Investors learned a lot last week, but still have more questions than answers

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — August 4, 2025

Stocks looked set to glide through a pivotal week of data last week, that was, until some unexpected bumps in the road formed on Friday. Big Tech earnings were mostly impressive, and the Fed offered few surprises post-meeting. However, a disappointing July jobs report, weakness in Amazon shares, and concerning trade headlines from the White House pressured major stock indexes last week.

A light slate of economic data and roughly a quarter of S&P 500 companies reporting Q2 profit results line the week.

Last week in review:

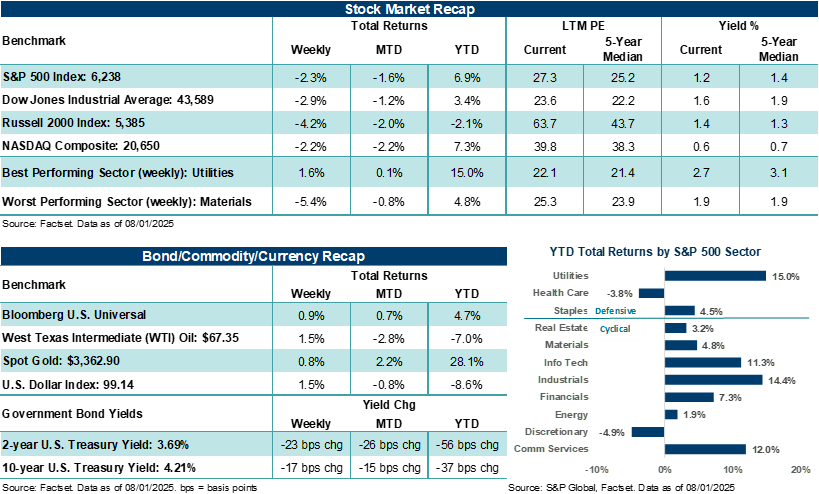

- The S&P 500 Index and NASDAQ Composite lost 2.4% and 2.2%, respectively. The Dow Jones Industrials Average (-2.9%) and Russell 2000 Index (-4.2%) also finished lower.

- U.S. Treasury yields fell. Gold, West Texas Intermediate (WTI) crude, and the U.S. Dollar Index moved higher. Copper fell over 23% after the White House announced refined metals would be excluded from tariffs.

- The Federal Reserve held rates steady at 4.25% – 4.50% with two dissents for a cut. Fed Chair Powell offered no clear hint of a September move, providing a somewhat hawkish tone.

- Microsoft and Meta Platforms delivered strong profit beats on AI-driven growth. Apple posted solid iPhone and China results. Amazon finished the week lower by over 7.0% on softer-than-peer cloud results and outlook.

- July nonfarm payrolls rose just +73,000, with a combined 258,000 jobs revised lower for May and June. Notably, the surprising revisions were the weakest two-month decline since 2020. The unemployment rate edged up to 4.2% from 4.1% in June.

- The White House announced sweeping new reciprocal tariffs beginning on August 7, including aggressive hikes on Canada, India, Brazil, and others. The headlines on Friday reignited trade tensions and growth concerns.

- July ISM Manufacturing remained in contraction, with tariff-driven cost concerns. Yet, consumer sentiment improved modestly as inflation expectations eased.

- Q2'25 GDP surprised to the upside at +3.0% quarter-over-quarter on lower imports. Core PCE rose +2.8% year-over-year, slightly above forecasts.

- Companies outside of Big Tech flagged tariff headwinds with P&G, UPS, and Stanley Black & Decker warning of price hikes, inventory costs, and demand risks.

“The final week of July delivered an interesting mix of economic data, corporate earnings, and policy developments that left investors both reassured about the path ahead as well as cautious about key questions that remain unanswered.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Investors learned a lot last week. But we still have more questions than answers.

The final week of July delivered an interesting mix of economic data, corporate earnings, and policy developments that left investors both reassured about the path ahead as well as cautious about key questions that remain unanswered.

U.S. equity markets ended the month on a high note, buoyed by robust GDP growth, stellar Big Tech earnings, and a Federal Reserve that, while holding its policy rate steady, signaled a continued data-dependent approach. Yet, beneath the surface of investor optimism that continues to keep major U.S. stock averages around new highs, signs of complexity and potential volatility are emerging, particularly around trade policy and inflation dynamics.

Notably, the U.S. economy expanded at a +3.0% rate in the second quarter, well ahead of the +2.0% economists estimated. This headline strength, however, was mostly driven by trade dynamics, as a sharp drop in imports – subtracted in GDP calculations – boosted the overall headline figure. However, final sales to domestic purchasers, a cleaner measure of underlying demand, in our view, slowed to +1.1% in Q2 from +1.5% in Q1, suggesting a more tempered pace of domestic activity.

Meanwhile, the labor market remains resilient, but July's nonfarm payrolls report raises unexpected concern regarding the underlying strength of job creation in the U.S., particularly against heavy downward revisions for May and June. Also, inflation data showed core PCE rising +0.3% month-over-month in June, the steepest increase since February, keeping the annualized rate at +2.8%. These figures, while not alarming, reinforce the Fed's cautious stance.

To that point, the Federal Reserve left its fed funds rate unchanged for the fifth consecutive meeting last week. Notably, Governors Waller and Bowman dissented in favor of a 25-basis-point rate cut – the first dual dissent since 1993 – highlighting growing divergence on rate policy within the committee. Nevertheless, Chair Powell's press conference struck a slightly hawkish tone, emphasizing that inflation remains above target and that the economy does not appear constrained by current policy. Importantly, Powell reiterated the Fed's commitment to evaluating additional inflation and employment data before the September meeting, leaving the door open for either a rate cut or a continued hold. However, after Friday's weaker-than-expected employment data, the odds of a rate cut next month jumped materially. In our view, if job growth hovers around current levels, and given the weaker-than-expected levels over prior months, the Fed is likely to cut rates in September.

Against this backdrop, outsized Big Tech earnings growth continues to provide a powerful tailwind for risk sentiment heading into what is normally a historically weaker two-month period for stocks. For example, Microsoft and Meta Platforms both materially exceeded profit expectations for the previous quarter and provided solid guidance, reinforcing the secular growth theme around artificial intelligence. And both companies highlighted aggressive capital expenditure plans to support AI infrastructure. These results not only validate the AI investment thesis but also could help buoy broader equity indices should volatility rise. Both Apple and Amazon also surpassed analyst profit expectations, but investor reactions to Amazon's cautious AWS outlook were not well-received. Bottom line: Strong profit results from Big Tech underscore a wider industry trend: AI is becoming a central driver of investment, product development, and long-term growth across Technology, which over time, should find its way into other industries, including Financials and Healthcare, which are early adopters of new technology. For now, Big Tech is delivering on expectations and confirming that the AI trend remains a durable theme that is increasingly profitable for technology companies with the size, scale, and dollars to invest in the buildout of AI.

Yet, the market's upward bias could be underappreciating some of the risks lurking around the corner. The White House issued a host of new tariff rates to be implemented on August 7 against many countries that will likely further complicate global trade. This includes more aggressive tariffs against Canada, India, and Brazil, as well as a 90-day reprieve for Mexico. In total, the average U.S. tariff rate will rise to 15.2% from 13.3% if the proposed new tariff rates kick in as the White House has laid out. In our view, the lack of clarity around announced deals, implementation, and enforcement raises longer-term concerns about the durability of trade conditions. While some trade deals promise increased U.S. energy purchases and investment, the details remain vague. The administration's tariff strategy, while aimed at reshaping global trade, continues to keep uncertainty elevated for businesses and investors alike. We didn't even mention that Trump's legal authority to institute these reciprocal tariffs is currently being challenged in the U.S. court system, which could very likely find its way to the Supreme Court at some point.

Corporate commentary echoed some of this concern last week. Procter & Gamble warned of mid-single-digit price hikes due to tariff-related input costs. UPS withheld 2025 profit guidance, citing tariff uncertainty and inventory headwinds. Whirlpool and Stanley Black & Decker flagged weakening demand and rising costs, with the latter estimating an $800 million tariff impact. These anecdotes suggest that while Big Tech thrives, other U.S. industries are grappling with the fallout from trade.

Finally, we believe equity valuations also warrant some scrutiny at current levels. The S&P 500 Index trades at a premium to historical averages as well as international peers based on earnings, largely driven by the outsized performance of a few mega-cap tech names. While this may be justified by superior earnings growth in Tech, it leaves the market vulnerable to shocks, be it from trade, inflation, or a potential stumble by a key Index heavyweight (e.g., NVIDIA). To us, the market appears priced for a "glass half full" scenario, and investors should be prepared for potential volatility, especially as seasonal headwinds and policy uncertainties loom.

In sum, the most pivotal week of the year so far offered a snapshot of an economy that remains fundamentally sound, a market buoyed by tech optimism, and a policy environment that is anything but settled. For investors, the message is clear: Stay grounded in fundamentals, remain diversified across high-quality assets, and be prepared to navigate both calm waters and the occasional storm ahead.

The week ahead:

- Economic releases will be light this week, with a final read on June durable/factory orders and July manufacturing and services activity the highlights. Weekly jobless claims on Thursday could receive more attention following the weaker-than-expected July jobs report last week.

- Key earnings reports include Advanced Micro Devices, McDonald's, Eli Lilly, and The Walt Disney Company.