How will Fed Chair Powell shape his keynote address at Jackson Hole?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — August 18, 2025

Major U.S. stock averages finished last week in the green, despite mixed reads on the U.S. economy. Inflation updates, data on the American consumer, government intervention into some U.S. businesses, and a summit between President Trump and Russian President Putin on the Ukraine war dominated headlines.

This week, key earnings reports from retailers should provide further color on the effects of tariffs on consumers and businesses. Central bankers and policymakers will meet in Jackson Hole later this week for the Federal Reserve's annual confab, which will focus on topics such as demographics and productivity this year.

Last week in review:

-

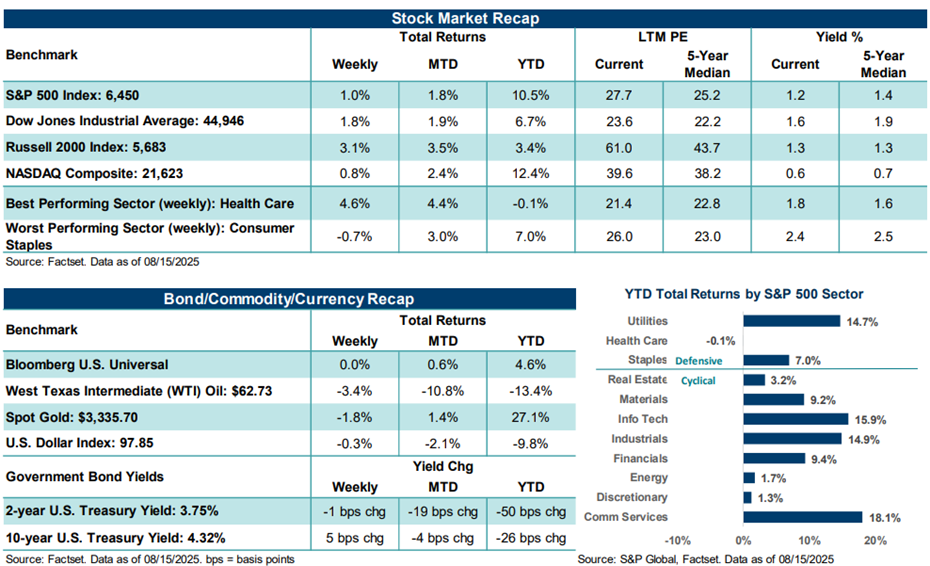

The S&P 500 Index and NASDAQ Composite rose +1.0% and +0.8%, respectively. The Dow Jones Industrials Average gained +1.8%, while the Russell 2000 Index jumped +3.1%.

-

The 10-year U.S. Treasury yield drifted slightly higher, with the 2/10 spread hitting its steepest point since May.

- Gold and West Texas Intermediate (WTI) crude settled lower, as did the U.S. Dollar Index.

- July core and headline measures of the Consumer Price Index (CPI) came in line with expectations. However, the July Producer Price Index (PPI) was hotter than expected, driven higher last month by a jump in services inflation.

- A preliminary look at August University of Michigan Sentiment showed a decline from July levels. July retail sales showed continued consumer strength but guarded spending in certain areas.

- The U.S. government will collect 15% of the revenue NVIDIA and AMD generate on semiconductors sold to China in exchange for export licenses. Further, speculation that the U.S. government could take a stake in Intel (+23.1% on the week) drove the company higher.

- President Trump and Russian President Putin met in Alaska on Friday to discuss how to end the war in Ukraine. The brief meeting yielded little evidence of any breakthroughs, though Ukrainian President Zelenskyy and European leaders will meet with Trump at the White House on Monday.

“Incoming employment data that points to a resilient labor market may cause investors to walk back odds for further rate cuts after September. However, we believe that if rate cuts are delayed following a potential rate cut in September, the stock market could absorb the adjustment if fundamental conditions in the economy and a solid profit backdrop remain intact.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Amid a complex economic backdrop, how will Fed Chair Powell shape his keynote address at Jackson Hole?

Investors looking ahead to the Federal Reserve's next move – particularly as the Fed's annual Jackson Hole Symposium kicks off later this week – should take note of a still pretty complex and evolving set of economic and market dynamics that could influence policy in the months ahead.

For instance, last week's key economic updates on inflation, retail sales, and consumer sentiment, as well as a batch of retail earnings reports this week, should continue to paint a nuanced picture of the U.S. economy and markets at present. One that may possibly allow the Federal Reserve to adjust its policy rate lower in September, though not without lingering inflationary concerns that ultimately could complicate rate cut expectations from there.

On the consumer front, July retail sales came in as expected, rising +0.5% month-over-month. However, the upward revision to June's sales suggests stronger momentum in consumer spending than previously thought. In addition, sales gains in July were broad-based, with notable strength in autos, furniture, and online sales. That said, softer sales in restaurants and building materials last month hint at some forming consumer caution.

Notably, updated inflation data likely complicates the picture for Fed officials, in our view. The July Producer Price Index (PPI) surged +0.9% month-over-month, the sharpest increase since March 2022, driven largely by higher services and food prices. The hotter-than-expected producer inflation last week followed a rather mixed July Consumer Price Index (CPI) report, which showed headline inflation rising +0.2% month-over-month and core CPI up +0.3%. While goods inflation cooled, services inflation re-accelerated, raising concerns about persistent price pressures. Bottom line: Inflation remains sticky and complicated by tariffs, with producers seeing rising costs that could eventually make their way into consumer prices.

And depending on how labor market data develops over the coming weeks and months, a firm employment backdrop could push back on the market's growing assumption of more dovish rate policy ahead. For example, last week's initial jobless claims fell below consensus, and continuing claims also declined. In our view, this suggests a resilient employment backdrop, despite the unexpected slump in nonfarm payrolls over recent months. Recall that building expectations for Fed rate cuts over the last week or two has been accompanied by concerns about softer labor trends. Bottom line: Incoming employment data that points to a resilient labor market may cause investors to walk back odds for further rate cuts after September. However, we believe that if rate cuts are delayed following a potential rate cut in September, the stock market could absorb the adjustment if fundamental conditions in the economy and a solid profit backdrop remain intact. S&P 500 profits are expected to grow by +7.5% year-over-year in the third quarter and by +7.0% in the fourth quarter, driven by strong artificial intelligence demand and stable trends elsewhere.

On the sentiment front, signals appear mixed at the moment. The University of Michigan's preliminary consumer sentiment report for August fell from July levels and missed expectations. Inflation expectations moved higher, with one-year expectations rising to +4.9% and five-year expectations to +3.9%. In our view, these figures suggest that consumers are increasingly worried about inflation and employment, despite recent signs of economic resilience. In addition, retail investors have grown more pessimistic on the stock outlook over recent weeks, as bearishness in the American Association of Individual Investors Survey has climbed higher.

Conversely, small business optimism improved in July, yet labor quality remains a top concern among business owners, and the "Uncertainty Index" within the small business survey rose sharply. A net 28% of small businesses plan to raise prices, down from June but still above historical norms — yet another signal of forming inflation pressures. And on the investor sentiment front, the latest BofA Global Fund Manager Survey showed rising bullishness among investment professionals, with equity allocations at six-month highs and cash levels near historical lows. Yet, a record 91% of fund professionals view U.S. equities as overvalued today, and inflation remains the top tail risk. The survey also reflects growing skepticism about the Fed's ability to cut rates amid persistent price pressures.

The title of this year's Jackson Hole Symposium (August 21 – 23) is "Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy." The annual conference allows central bankers and economic and policy experts from across the globe to discuss and strategize near and long-term dynamics facing global economies. However, most of the market will really only be focused on sideline interviews with Fed officials and Friday's keynote speech from Fed Chair Powell. Though we expect Powell to keep the committee's optionality open at the September meeting, he may choose to open the door to potential rate cuts on "conditional metrics", such as softening-to-stable labor conditions combined with the absence of a further uptick in inflation pressures. Given market odds for a 25-basis-point September rate cut already stand at 83%, Powell may choose to tread cautiously in his speech on Friday, so as not to further cement a predetermined rate path, given he and the committee will get another look at a nonfarm payrolls report and key inflation data ahead of the September meeting.

In total, macroeconomic conditions in the U.S. continue to show incredible resilience, but we believe pressures from trade and tariffs are beginning to form under the surface. At the same time, major U.S. stock averages sit near all-time highs and investors "expect" lower interest rates in the future, ongoing corporate profit strength, and any trade and tariff impacts to be manageable through year-end. If these conditions come to pass, we believe stocks can grind higher from here. However, should inflation pressures rise and erode companies' ability to maintain profit strength, stocks could see more bumps in the road at current valuations outside of Tech. On that front, a batch of retail earnings reports this week, from the likes of Home Depot, Target, TJX, and others, could start to provide a better picture of how exactly consumers and retailers are feeling tariff impacts.

The week ahead:

-

It's usually not a great idea to bet against the American consumer. That theory will be tested this week when a batch of retailers report their profit results for the previous quarter and provide outlooks on trade and consumer trends. Thus far, investors have been comfortable looking through potential tariff headwinds for the group, with the SPDR S&P Retail ETF (XRT) up nearly +35.0% from its April lows.

-

Housing data, the July FOMC minutes, and preliminary looks at August manufacturing and services data line the week.