The Fed will likely hold rates steady this week. But are central bankers ready to change their tone?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 10, 2024

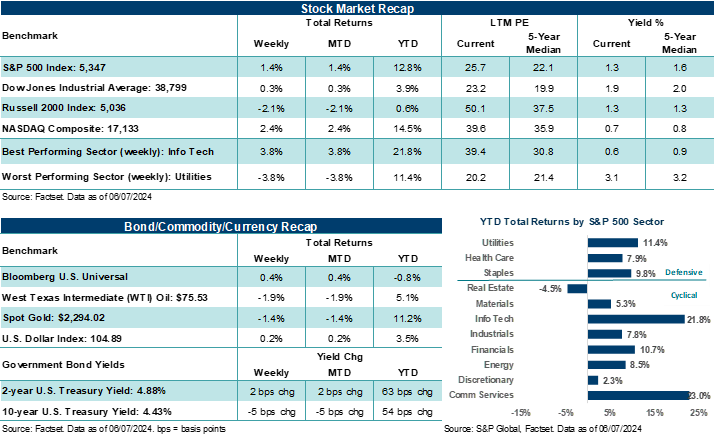

The S&P 500 Index and NASDAQ Composite each logged their sixth week of gains out of the last seven and hit fresh new highs last week. Information Technology led gains, while Utilities and Energy lost ground. NVIDIA again supported Big Tech's strength, splitting 10 for 1 after Friday’s close. However, concentrated leadership and narrow breadth across the rest of the market was flagged as a growing concern. Jobs data and fresh looks at economic data in the U.S. helped lift major stock averages higher. At the same time, rate cuts from the Bank of Canada and the European Central Bank last week could set the stage for easier monetary policies in the second half.

Last week in review

- The S&P 500 hit its 25th closing high of the year, gaining +1.3% on the week. The Dow Jones Industrials Average (+0.3%) and NASDAQ (+2.3%) closed the week higher as well, while the Russell 2000 Index slumped lower by over +2.0%. A higher-for-longer rate environment continues to challenge small-cap stocks.

- Information Technology moved higher by +3.8% last week and is higher by over +21.0% in 2024.

- NVIDIA crossed the $3 trillion market capitalization level for the first time, joining Apple and Microsoft as the largest companies on the planet.

- The Bank of Canada and European Central Bank each cut their policy rates by 25 basis points and are the first G7 central banks to ease monetary policies in this cycle.

- Nonfarm payrolls jumped +272,000 in May, higher than the +180,000 jobs expected and more than the downwardly revised +165,000 jobs created in April. The unemployment rate ticked higher to 4.0% in May from 3.9% in the month prior.

- U.S. Treasury prices were volatile on the week as investors attempted to read the tea leaves across incoming economic data for clues about potential rate cuts from the Federal Reserve later this year. Following the hotter-than-expected nonfarm payrolls report, odds of a 25 basis point fed funds rate cut in September currently stands near 50/50.

- Gold slid lower on the week.

- West Texas Intermediate (WTI) crude lost nearly 2.0%.

- The U.S. Dollar Index was slightly stronger versus a basket of developed country currencies.

“Navigating a soft landing for the economy requires some policy nuance around understanding when rates may become too restrictive for growth and if the last mile of inflation might just need time to normalize back to target.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

With NVIDIA’s run to a $3 trillion market capitalization last week, Apple, Microsoft, and NVIDIA now have combined market caps slightly above all the companies trading across China’s entire stock market. As China’s economy struggled through the pandemic and post-pandemic recovery, continues to grapple with a slowly deflating property bubble, and sees ongoing trade and political headwinds with the U.S., the size of its stock market has shrunk over recent years.

Conversely, as a pandemic-led technology refresh cycle and artificial intelligence boom has boosted the profitability of Apple, Microsoft, and NVIDIA, the size of these three companies has grown tremendously over the last few years. In fact, the three tech giants combined now account for roughly 20% of the S&P 500. Bottom line: The influence of these mega-cap stocks on the direction of U.S. markets currently sits in some pretty rare air.

On the U.S. economic front last week, updated looks at activity and employment show that the U.S. economy is on a continued, yet uneven, trend toward normalization. The April Job Openings and Labor Turnover Survey (JOLTS) showed open roles coming in lower than expected. Simply, fewer open roles and less job switching could help keep a lid on upward wage pressures over time. In addition, May ADP private payrolls came in weaker than expected, with April figures revised lower. Notably, May updates on economic activity, including ISM Manufacturing and Services reports, show a more hopeful inflationary environment. While ISM Services moved into expansion more aggressively than expected last month after unexpectedly falling into contraction in April, respondent commentary in the survey was mostly downbeat, mentioning steady but slowing conditions. ISM manufacturing activity remained firmly in contraction last month. Prices paid (a measure of inflation) fell in both reports last month. And while the May nonfarm payrolls report pushed back on rate cut expectations somewhat, including hotter-than-expected wage pressures, we don’t believe last week’s reports change the Fed’s policy calculus much.

Overseas, the European Central Bank (ECB) lowered its target rate by 25 basis points to 3.75%, its first rate cut since September 2019 following nine consecutive months of steady rate policy. Yet, much of investors’ focus following the expected rate cut was on the ECB’s outlook. However, the ECB’s policy statement made no commitment to future rate cuts, with ECB President Christine Lagarde stressing the central bank’s “data-dependent” approach. In an interesting twist, the ECB “raised” its 2024 inflation outlook. Intuitively, the ECB raising its inflation outlook while cutting interest rates may seem at odds.

However, Lagarde addressed this mismatch by saying the rationale for cutting rates was driven by the committee’s concerns that monetary policy may become too restrictive to support growth over time, given its rising confidence in its medium-term inflation projections. Meaning, that the committee now has greater confidence that inflation will gradually move to its targets over time, and supporting growth in the economy today has become an increasingly important driver of policy decisions.

This is a very important change in ECB policy tone and one the Federal Reserve may soon have to face. Bottom line: Navigating a soft landing for the economy requires some policy nuance around understanding when rates may become too restrictive for growth and if the last mile of inflation might just need time to normalize back to target. The ECB’s move last week suggests that some policymakers may sympathize with this view, hence a willingness to cut rates slightly to prevent growth from slowing more aggressively even though inflation isn’t fully back to target.

The week ahead

Key updates on inflation and a Fed policy meeting this week could set the tone for markets as the second quarter begins to wind down. Given the current bias for stocks to melt higher at the moment, fresh looks at consumer and producer price inflation that show even slight tilts lower could be greeted positively by investors.

Expect the Federal Reserve to hold rates steady on Wednesday. We expect Fed Chair Powell and company to maintain a position that stresses potential rate cuts remain contingent on the committee seeing further progress made on bringing down price pressures. Outside of how this week’s inflation updates come in, trends across consumer and producer prices over recent months have shown mixed progress, thus keeping Fed officials comfortable on the sidelines.

- On Wednesday, the May core Consumer Price Index (CPI) is expected to hold steady on a month-over-month basis at +0.3% versus April levels and fall to +3.5% year-over-year from +3.6% previously. In addition, May headline CPI is expected to drop to +0.1% month-over-month from +0.3% in April and remain at +3.4% year-over-year. Lower gasoline prices last month should help ease headline consumer inflation in May.

- Much of the Fed focus this week will fall on the updated Summary of Economic Projections. Several Fed watchers expect the updated “dot plot” to show policymakers, in aggregate, now forecast just one or two rate cuts in 2024, down from three cuts forecast in March. Bottom line: We expect the Fed to remain guarded this week on rate cut messaging and continue to highlight a strong economy and elevated inflation as reasons to leave rates higher for longer.

- The Producer Price Index on Thursday and a preliminary look at June Michigan Sentiment on Friday round out the week.

Return to My Accounts

Return to My Accounts