Mag Seven’s profits set to steer the most concentrated market in 35 years

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — October 27, 2025

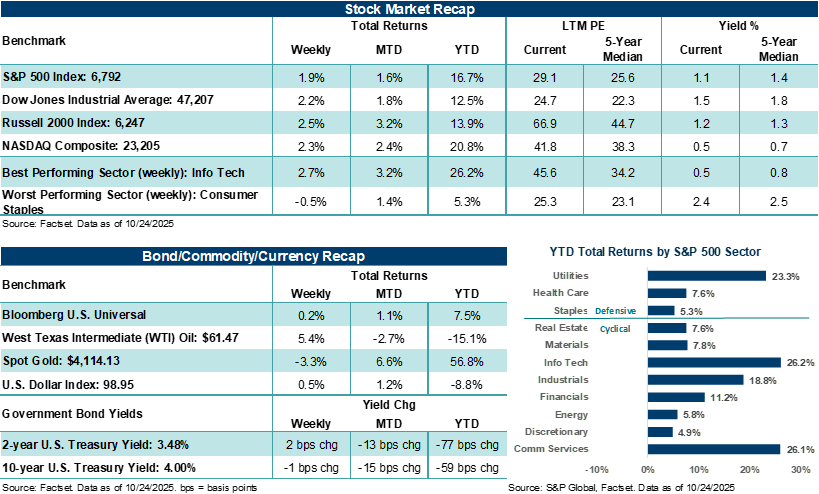

Following a cooler-than-expected and delayed September consumer inflation report on Friday, major U.S. stock averages finished last week at new highs. Notably, with 30% of S&P 500 companies' third-quarter earnings reports already complete, 84% are surpassing analysts' estimates, well ahead of the five-year average of 70%. This week, with Mag Seven earnings, a Fed decision, and trade headlines, investors will face a busy week to navigate.

Last week in review:

-

The S&P 500 Index finished higher by +1.9%. The broad-based U.S. stock benchmark hasn’t seen a 3.0% or more decline in over 180 days. The NASDAQ Composite rose +2.3%, driven by strong gains across Amazon and semiconductors.

-

The Russell 2000 Index rose +2.5%, while the Dow Jones Industrials Average rose +2.2%. Along with the S&P 500 and NASDAQ, both benchmarks hit fresh highs on Friday.

- Causing stocks to pop higher on Friday and finish the week with solid gains was a cooler-than-expected September Consumer Price Index (CPI) report that showed both headline and core measures at +3.0% on an annualized basis. The report was delayed due to the current U.S. government shutdown and will be the only government report to be released until Washington reopens for the people’s business. Stocks rose on Friday as the CPI report likely clears the way for the Federal Reserve to cut its policy rate by 25 basis points this week.

- U.S. Treasury yields were mostly firm, Gold moved lower, the U.S. Dollar Index moved higher, and West Texas Intermediate (WTI) crude rose +5.4% amid a fresh round of U.S. sanctions on Russia.

- U.S.-China headlines remained volatile ahead of this week’s scheduled meeting between President Trump and China President Xi Jinping at the APEC summit. Despite President Trump threatening to raise tariffs on Beijing by 100% starting November 1, and the administration considering export curbs on U.S. software headed to China in retaliation for its rare earths curbs, markets are pricing in the possibility that both sides will lower the temperature on their trade threats following this week’s meeting.

- With a dearth of government economic data currently available, private reads on activity and sentiment, as well as Q3 earnings reports, are carrying added weight. Preliminary data on manufacturing and services activity for October indicated healthy expansion levels, while a final look at October's Michigan consumer sentiment showed little change from the original estimate. On the earnings front, overall profit trends are coming in solidly, with GM and Ford showing better-than-expected results, and Tesla noting margin headwinds.

“This could be one of the most pivotal weeks for the market between now and the end of the year. Of course, this week’s trade and Federal Reserve headlines will likely play key supporting roles in moving markets in their own right. However, it will be the earnings reports from the Magnificent Seven over the coming days that will likely receive top billing with investors this week, and their results and outlooks could shape how the major averages trade through the rest of the year.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

The Mag Seven’s profit reports this week are set to steer the most concentrated market in 35 years.

This could be one of the most pivotal weeks for the market between now and the end of the year. Of course, this week’s trade and Federal Reserve headlines will likely play key supporting roles in moving markets in their own right. However, it will be the earnings reports from the Magnificent Seven over the coming days that will likely receive top billing with investors this week, and their results and outlooks could shape how the major averages trade through the rest of the year. Meta Platforms, Alphabet, and Microsoft will report their Q3’25 results and outlooks on Wednesday, and Apple and Amazon will release their updates on Thursday. Hence, investors won’t have to wait long before they have a fresh set of profit results and outlooks, particularly around artificial intelligence trends, from the key companies that are driving major stock averages higher in 2025.

At the end of the third quarter, companies in the Magnificent Seven (i.e., Microsoft, Amazon, Alphabet, Apple, Meta Platforms, Tesla, and NVIDIA) collectively were expected to see Q3'25 earnings per share (EPS) growth of +14.9% year-over-year, according to FactSet. In comparison, the other 493 companies are collectively expected to grow EPS by a much smaller +6.7%. Notably, as the Q2 '25 earnings season approached, analysts expected the Magnificent Seven's EPS to grow by +13.9% year-over-year. However, when the previous earnings season concluded and each of the seven companies reported their second quarter results, EPS growth for the Mag Seven came in at a much more impressive +26.6% annualized growth rate. And we suspect investors may be expecting a similar scope of beat rates this time around. As we enter a pivotal week for the group, profit expectations for Mag Seven companies are high compared to the rest of the market, and so are valuations. Outlooks from these key tech and AI companies, as well as how much these companies can surpass analyst estimates for the prior quarter, could play a significant role in shaping how the group trades post reports this week.

Without a doubt, AI infrastructure buildout trends will play a prominent feature across the results of hyperscalers, such as Microsoft, Amazon, Google, and Meta Platforms, as each has continued to ramp up capital expenditures this year. Expect investors to scrutinize whether the era of “capex at any cost” continues to ring true, or if a focus on return on investment (ROI) and results that start to monetize AI investments begins to gain more prominence. Finally, company-specific drivers related to other AI and tech trends, hardware and software sales, advertising, consumer and business behaviors, trade, and tariffs will be closely monitored as the largest companies on the planet provide their quarterly reports.

Importantly, the Mag Seven companies reporting this week represent an eye-popping 24% of the S&P 500 by market capitalization, with the Mag Seven as a whole trading at roughly thirty-nine times trailing earnings, which is approaching a 40% premium to the overall S&P 500. According to the latest American Association of Individual Investors Survey, retail investors overwhelmingly believe that stocks are currently overvalued or mixed (i.e., some stocks are expensive while others are relatively cheap). Thus, an increasing number of investors are growing concerned that the strong stock gains seen over recent months may have outpaced fundamentals, at least in the very near term. This week’s Mag Seven earnings reports provide a chance for companies to either confirm or challenge that view.

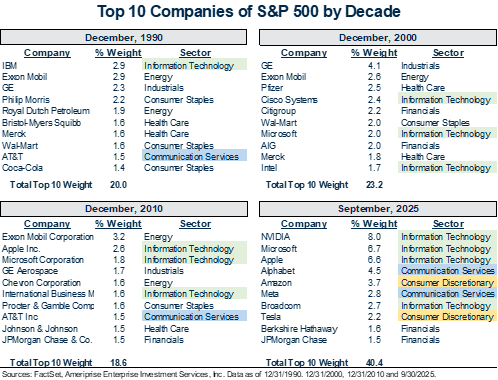

Speaking of size, at no other time over the last thirty-five years have the top ten companies by market-cap in the S&P 500 held so much influence on one of the broadest measures of the U.S. stock market. At the end of September, the ten largest companies in the S&P 500 accounted for over 40% of the Index, essentially double the size of what they’ve represented over the last three decades, as the Ameriprise chart above shows. What’s also remarkable is that the concentration of the top ten S&P 500 companies today is currently primarily held in the Tech and Tech-related sectors, reducing some of the S&P 500’s sector diversification across the top ten constituents seen in the 1990s, 2000s, and even the 2010s.

An unrelenting secular shift towards technology and tech-related growth across the global economy since 2000, combined with U.S. dominance in this area and strong profits over several years relative to other S&P 500 companies, has led to a steady rise in the number of Big Tech companies now responsible for dominating the Index. While we’ll refrain in this week’s perspective report from opining on what that may mean for the Index in the future, or if time will further concentrate the S&P 500 or lead to more diversification among the top ten, the context helps drive home why this week’s Mag Seven results are so important to broader markets. Overall, we believe the Mag Seven is well-positioned to meet profit expectations for the prior quarter, which is a fundamental positive that investors shouldn’t easily dismiss. However, given current valuations and the size and influence these companies currently hold over the broader market, it's their outlooks and views on profitability moving forward that will likely carry the most sway with investors this week, and probably beyond.

The week ahead:

-

175 S&P 500 companies report Q3 profit results this week, including the Magnificent Seven companies discussed above, marking one of the busiest weeks of the season.

-

The Federal Reserve is all but certain to cut its policy rate by 25 basis points on Wednesday. However, Fed Chair Powell’s press conference will be the main event of the meeting, as investors look to see if Mr. Powell will provide any clues about an additional quarter-point cut in December, which is widely expected based on current market odds.

- President Trump and Chinese President Xi Jinping will meet this week on the sidelines of the APEC summit. Based on positive pre-meetings between U.S. and Chinese delegates, headlines over the weekend suggest that the two leaders have an opportunity to reach an agreement that will avert further tariffs.