Consumers are in a festive mood

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — December 9, 2024

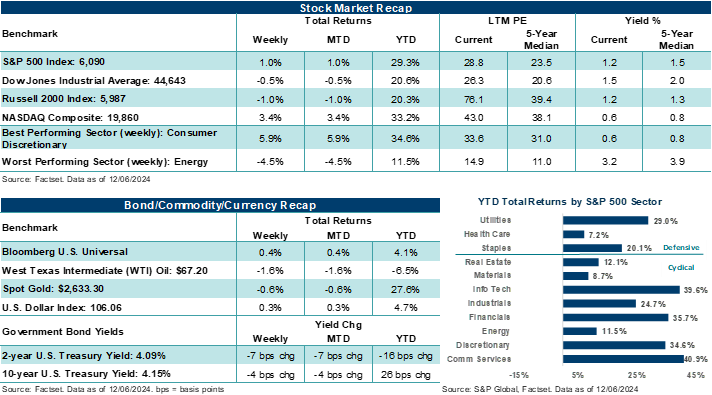

The S&P 500 Index and NASDAQ Composite both finished last week at fresh record highs. The NASDAQ was the best-performing benchmark on the week, driven by further Big Tech upside. Yet performance across the major U.S. stock averages was mixed, as the Dow Jones Industrials Average and Russell 2000 Index fell on the week. Importantly, fresh looks at U.S. employment data showed a firm environment, but one that will likely allow the Federal Reserve to cut its policy rate again later this month. And with the employment picture remaining healthy, consumers look comfortable splurging on gifts this holiday season, as sales over the five-day Thanksgiving holiday came in strong. Overseas, political disruptions flared in France, South Korea, and Syria, reminding investors that the risk of the unexpected never really goes away, no matter how good the market environment looks.

This week, fresh looks at inflation will be the last pieces of the economic puzzle Fed officials will have before delivering their final rate decision of the year on December 18. In the background, market pundits will debate if this year’s strong stock momentum can continue into 2025 while updates on small business sentiment and several U.S. Treasury auctions grab investors' interest.

Last week in review:

- The S&P 500 gained +1.0%, finishing higher for the third consecutive week, and is up four of the past five weeks. On Friday, the Index recorded its 57th record close of 2024. Since the November 5 election the broad-based U.S. stock benchmark is higher by +5.3% and up a stunning +29.3% for the year.

- The NASDAQ rose an impressive +3.4%, also closing higher for the third straight week. The tech-heavy index was supported by a rotation back to Big Tech leadership and fueled by solid earnings results from Salesforce, Marvell Technology, and Hewlett Packard Enterprise. Positive artificial intelligence takeaways from the Amazon AWS conference also helped boost tech sentiment.

“The U.S. economy is primed to finish its tenth straight quarter of growth, inflation is approaching normalized levels, the unemployment rate is low, investor and consumer optimism is high, and the Federal Reserve is in the process of lowering interest rates. Pile on expectations for lower taxes, less regulation, and a growth-friendly business environment next year, and it’s not surprising that Americans are feeling pretty darn good about the future. And when Americans feel good, they generally open their wallets and spend.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The Dow (-0.6%) and Russell 2000 (-1.1%) slid lower on the week.

- U.S. Treasury yields slightly dipped as prices firmed.

- The U.S. Dollar Index edged higher, Gold edged lower, and West Texas Intermediate (WTI) crude finished near flat.

- Bitcoin rose on the week, surpassing $100,000 for the first time. President-elect Trump picked former SEC Commissioner Paul Atkins to lead the agency, who is expected to oversee (if confirmed) a more crypto-friendly regulatory agency.

- November nonfarm payrolls rebounded from October’s hurricane and Boeing strike depressed levels, rising +227,000. November’s job gains came in above consensus estimates, with job revisions over the last two months rising by +56,000. The unemployment rate ticked higher to 4.2% last month from 4.1% in October, while the prime-age employment-to-population ratio and participation rate weakened. Following the release of Friday’s jobs report, odds of a 25-basis point rate cut this month jumped to 89% from 70% pre-release. In addition to the nonfarm payrolls report, job openings in October came in stronger than expected, while November private ADP payrolls missed estimates, with October figures revised lower. Bottom line: The job market remains healthy but is softening on the edges. Labor conditions should allow the Fed to comfortably lower its policy rate this month outside of an unexpected shock in inflation data this week.

- In other U.S. economic updates, ISM manufacturing activity remained in contraction but rose to its highest level since April and put in its best month-over-month gain since August 2023. However, ISM services activity softened, slowing to a three-month low but remaining firmly in expansion territory. And a preliminary look at December Michigan sentiment saw consumer optimism improve to its highest level since April and logged its fifth straight month of improvement. However, one year ahead inflation expectations (+2.9%) rose to its highest reading in six months.

- Overseas, the French government led by Prime Minister Michel Barnier fell after the first no-confidence vote since 1962. Marine Le Pen’s National Rally party joined the left-wing New Popular Front to topple the government. Uncertainty now clouds the path for fiscal leadership, as parliamentary elections cannot be held until July. In further political instability, Soth Korea’s ruling People’s Power Party (PPP) chief, Han Dong-hoon, said South Korean President Yoon Suk Yeol should no longer be allowed to exercise his executive powers after seeing evidence the President planned to arrest major political leaders during a failed attempt at martial law earlier in the week. Over the weekend, Yoon avoided impeachment after allied lawmakers walked out on a vote to remove him from office.

Consumers are in a festive mood, which should help support a strong finish to an exceptionally strong year.

Let’s just get this out of the way at the top. The S&P 500 is on pace for its best year since 2019 and ready to close out two consecutive years of +20% plus returns, which would be a first since the late 1990s. The U.S. economy is primed to finish its tenth straight quarter of growth, inflation is approaching normalized levels, the unemployment rate is low, investor and consumer optimism is high, and the Federal Reserve is in the process of lowering interest rates.

Pile on expectations for lower taxes, less regulation, and a growth-friendly business environment next year, and it’s not surprising that Americans are feeling pretty darn good about the future. And when Americans feel good, they generally open their wallets and spend.

The five-day Thanksgiving holiday, as well as the week before, provided a good barometer of consumers' festive mood. The NRF reported that roughly 197 million Americans participated in the five-day Thanksgiving shopping extravaganza across in-store and online shopping venues. Interestingly, retailers got a jump on promotional activity early this year, given the shortened number of days between Thanksgiving and Christmas. This brought forward some shopping and spending that may have normally shown up between Thanksgiving and Cyber Monday. In fact, the NFR reported that 38% of shoppers took advantage of deals specifically during the week before the Thanksgiving holiday weekend.

In addition, Thanksgiving shopping data from providers such as Adobe Analytics and Mastercard SpendingPulse showed strong spending trends, with an increasing number of shoppers tending to make their purchases online. Notably, Americans spent a record $10.8 billion online on Black Friday, up an impressive +10.2% over Black Friday last year.

Bottom line: We believe consumers are in a healthy and willing position to spend this holiday season. At the most basic level, this should be supportive of fourth quarter GDP and corporate profit growth. We believe strong holiday spending patterns this month could be the icing on the cake to what has been a very solid year for financial markets and U.S. economic stability. This week’s inflation reports and the Federal Reserve rate decision the following week likely offer the last bits of newsworthy and market-moving items to watch before the calendar quickly shifts to 2025.

The week ahead:

Outside of the U.S., the week began with Syrian President Bashar al-Assad fleeing Syria after rebel forces stormed Damascus. Inside the U.S., key reports on consumer and producer inflation this week could show prices across both measures remain sticky.

- The removal of Syria’s president, Assad, could be welcomed by many who want to see a repressed population return to stability and dignity. However, the vacuum of leadership and the disjointed power structure within Syria (including groups the U.S. considers terrorist organizations) could make for a less stable country in an already unstable Middle East.

- A slight decline in gasoline prices in November should temper upward pressures on the headline Consumer Price Index, while the core rate should stick close to levels it has traced since September. That said, a persistent moderation across inflation in 2025 should allow the Federal Reserve to ease rates next year, but possibly at a slower pace than investors currently expect.

- Producer inflation may show signs of firming in November, while the U.S. Treasury is expected to offer $119 billion in new offerings this week.

- Finally, the European Central Bank, Swiss National Bank, and Bank of Canada are all expected to lower their policy rates at their last meeting of the year. The Reserve Bank of Australia is expected to hold rate policy steady.

These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Sources: FactSet and Bloomberg. FactSet and Bloomberg are independent investment research companies that compile and provide financial data and analytics to firms and investment professionals such as Ameriprise Financial and its analysts. They are not affiliated with Ameriprise Financial, Inc.

The views expressed are as of the date given, may change as market or other conditions change, and may differ from views expressed by other Ameriprise Financial associates or affiliates. Actual investments or investment decisions made by Ameriprise Financial and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances.

Some of the opinions, conclusions and forward-looking statements are based on an analysis of information compiled from third-party sources. This information has been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial. It is given for informational purposes only and is not a solicitation to buy or sell the securities mentioned. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as advice designed to meet the specific needs of an individual investor.

This market commentary is intended to provide perspective on how potential election outcomes may impact financial markets and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

Investments in small cap companies involve risks and volatility greater than investments in larger, more established companies.

Stock investments involve risk, including loss of principal. High-quality stocks may be appropriate for some investment strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with investing in stocks, as they can lose value.

Past performance is not a guarantee of future results.

An index is a statistical composite that is not managed. It is not possible to invest directly in an index.

Definitions of individual indices and sectors mentioned in this article are available on our website at ameriprise.com/legal/disclosures in the Additional Ameriprise research disclosures section.

The S&P 500 Index is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value (shares outstanding times share price), and its performance is thought to be representative of the stock market as a whole. The S&P 500 index was created in 1957 although it has been extrapolated backwards to several decades earlier for performance comparison purposes. This index provides a broad snapshot of the overall US equity market. Over 70% of all US equity value is tracked by the S&P 500. Inclusion in the index is determined by Standard & Poor’s and is based upon their market size, liquidity, and sector.

The S&P 500 Information Technology Index comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard (GICS) information technology sector.

The NASDAQ Composite index measures all NASDAQ domestic and international based common type stocks listed on the Nasdaq Stock Market.

The Dow Jones Industrial Average (DJIA) is an index containing stocks of 30 Large-Cap corporations in the United States. The index is owned and maintained by Dow Jones & Company.

The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. The Russell 2000 includes the smallest 2000 securities in the Russell 3000.

West Texas Intermediate (WTI) is a grade of crude oil commonly used as a benchmark for oil prices. WTI is a light grade with low density and sulfur content.

The US Dollar Index (USDX) indicates the general international value of the USD. The USDX does this by averaging the exchange rates between the USD and major world currencies. This is computed by using rates supplied by approximately 500 banks.

The Institute for Supply Management (ISM) manufacturing index is a national manufacturing index based on a survey of purchasing executives at roughly 300 industrial companies. It is an index of the prevailing direction of economic trends in the manufacturing and service sectors.

The ISM Services is compiled and issued by the Institute of Supply Management (ISM) based on survey data. The ISM services report contains the economic activity of more than 15 industries, measuring employment, prices, and inventory levels; above 50 indicating growth, while below 50 indicating contraction.

University of Michigan Consumer Sentiment Survey is a rotating panel survey based on a nationally representative sample of households in the U.S. that measures how consumers feel about the economy, personal finances, business conditions, and buying conditions.

Third party companies mentioned are not affiliated with Ameriprise Financial, Inc.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.