 500 Index, collectively known as The Magnificent 7, or Mag 7 for short, drove significant market returns. However, the trend of the past two-plus years shifted in late 2024 and early 2025. Around mid-March, the Mag 7 entered bear market territory, defined as a 20% drop from a high in the previous 12 months. The Mag 7 continued to experience volatility through April’s tariff announcements.

What happened? Here's what may be driving the Mag 7 pullback and where investors might turn as uncertainty continues.

Looking back at Mag 7 at its peak

The Mag 7 includes Alphabet Inc., Apple Inc., Amazon.com, Meta Platforms, Microsoft Corp., NVIDIA Corp., and Tesla Inc. The combination of their sheer size and investor obsession with technology themes such as artificial intelligence (AI) culminated in some of the world's largest publicly traded companies.

These companies became so prominent in market capitalization (the number of outstanding shares multiplied by the price) that they dwarf most countries' annual gross domestic product (GDP). To put an even finer point on their sheer size, at the peak of the Mag 7 dominance, these seven companies collectively held a market capitalization of just over $17 trillion (for reference, the U.S. GDP was just under $30 trillion in 2024).

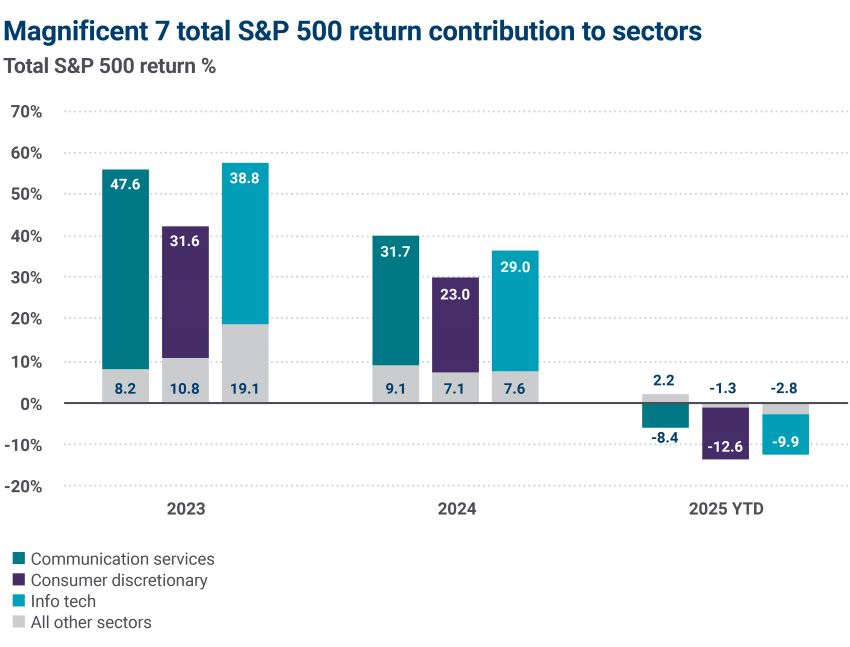

How the Mag 7 contributed to sector returns

In addition to outsized market performance in 2023 and 2024, the Mag 7 also drove most of the returns in communication services, consumer discretionary and technology. Across these sectors, the Mag 7 rode the simultaneous waves of AI, electric/autonomous vehicles, mobile phones, and cloud computing buildouts. Collectively, these three sectors now account for nearly 50% of the overall weight of the broad S&P 500 Index, and for some, where the Mag 7 went, so went the market.

Source: FactSet, Ameriprise Financial Services, Inc. Data as of 3/14/2025. These figures are shown for illustrative purposes only and are not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

What is driving the 2025 Mag 7 pullback?

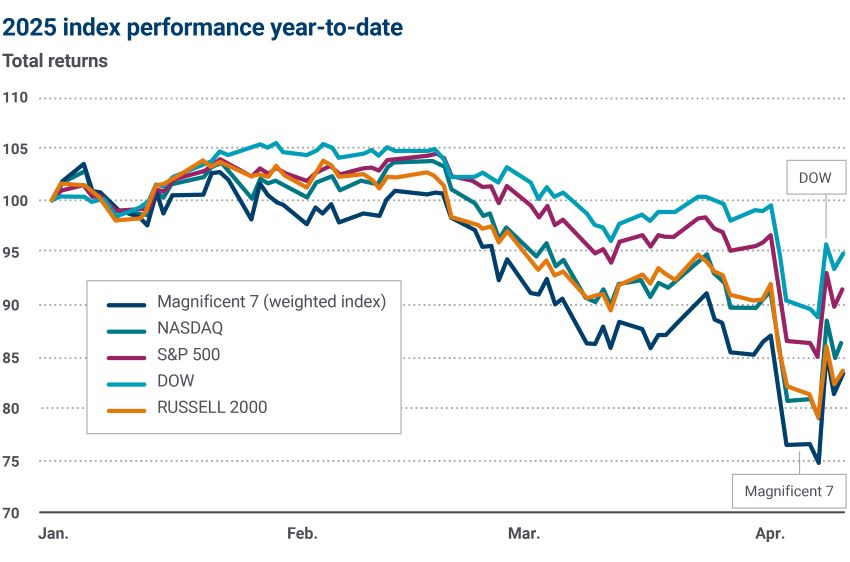

We attribute the 2025 pullback to several factors, including how companies monetize their multi-year artificial intelligence (AI) investments, and uncertainty over policy decisions, including tariffs, valuation levels, and future growth rates. In the chart below, you can compare how several major U.S. stock indices and a weighted index of the Mag 7 have performed in 2025 through mid April.

Source: FactSet, Ameriprise Financial Services, Inc. Data as of 3/14/2025. These figures are shown for illustrative purposes only and are not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

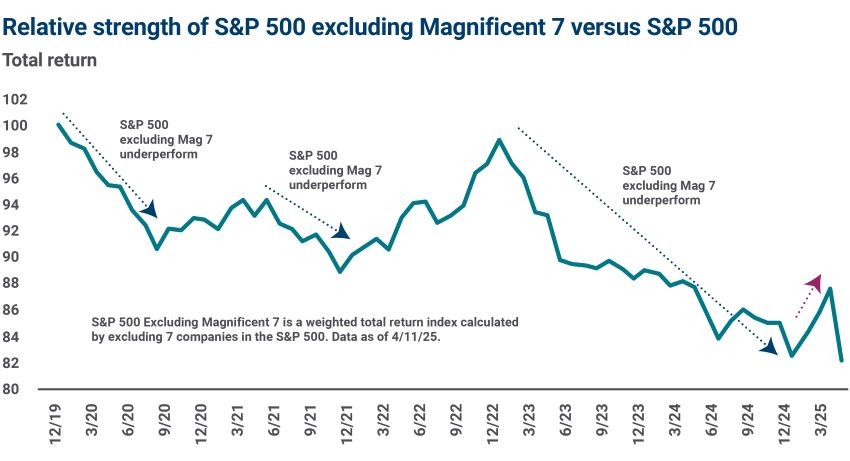

How the rest of the S&P 500 performs without Mag 7

When we exclude the Mag 7, the overall performance this year for the remaining 493 companies in the S&P 500 Index is not as “bad” as it appears during the first few months of 2025. For instance, the broad market fell approximately 15% by early April from the first of the year, while the Mag 7 was down approximately 25% over the same period.

While this may not be much comfort to portfolios heavily skewed toward the biggest companies in the index, it also underscores how a diversified portfolio is essential for long-term investors.

In the chart below, we show how the Mag 7 influenced market performance going back to early 2020. While there are multiple periods when the 493 companies in the S&P 500 underperformed the Mag 7, there are also periods when these companies outperformed, including the first few months of 2025.

Source: FactSet, Ameriprise Financial Services, Inc. Data as of 3/14/2025. These figures are shown for illustrative purposes only and are not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

With uncertainty high, where can equity investors turn beyond the Mag 7?

With expectations for market leadership to broaden beyond the Mag 7, investors can be more selective when making tactical decisions. A more targeted approach provides an opportunity to increase exposure to more thematic market segments without being tied to legacy and potentially slower-growth parts of the economy. For instance, we believe well-positioned industries exist within larger sectors of the market including MedTech (health care sector), capital markets (financials), natural gas (energy) and software/cybersecurity (technology).

The bottom line: For investors, oftentimes too much of a good thing can be… too much of a good thing. Thus far in 2025, outsized weakness in the largest stocks is a reminder that a well-diversified portfolio can help long-term investors ride out short-term market volatility. For these patient, long-term investors, a diversified investment portfolio includes exposure to multiple asset classes (including stocks, bonds, alternatives and cash) and is tailored to your risk profile.

Review your investment strategy with your financial advisor

To discuss your investments and long-term strategy, connect with an Ameriprise financial advisor. An advisor can help ensure your portfolio is well-diversified and positioned to help you weather an uncertain market.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.