Investors should remain focused on fundamentals to navigate through historically weak September

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — September 3, 2024

Major U.S. stock averages put in a mixed week of performance but finished higher in August following a rocky start to the month. NVIDIA's earnings report and outlook last week easily surpassed analyst expectations. However, the stock fell on the week (down nearly 8.0%), as the rate at which it usually hurdles over profit estimates continues to shrink. A second look at Q2 U.S. GDP showed stronger growth than initially reported, and the Fed's preferred inflation measure for July fell in line with expectations. In the background, investor sentiment has improved from the July/August lows. Yet, there is a cautious tone across the market heading into a historically weak September, with key data and events offering opportunities for periods of elevated volatility as the summer winds down.

Last week & month in review:

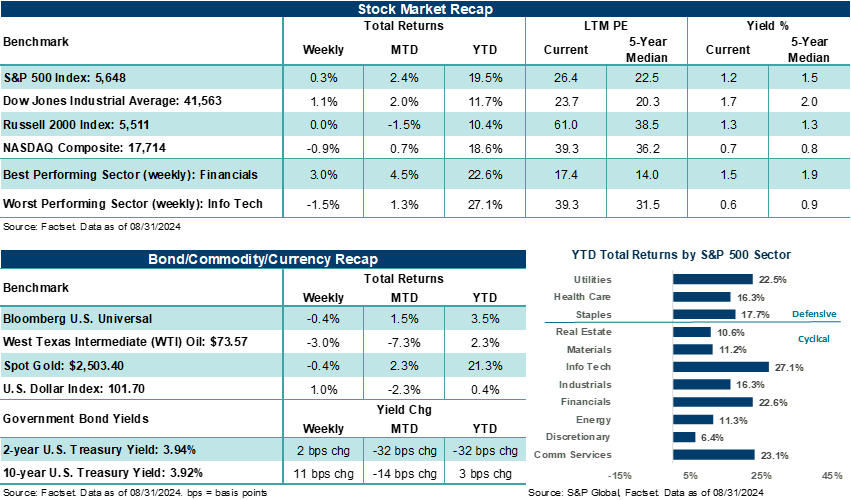

- The S&P 500 Index rose +0.2% on the week (its third consecutive weekly gain) and closed higher by +2.3% in August. The August gain is the S&P 500's fourth straight month of positive returns and its best month since June. Over the last four months the Index is higher by +12.2%. Despite a shaky start to August, the S&P 500 finished the month less than 0.5% away from its all-time high made in July.

- Notably, the last full month of summer included a volatility spike, which was comparable to the COVID-19 spike seen in early 2020 — driven by concerns that U.S. growth was slowing more rapidly amid elevated policy rates from the Federal Reserve. A weaker-than-expected July nonfarm payrolls report kicked off the volatility spike, which was compounded by a quick/sudden unwind of yen carry trades across professional investors following an unexpected rate hike by the Bank of Japan. However, other U.S. economic data points across the month, including inflation reports and services activity, helped build back support for the soft-landing scenario. Importantly, at the Fed's annual Jackson Hole Economic Symposium in late August, Fed Chair Powell all but ensured rate cuts are coming next month. Bottom line: After some shaken confidence in the soft-landing scenario in early August, resulting in a brief downdraft for stock prices, investors quickly regained their composure and largely used the volatility shock as a buying opportunity.

“Investors should remain cognizant that expectations and valuations for NVIDIA and Big Tech as a whole are elevated compared to other areas of the market that are more reasonably priced. This could result in more volatility across Big Tech based on how investors perceive the trajectory for growth and profits over the coming quarters. With expectations already high, investors may have to stomach more volatility moving forward and less homogenous trading across technology stocks as we move through the rest of the year.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite ended August on a down note, falling 0.9% on the week. Although the NASDAQ eked out a small August gain of +0.7%, volatility across Big Tech during the month and a rotation into more defensive areas of the market acted as a headwind for the tech-heavy index.

- In August, Consumer Staples (+5.8%), Health Care (+5.0%), and Utilities (+4.3%) helped lead the S&P 500 and Dow Jones Industrials Average higher. The Dow gained +0.9% on the week and rose +1.8% in August. However, the Russell 2000 Index was hampered by growth concerns more than other major U.S. benchmarks last month, finishing the week essentially flat and falling 1.6% on the month.

- For weeks, investors have been waiting on NVIDIA's earnings and outlook to gauge the demand for its artificial intelligence chips and get a sense of evolving trends in the AI space. Though NVIDIA's results were impressive they were not impressive enough to "wow" investors like in previous quarters. Simply, when a company is priced for perfection, delivering just "great" results sometimes doesn't cut it. In our view, the law of large numbers is beginning to catch up with a company that, until the previous quarter, could easily surpass even the most aggressive analyst profit estimates. While NVIDIA's revenue grew +122% year-over-year in the last quarter, that's down from three straight quarters of +200% plus year-over-year growth. Bottom line: The stock ended up +2.0% in August and followed volatile swings all month. That said, the stock is higher by over +140% this year. Fundamentals remain strong, the AI buildout is in the early innings, and NVIDIA's chips continue to be the go-to engine that powers most AI architectures. However, investors should remain cognizant that expectations and valuations for NVIDIA and Big Tech as a whole are elevated compared to other areas of the market that are more reasonably priced. This could result in more volatility across Big Tech based on how investors perceive the trajectory for growth and profits over the coming quarters. With expectations already high, investors may have to stomach more volatility moving forward and less homogenous trading across technology stocks as we move through the rest of the year.

- During the last week of August, July pending home sales unexpectedly fell 5.5% month-over-month, August consumer confidence came in ahead of expectations, Q2 GDP was revised higher to +3.0% from +2.8% previously, and core PCE inflation (the Fed's preferred measure) came in at an annualized pace of +2.6% for July, matching June's level.

- In August, the 2-year U.S. Treasury yield fell over 30 basis points, hitting its lowest levels going back to early 2023. The 10-year U.S. Treasury yield also moved lower on the month as inflation concerns moderated.

- The U.S. Dollar Index lost over 2.0% in August, recording its second consecutive monthly decline and touching its lowest levels since July 2023. Conversely, Gold rose over +2.0% last month, hitting fresh record highs. West Texas Intermediate (WTI) crude dropped 7.3% last month amid slower global growth, particularly in China.

UGH! It’s September.

Historically, September has been a challenging month for stocks. Over the last four years, the S&P 500 has dropped 4.9%, 9.3%, 4.8%, and 3.9%, respectively, in September. Those significant declines have contributed to producing a ten-year average S&P 500 September decline of 2.3%, which, by far, is the worst month for stocks over the measured period.

Over the last twenty years, the average S&P 500 September decline falls to 0.7% but remains the worst month of the year for performance. Notably, some defensive sectors have risen to the top of the performance charts over recent weeks. In our view, it's not surprising near-term investors/traders are positioning a little more cautiously ahead of a pretty volatile month historically.

Bottom line: With key macroeconomic reports on the horizon (August nonfarm payrolls on Friday and August CPI on September 11th) followed by an FOMC policy decision on September 18th, there are ample opportunities for increased volatility. And the likely ramp higher in political rhetoric pre-and-post the Harris/Trump debate on September 10th is also a near-term volatility risk, in our view.

But importantly, we believe that's all "noise" that distracts from the still solid fundamentals across growth and profits that could help stocks navigate through a period of volatility and into a seasonal period where historical trends are more favorable for asset prices. On average, the October-December period is the S&P 500's strongest three-month stretch, gaining +1.8% over the last ten years. In our view, investors should remain focused on using volatility to their advantage. Importantly, lean on time-tested dollar-cost averaging strategies and portfolio diversification to weather a potentially bumpier push into year end.

The week ahead:

This week's employment data, including the August nonfarm payrolls report on Friday, could help shape whether the Federal Reserve delivers a "jumbo-sized" rate cut later this month. Odds predominantly favor a 25-basis point rate cut on September 18th, but outsized weakness in labor trends could prompt officials to begin the rate-cutting cycle more aggressively than markets anticipate.

- Bloomberg estimates suggest August nonfarm payrolls grew by +165,000, up from the +114,000 jobs created in July. The unemployment rate is expected to tick down to +4.2% from 4.3% previously.

- July job openings data, August ADP National Employment, and August ISM manufacturing/services reports will also provide key insights into the pace of economic growth.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.