Investing through uncertainty is generally a winning long-term formula

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — April 21, 2025

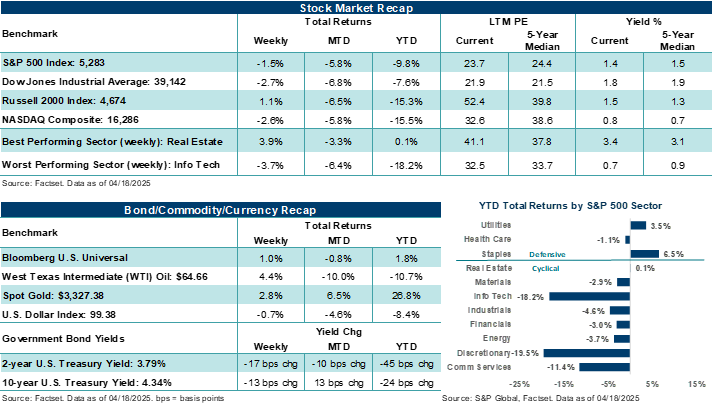

Stocks finished the shortened Easter week mostly lower. The S&P 500 Index and NASDAQ Composite ended in the red for the third week of the last four, with Big Tech and NVIDIA weighing on performance. March retail sales saw their biggest monthly gain since January 2023, and trade and tariff headlines out of the White House continued to keep investors on guard throughout the previous week. Overseas, the European Central Bank cut its policy rate by 25 basis points for the seventh time since June 2024.

This week, a little less than 25% of S&P 500 companies are scheduled to report profit results for the previous quarter. Although investors will likely look through first quarter earnings numbers, outlooks and company guidance will be highly scrutinized. Outlooks on demand, tariff impacts, and whether some companies decide to lower or pull guidance given the uncertain macroeconomic backdrop will most likely influence stock reactions this week. Preliminary looks at manufacturing and services activity as well as housing data line the economic calendar.

Last week in review:

-

The S&P 500 Index (-1.5%) and NASDAQ Composite (-2.6%) slid lower. NVIDIA dropped 8.5% as the stock reacted unfavorably to stiffer U.S. export restrictions on its H20 chips. However, the company said it would produce artificial intelligence supercomputers entirely in the U.S.

“The current investing environment is extraordinarily difficult to navigate and unpredictable at the moment. If we see further deterioration in trade developments from here, the risk of an economic slowdown in the coming months and a reduction in corporate profits could elevate quickly.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- Despite the continued pressure across Information Technology (-3.7%) and Communication Services (-3.0%), defensive sectors and areas less affected by tariffs, such as Real Estate (+3.9%) and Energy (+3.2%), performed well.

- The Dow Jones Industrials Average lost 2.7%, driven down by United Health Care falling over 24% in the week after missing first quarter earnings estimates and cutting full-year guidance on higher healthcare utilization. The Russell 2000 Index lost 1.1%.

- U.S. Treasury prices moved higher as yields on the 2-year and 10-year dipped lower.

- The U.S. Dollar Index finished lower. Gold advanced +2.8%, and West Texas Intermediate (WTI) crude rose +4.4%.

- On the trade front, the White House said China faces up to 245% tariffs on certain imports (e.g., electric vehicles and syringes) and higher than the 145% tariff routinely discussed for most other products, outside of the temporary exemption on certain tech products. In response, China said it would “fight to the end” and pared back its Boeing passenger plane orders. President Trump said trade talks with Japan were making progress. At the same time, Bloomberg noted that U.S./European Union trade discussions made little progress last week, with the bulk of tariffs looking like they might go into effect after the 90-day negotiating reprieve.

- Headline March retail sales increased +1.4% month-over-month, supported by consumers likely pulling ahead goods purchases, like autos, before the implementation of tariffs. The latest New York Fed Survey of Consumer Expectations showed short-term inflation expectations rising and expectations for the labor market deteriorating.

- Lastly, on the earnings front, Taiwan Semiconductor, the predominant chip fabricator of the world, beat earnings estimates for the first quarter and guided second quarter profits higher. The company also left full-year guidance unchanged despite tariff concerns. In our view, this is a positive sign that chip demand, particularly for advanced and AI semiconductors, hasn’t yet fallen due to increased volatility and tariff friction.

Investing through uncertainty is generally a winning long-term formula, even if conditions temporarily worsen.

The current investing environment is extraordinarily difficult to navigate and unpredictable at the moment. If we see further deterioration in trade developments from here, the risk of an economic slowdown in the coming months and a reduction in corporate profits could elevate quickly. That said, we believe there is still time for the White House to walk back some of its most aggressive proposals and form trade deals before the ball gets rolling on a downturn, which can and often starts to turn into a self-fulfilling prophecy that can be hard to reverse without a strong policy response. As investors, this is a good time to:

-

Trust in your well-constructed investment strategy and lean into diversification strategies.

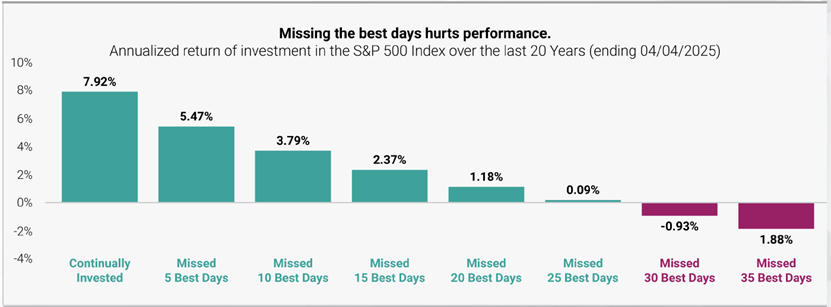

- Understand risks of further stock pressures are rising, at least temporarily. However, your ability to time the next 10% or 15% move in the market statistically is poor. And if you are successful in avoiding a further downturn in stocks, there is a low probability you will time the market correctly on the way up. As the chart below shows, with enough time, investing through downturns, recessions, and volatility while staying “continually invested” is generally a sound strategy for the long term.

- Avoid reacting to the barrage of headlines, and unfortunately, expect the market to be headline-driven for the foreseeable future. This could keep stock volatility elevated.

- Be sure you’re comfortable owning your investments for the longer term.

- And particularly for accumulators, if you love what you own, you may want to reframe recent declines in price as an opportunity to acquire quality investments on sale.

Sources: Bloomberg, Standard and Poor's, American Enterprise Investment Services, Inc. Returns assume investor was fully and continually invested in the S&P 500 Price Return Index except for the days specified. Calculations assume no fees or transaction costs. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

The week ahead:

Earnings reports from 3M, Tesla, AT&T, Chipotle Mexican Grill, Alphabet, Pepsi, and PG&E Corp are just a few of the key companies reporting first quarter results this week. Along with corporate outlooks, preliminary looks at manufacturing and services activity for April could provide investors with early reads on how consumers, businesses, and overall economic activity are responding to tariff uncertainty at the start of the second quarter.

-

With 12% of S&P 500 first quarter reports complete, blended earnings per share (EPS) growth is higher by +7.2% year-over-year on revenue growth of +4.3%. Thus far, 71% of companies reporting results have surpassed Q1’25 EPS estimates, below the five-year average of 77%.

- Preliminary reads on April manufacturing and services activity hit on Wednesday, and both measures are expected to decelerate from March levels. A batch of home data, the Fed Beige Book, and March durable orders also line the week.