Could Q4 kick off with the U.S. Government closed?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — September 29, 2025

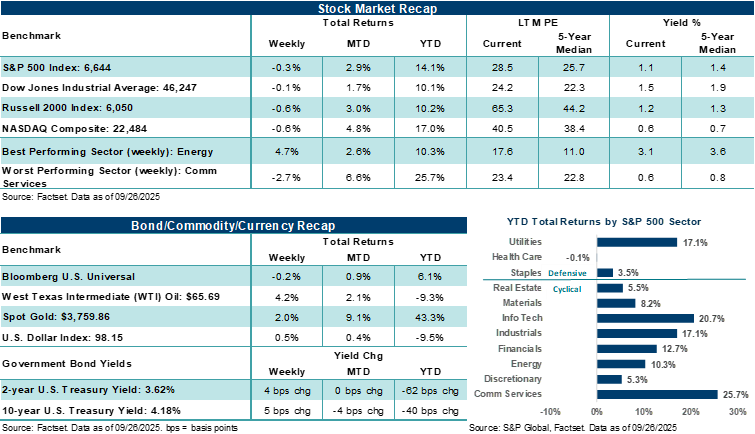

Major U.S. stock averages took a breather last week, closing lower following three consecutive weeks of gains. Investors dialed back rate cut expectations amid better-than-expected economic data last week and the Federal Reserve's preferred measure of inflation coming in as expected. Trade headlines and concerns about a potentially circular environment for artificial intelligence also kept a lid on market sentiment.

At least at the start of the week, headlines will focus on a pending U.S. partial government shutdown on Wednesday, which could complicate the release of the all-important September nonfarm payrolls report on Friday.

Last week in review:

-

After hitting new highs on Monday, the S&P 500 Index and NASDAQ Composite drifted lower during most of the week, finishing down 0.3% and 0.6%, respectively. NVIDIA's up to $100 billion multiyear investment in OpenAI to help build out data centers prompted some market watchers to comment on whether NVIDIA's end goal is to prop up demand for its own chips. However, deals that support the growing need for additional computing and power generation are necessary to further AI models and spark broader adoption over the coming years, which is likely why NVIDIA's stock finished the week higher.

-

The Dow Jones Industrials Average finished lower by 0.1%, while the Russell 2000 Index ended lower by 0.6%.

- U.S. Treasury yields ticked higher amid the week's tepid-to-weak demand for new issuance of Treasuries. The U.S. Dollar Index finished higher, Gold hit $3,800 for the first time, and West Texas Crude posted its best week since June, rising on geopolitical tensions with Russia.

- A host of Federal Reserve officials spoke last week, with most providing comments that supported one or two 25-basis-point rate cuts by year-end. However, newly minted Governor Miran laid out his contrarian economic views, which support far more aggressive rate cuts.

- August core PCE inflation increased by +2.9% year-over-year, matching expectations. However, personal spending and income trends last month came in stronger-than-expected, helping support the idea that consumers remain on solid footing.

- President Trump announced new sectoral tariffs on pharmaceuticals, heavy trucks, and furniture imports, offering exemptions for companies that manufacture or have plans to manufacture in the U.S. With little progress made between Democrats and Republicans to fund the government past September 30, odds of a partial shutdown this week are high.

“The market enters Q4 with solid momentum, but we believe stocks face a high bar of execution to justify further gains from here. Investor sentiment is constructive but not euphoric, and the upcoming earnings season will be critical in determining whether the rally can be sustained into what is historically a seasonally strong three-month period for stocks.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

As Q4 begins, economic stability, earnings optimism, and policy uncertainty color the investment landscape.

On Tuesday, the books will close on the third quarter, and by most accounts, economic, profit, and market conditions in the U.S. appear in good standing heading into the final quarter of the year. The Atlanta Federal Reserve's GDPNow model is pointing to growth of +3.9% in Q3, consumer spending and income levels have accelerated over recent months, inflation remains stable, but elevated, and job growth, while slowing, appears on solid footing. In addition, analysts expect Q3 S&P 500 earnings per share (EPS) to grow by a healthy +7.9% year-over-year, which would mark the ninth consecutive quarter of earnings growth. And per historical precedent, we believe there is space for profit results to surprise modestly to the upside during the reporting season, which begins next month.

Notably, despite some recent equity volatility last week, U.S. equities are on track for another strong quarter of gains, with the S&P 500 Index up +8.5% quarter-to-date. Gains, however, remain concentrated in Communication Services and Information Technology, reflecting still top-heavy returns within major averages and elevated valuations across large-cap and Big Tech stocks. That said, the Russell 2000 Index is also on pace for a solid quarter of gains, as expectations for additional Fed rate cuts through year-end and into next year have helped lift sentiment on an equity category that has been unloved for quite some time. And we would be remiss if we didn't note that Gold is up nearly +14.0% quarter-to-date.

In our view, investor sentiment entering the fourth quarter looks balanced, yet slightly cautious. The latest American Association of Individual Investors Survey shows bullish sentiment modestly above its long-term average. Nevertheless, retail investor sentiment appears more guarded than the data suggests, reflecting persistent concerns about trade, tariffs, inflation, and elevated stock valuations. Some of this caution can be seen among consumers as well, with a final look at September University of Michigan Consumer Sentiment showing 44% of respondents saying that high prices are eroding their personal finances — the highest reading of the year. But we care most about what consumers "do", rather than how they "feel". With a string of better-than-expected economic releases recently, including a final Q2 GDP print of +3.8% (driven by strong consumer spending), and initial jobless claims at two-month lows, investors may need to temper their expectations for more aggressive Fed rate cuts ahead. Nevertheless, we believe the Fed does have room to lower its policy rate by 25 or 50 basis points before year-end to help normalize policy. Bottom line: Solid macroeconomic conditions, supported by healthy consumer activity, combined with an opportunity for the Fed to ease rates, have contributed to a market environment where stock volatility has been largely contained since the April lows.

The bullish narrative heading into Q4 has been reinforced by strong capital markets activity as of late, including increased M&A trends and record high-yield bond issuance for September. According to EPFR Global, retail flows have also been notable, with nearly $90 billion in global equity inflows over the past two weeks, the third largest on record. Importantly, artificial intelligence investment remains a clear driver for markets, with NVIDIA announcing plans to invest up to $100 billion in OpenAI and Alibaba's stock moving higher on increased AI spending guidance.

However, the market's resilience could be tested at some point in the fourth quarter. Headlines have increasingly scrutinized the sustainability of AI monetization, and return-on-investment metrics could become increasingly important to investors amid record levels of capex spend by the hyperscalers. Valuations also remain elevated. The S&P 500's forward price-to-earnings ratio sits at 22.5x, a level only approached once in the past five years, during the COVID-19 recovery. While the earnings environment is strong for select mega-cap tech companies, profit expectations are high, and we believe much of the good news sentiment about the profit outlook is reflected in prices today. Historical analysis shows that after outsized 100-day gains in the S&P 500 (like we've seen recently), forward returns tend to be more muted, reinforcing the case for mean reversion and the potential for a period of consolidation or a short-term pullback in the market. That said, we believe fundamental dynamics, including a stable rate environment and durable profit conditions, remain supportive of current stock levels, provided there is no unexpected deterioration in labor market trends or a negative surprise from Big Tech earnings.

Looking ahead, the upcoming Q3 earnings season is likely to play a key role in how stocks perform out of the gate in Q4. Analysts have bumped up their Q3 profit estimates over the course of the current quarter, with Information Technology projected to deliver +20% year-over-year profit growth. The second quarter saw S&P 500 earnings per share rise +12.0%, far exceeding the +4.8% growth expected, but this quarter's higher starting point could leave less room for upside surprises. Of course, Big Tech will again play a central role in how investors interpret results, with hyperscaler capex trends and monetization themes under increased scrutiny, as discussed above. However, big banks will set the tone for the earnings season early, with investors focused on consumer health, net interest income trends, and the outlook for capital markets activity. In addition, the ability of tariff-exposed companies to pass on tariff costs has diminished, potentially challenging the mitigation narrative companies pointed to in their last earnings updates. Speaking of tariffs, U.S. trade policy could remain a headline risk for the market in Q4, with new sectoral tariff announcements intersecting with current legal challenges on reciprocal tariffs and amid already inked trade deals and ongoing negotiations.

This week, a potential partial U.S. government shutdown will likely be front and center in the headlines, as the odds of a shutdown are currently high. Republicans and Democrats appear far apart on a continuing resolution that would fund the government past September 30. Both parties are expected to meet with President Trump on Monday. However, history suggests that shutdowns have had little to no lasting impact on financial markets. The S&P 500 has actually posted "gains" during the most recent shutdowns, with the market viewing these episodes as more of an annoyance than a material economic threat. Should the government shut down on Wednesday, essential operations will continue, and Congress will eventually form a short-term deal to reopen the government and continue budget negotiations. Thus, markets tend to look through these types of political theater.

Bottom line: The market enters Q4 with solid momentum, but we believe stocks face a high bar of execution to justify further gains from here. Investor sentiment is constructive but not euphoric, and the upcoming earnings season will be critical in determining whether the rally can be sustained into what is historically a seasonally strong three-month period for stocks. While risks around trade, policy, and sector-specific headwinds persist, historical precedent suggests that even in the face of government shutdowns, markets have the capacity to advance, provided underlying fundamentals remain intact.

The week ahead:

-

"If" the U.S. government enters a partial shutdown "and" it lasts through Friday, the Bureau of Labor Statistics could shutter operations during the shutdown. This may delay Friday's jobs report. And if the shutdown lingers, highly anticipated September inflation reports in mid-October could also be negatively affected. Notably, an extended period where the BLS is not operating at full strength could affect data collection efforts for other reports, which may impact the quality of the data.

-

Friday's payroll report is expected to show that the U.S. economy added 51,000 new jobs in September, while the unemployment rate held steady at 4.3%. Helping fill a packed calendar of data and Washington drama, the August Job Openings and Labor Turnover Survey (Tuesday), September Consumer Confidence (Tuesday), September ISM Manufacturing (Wednesday), the September ADP Employment Survey (Wednesday), and September ISM Services (Friday) will keep investors very busy.