Happy third birthday, bull market. From bear bottom to AI boom — what's next?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — October 13, 2025

Stocks opened last week with positive momentum, driven by continued AI deal announcements. However, major U.S. stock averages finished the week lower after rising trade tensions between the U.S. and China rekindled concerns that their economic relationship is continuing to deteriorate. In addition, the U.S. government remained shut down due to Democrats' and Republicans' inability to pass a continuing resolution that would provide temporary funding.

This week, furloughed government workers (and those considered essential, who are still on the job) will begin missing pay if the government remains shut down, as will active-duty military personnel. And the third-quarter earnings season kicks off in earnest this week, with a host of heavyweight banks scheduled to report results and outlooks starting Tuesday.

Last week in review:

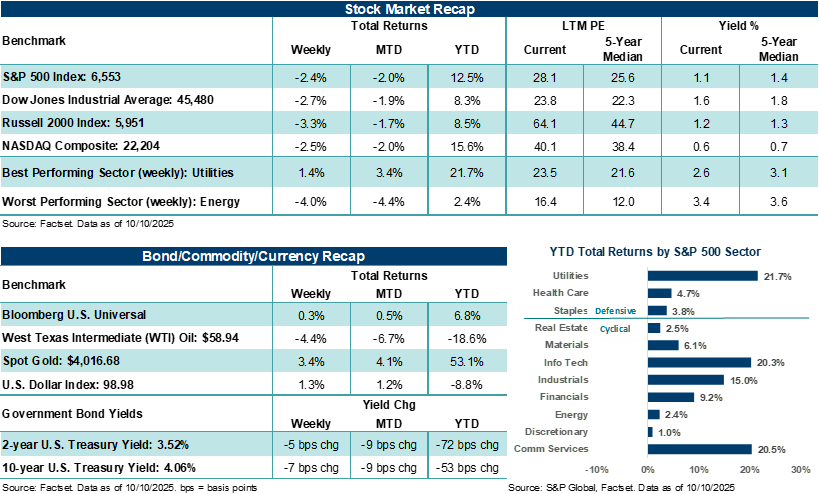

- After making new highs earlier in the week, the S&P 500 Index and NASDAQ Composite finished the week lower by 2.4% and 2.5%, respectively. The major averages closed lower for the second week in the past three, with Friday's decline in the S&P 500 marking its worst daily performance since April 10.

- On Friday, news broke that China had established new export controls on its rare earths materials, which are essential for technology and auto production across the world and announced other measures that could harm U.S. businesses operating in China to gain leverage in upcoming trade discussions with the U.S. Note: China controls roughly 70% of the global supply of rare earths, according to a January U.S. Geological Survey. In addition, the stock market turned south on Friday after President Trump announced that the White House would reinstate tariffs on goods imported from China to levels well above 100% when combined with existing tariffs, effective November 1. Currently, the effective tariff rate on China stands at 40%, according to the Federal Reserve Bank of New York. Finally, on the tariff front, and a potential near-term blow specifically to the momentum across technology stocks, President Trump announced that on November 1, he would impose export controls on "any and all critical software" destined for China.

- The Dow Jones Industrials Average lost 2.7%, while the Russell 2000 Index finished lower by 3.3%.

- U.S. Treasury yields declined on the week, particularly on Friday, as investors sought safety in government bonds. Gold finished higher for the eighth straight week, touching above $4,000 per ounce for the first time. The U.S. Dollar Index finished higher, while West Texas Intermediate (WTI) crude fell below $60 per barrel, currently at its lowest levels since May.

- At the start of the week, OpenAI announced it would purchase $300 billion of computing power from AMD over the next five years, with the option to acquire a 10% stake in the semiconductor maker. Concerns over circular deals across the AI ecosystem (i.e., where a few key players are responsible for driving broad demand/profits across the supply chain) continue to resonate in the headlines.

- House Speaker Mike Johnson said he doesn't plan to bring House members back in session until the Senate passes the continuing resolution passed weeks ago.

- Despite the lack of government economic data being released due to the government shutdown, the Bureau of Labor Statistics (BLS) confirmed it will release the Consumer Price Index (CPI) report on October 24, before the Federal Reserve holds its next policy decision on October 29.

“As the bull market enters its fourth year, we believe a balanced and cautiously optimistic view of the future remains appropriate, given current fundamental conditions and historical precedent. The past three years have been a textbook example of markets looking forward, not back, and focusing on the big-picture trends that shape profit and economic direction over the longer term, rather than the day-to-day minutiae that can derail investment success.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

Happy third birthday, bull market. From bear bottom to AI boom — what's next?

Taking a step back for a moment from the U.S. government shutdown, intensifying trade drama, and current macroeconomic, profit, and AI conditions driving markets at present, we decided to dedicate some ink to celebrating the current bull market, which turned three years old on Sunday. Interestingly, during periods of market stress, like in the fall of 2022, it can sometimes be difficult for investors to see the turns in the market. The same can probably be said when everything in the stock market appears to be humming along just fine (much like right now, absent Friday). That said, recognizing the third anniversary of the current bull market presents an opportunity to remind investors that markets can climb higher, even when the path forward for trade, policy, inflation, interest rates, growth, and profits isn't always crystal clear.

On October 12, 2022, the S&P 500 Index was down nearly 25% year-to-date, the Consumer Price Index was running at +8.2%, and the Federal Reserve was aggressively hiking rates. The U.S. economy had contracted in both Q1 and Q2 of that year, and recession fears were widespread. Yet, that date marked the end of the last bear market and the beginning of a new bull market, which investors continue to enjoy today. Through Friday, the S&P 500 is higher by roughly +91% cumulatively on a total return basis since the start of the bull market run. Notably, the S&P 500 Information Technology Index has risen by +176% since mid-October 2022, despite being down over 33% at the time. As investors now more fully appreciate, but didn't realize at the time, the launch of ChatGPT in November 2022 marked the beginning of a new era in AI computing, which has largely fueled this bull market ever since, even when other macroeconomic conditions have been less certain.

While the broader stock market hasn't necessarily moved in a straight line over the last three years, stocks have continued to rise relatively consistently since the bear market bottom in October 2022, despite numerous challenges, uncertainties, and reasons to be fearful of what lies ahead. Trade tensions, elevated inflation, growth concerns, and several event shocks have failed to derail the current bull market over the last three years. In our view, this is because the fundamental backdrop of consumers and businesses in the U.S. has remained stable for several years, and AI secular tailwinds have contributed to outsized profit growth among a subset of S&P 500 and NASDAQ companies that now dominate each of the indexes.

Notably, the roughly +91% return in the S&P 500 over the last three years (1095 days) isn't particularly aggressive by historical standards when considering overall bull market runs. Going back to 1929, the S&P 500 has averaged a +114.4% gain during a full bull market run, with the duration of the run lasting 1,011 days on average, according to Bespoke Investment Group. Bull markets tend to be long and steady, while bear markets have a history of being short and fierce. With the bull market stretching into its fourth year, some may fear it's getting long in the tooth. However, there are several instances where a bull market has lasted far longer than the average and died much earlier. At least thus far, this bull market run has looked fairly typical in terms of returns and duration but appears to be driven by an extraordinary factor of technological advancement that has not always been present in past bull runs.

According to Bespoke, there have been nine other instances where S&P 500 bull markets have stretched into a fourth year, dating back to the early 1940s. When a bull market stretches beyond its third year, the average duration of the run is 6.5 years, resulting in an average cumulative return of nearly +225%. Only the bull market in the mid-1960s didn't last a full four years. Notably, the bull markets that ran from late 1987 to March 2000, and the 2009 to 2020 bull run, may be more applicable today based on current technological advancements and economic and policy conditions.

Looking ahead to the rest of the year, equity performance will likely hinge on data related to employment, inflation, and earnings, particularly around AI spending and monetization themes, as well as technology profits and outlooks more broadly. Near-term risks include Q3 earnings volatility (particularly on the demand and tariff front), an escalation in trade tensions between the U.S. and China, as well as some potential near-term investor disappointment if AI outlooks from key players in the space don't match elevated expectations. Still, if fundamentals remain intact, we believe the market has an opportunity to settle slightly higher by year-end, despite temporary shifts in sentiment.

Bull markets typically end due to major shocks or policy tightening. Outside of a trade shock, neither condition appears imminent through year-end at least. While shocks are inherently unpredictable, fear of near-term declines should not deter investors from maintaining diversified portfolios with sufficient equity exposure for long-term growth. Importantly, the current bull market began before it was clear that growth would stabilize, inflation would ease, rates would peak, or profits would recover. What is often the case across history is that when bear markets turn into bull markets, stock prices reflect the expectation of improvement in these factors well ahead of confirmation. Investors who have stayed invested through the uncertainty over the last several years have benefited immensely, in our view.

Bottom line: As the bull market enters its fourth year, we believe a balanced and cautiously optimistic view of the future remains appropriate, given current fundamental conditions and historical precedent. The past three years have been a textbook example of markets looking forward, not back, and focusing on the big-picture trends that shape profit and economic direction over the longer term, rather than the day-to-day minutiae that can derail investment success. Investors would be wise to keep this point top-of-mind, especially "when" not "if" we enter the next rough patch in the market.

The week ahead:

-

Q3'25 S&P 500 earnings per share (EPS) are expected to grow by +8.0% year-over-year but are likely to grow by double digits when the dust settles, which would mark the fourth consecutive quarter of double-digit EPS growth for the Index.

-

Earnings from JPMorgan, Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley, BlackRock, Bank of America, and other companies will be the market's focus this week, as investors seek the latest insights into consumer and business trends. In addition, read-throughs/potential contagion issues regarding opaque commercial bank loans in the auto sector following the bankruptcy of Tricolor and First Brands will also receive a high degree of analyst attention.