Investors shouldn’t root for aggressive rate cuts

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — September 9, 2024

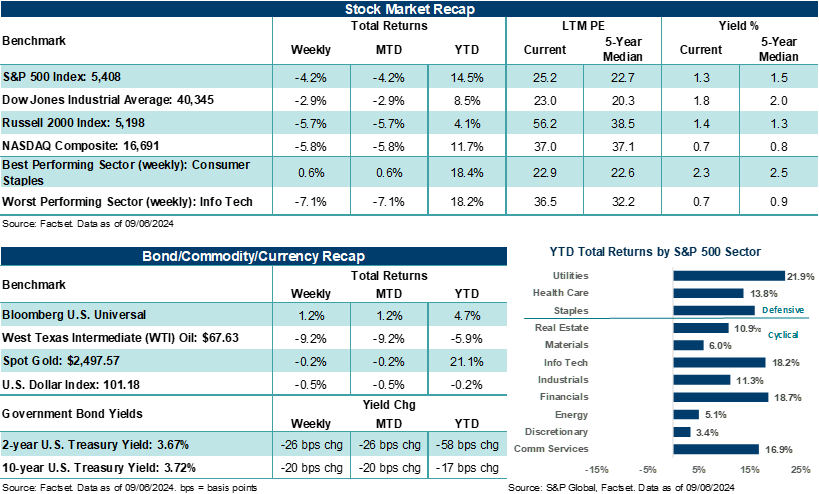

Well, after previously highlighting how terrible September is historically for the stock market, the month is certainly living up to that reputation in the early go. Stocks posted their worst week in well over a year as growth concerns have quickly overtaken anxiety around lingering inflation pressures. A batch of employment data last week was perceived by investors negatively, and stocks were pressured throughout the week. However, the government's closely watched nonfarm payrolls report did see jobs rebound in August from June and July's unexpectedly weak reports. Manufacturing activity remained in contraction last month, while services activity beat estimates, though it saw its employment index tick down. In all, investors sold off stocks last week and did so aggressively in areas like Technology, which have experienced outsized returns this year. Thus, increasing concerns about the pace of economic growth, combined with a little profit-taking in areas that have seen large year-to-date gains, appear to be the current tone across markets.

Last week & month in review:

- The S&P 500 Index dropped over 4.0%, snapping a three-week winning streak and posting its worst week since March 2023 in percentage terms. However, the nearly 240 points the Index shed last week was its worst point decline since January 2022.

- The NASDAQ Composite dropped 5.8%, posting its worst week since January 2022. Information Technology fell over 7.0% on the week, pressured by Big Tech (e.g., NVIDIA lost nearly 14%) and semiconductors (which dropped over 12%).

- The Dow Jones Industrials Average also fell but mitigated the pressure better than the other two growth-biased benchmarks above, declining 2.9%. That said, the Dow snapped a three-week winning streak and saw its worst week of performance since March 2023.

- With growth concerns now flagging as one of the largest headwinds for stock prices at the moment, the Russell 2000 Index currently sits at the heart of the pressure. The small-cap, domestically biased Index fell 5.7% on the week. The Index has taken a rollercoaster ride over the last three months, rising aggressively on prospects for growing profits and forthcoming Federal Reserve rate cuts, to now falling on fears of potentially unmet growth assumptions and "forthcoming fed rate cuts." Bottom line: Small-cap stocks are now under pressure due to concerns that the Fed's plan to normalize rate policy over time may actually turn into quick/aggressive cuts to help combat faltering growth conditions.

“Fed rate cuts are coming. But it's less important whether the first cut is 25 or 50 basis points, in our view. The more important dynamic for investors to keep tabs on is whether rate cuts take the escalator or elevator down from there.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- Treasury prices rallied, and bond yields fell as investors sought safety in government bonds. Treasury yields are now back to some of their lowest levels since early-to-mid 2023.

- Gold ended the week basically flat. West Texas Intermediate (WTI) sank 9.2%, its largest weekly sell-off since March 2023, with the price of crude back to its lowest levels since June 2023. Bottom line: In an environment where investors are concerned about the pace of growth and a possible recession, the world doesn't usually use as much oil under those conditions.

- Updates on labor conditions were the focal point of the week and the main catalyst for stocks' negative reactions. Job openings in July fell to their lowest level since January 2021, coming in weaker than expected, with June levels revised lower. ADP private payrolls showed a sub-100,000 job number last month for the first time since early 2021, with the small business segment of the report showing a net loss in jobs.

- And while the August nonfarm payrolls report added +142,000 jobs, that was weaker than the roughly +160,000 economists expected. Notably, revisions to June and July saw jobs decrease by a collective 86,000. The unemployment rate fell to 4.2% last month from 4.3% in July. Bottom line: Labor conditions are certainly softening but remain on a solid foundation, in our view. It's important to remember that "normalizing economic conditions" means activity, including hiring, needs to slow from unsustainable high levels. These conditions must be met before the Federal Reserve is comfortable cutting rates. Given last week's employment data, it's now just a matter of whether the Fed decides to cut 25 or 50-basis points this month.

- Finally, August ISM manufacturing activity dropped to its lowest level since November 2023 and sat in contraction for the fifth straight month. Conversely, ISM services activity (i.e., the main engine of U.S. economic growth) expanded more than expected last month. The services index has sat in an expansionary state (i.e., more businesses growing than contracting) for forty-eight of the previous fifty-one months.

Investors shouldn’t root for aggressive rate cuts

That statement might sound counterintuitive for a market that has mostly run on zero-based interest rates for the better part of the last fifteen years or since the Financial Crisis. And with the Federal Reserve soon ready to embark on its next rate easing cycle, consumers and businesses are, rightfully so, looking ahead to an environment of lower rates for business and consumer loans, including across autos, home, and other popular lending products.

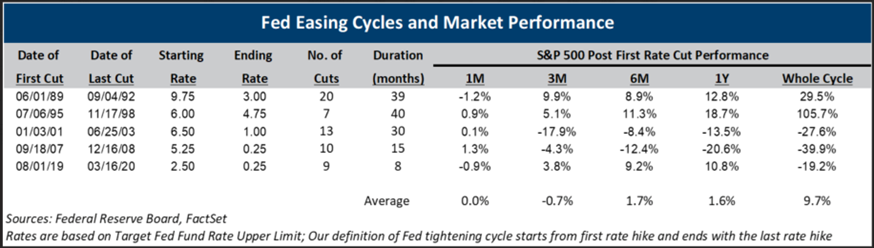

However, investors shouldn't really cheer an environment where the Fed has to aggressively/quickly cut its policy rate. As the Ameriprise table below shows, more often than not, when the Fed cuts rates swiftly and aggressively, it's because something is wrong in the economy, and it has to shift monetary policy suddenly in response. Historically, the S&P 500 Index has performed poorly in these types of environments over the next three, six, and twelve months after the first Fed rate cut. In our view, investors should prefer an environment where the Fed can take its time in cutting rates and can normalize monetary policy more gradually in response to evolving economic conditions.

This example is shown for illustrative purposes only and is not guaranteed.

For instance, the Fed, under former Chair Alan Greenspan, lowered the fed funds rate from 6.00% on the top end to 4.75% between the middle of 1995 and the end of 1998 to help support economic growth and after raising rates too aggressively in the front half of 1995. Conversely, unexpected event shocks or recessions typically precede large/quick rate cuts, resulting in activity/profit growth slowing more rapidly than the market anticipates, hence negative returns in the stock market through the rate-cutting cycle. The last three Fed rate-cutting cycles are solid examples. Bottom line: Fed rate cuts are coming. But it's less important whether the first cut is 25 or 50-basis points, in our view. The more important dynamic for investors to keep tabs on is whether rate cuts take the escalator or elevator down from there.

The week ahead:

Inflation updates, Apple's annual iPhone event, and a presidential debate are all on deck this week. Along the way, major stock averages, such as the S&P 500, will look to either gather their composure after last week's declines or see further selling pressure that could test major technical support lines. Wednesday marks the 23rd anniversary of the 9/11 terrorist attacks.

- On Monday, Apple is scheduled to unveil the iPhone 16, which is reported to have embedded artificial intelligence capabilities called Apple Intelligence. New product features and advanced software will likely be critical in driving demand for the next iPhone and helping Apple carve its place in the AI space.

- On Tuesday at 9 pm EST, Vice President Kamala Harris and former President Donald Trump will debate on ABC at the National Constitution Center in Philadelphia, Pennsylvania. Polls in swing states suggest a tight race with less than sixty days to go before Election Day. Thus, the stakes are high for both candidates to exit the debate without incurring any major damage that could seriously tilt independent voters to one side.

- August updates on consumer and producer price inflation (Wednesday and Thursday) will be the last before the Fed delivers its rate decision next week. Consumer prices are expected to hold steady on a month-over-month basis, while producer prices are expected to tick higher.

- Finally, how the S&P 500 and NASDAQ react to some of this week's events listed above could help inform if each can recover some of last week's declines and avoid falling below key technical thresholds.