Can the stock rally broaden in the second half of the year?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — June 24, 2024

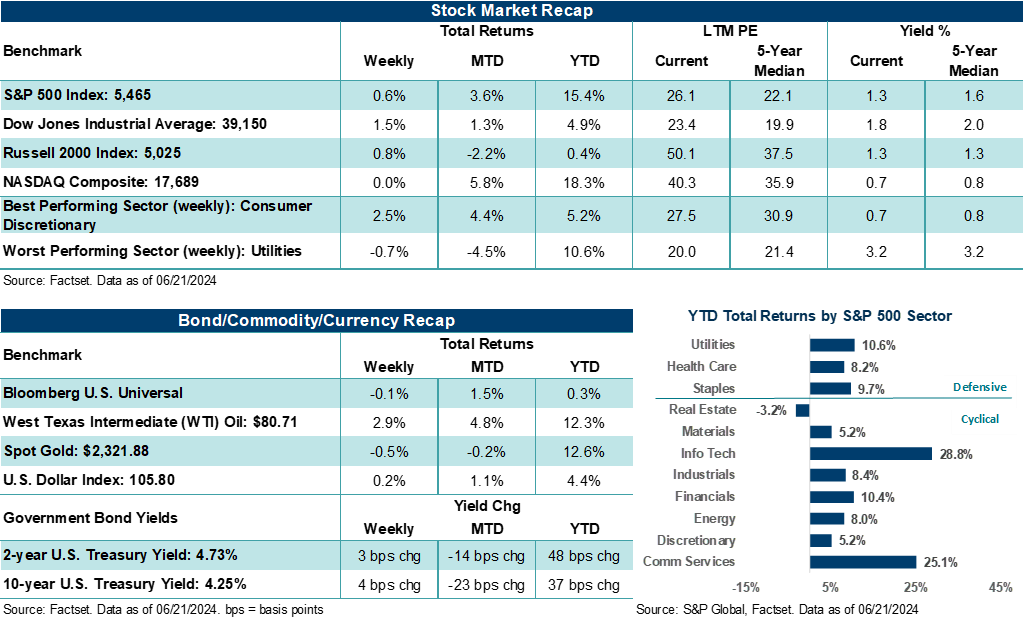

The S&P 500 Index finished last week higher, advancing for the eighth week out of the previous nine. The NASDAQ Composite finished flat on the week, while the Dow Jones Industrials Average led the major averages mostly higher. The week was largely quiet, with the Juneteenth holiday on Wednesday giving markets a breather and upward momentum in NVIDIA seeing a pause in action as the stock fell 4.0% on the week. The May retail sales report was the economic event of the week, with the headline figure missing estimates, partly due to falling gasoline prices. Of the thirteen categories tracked in the report, five saw monthly declines, helping add further evidence that the consumer is growing more cautious when spending. Consumer Discretionary and Energy led S&P 500 sectors higher on the week, while Utilities and Technology finished lower.

Last week in review

- The S&P 500 made its 31st closing high of the year, for a first half total that only trails 2021 for the most closing highs during the first six months of the year since 1998.

- With the first half of the year winding down, the S&P 500 is up over +15% year-to-date following a gain of roughly +24% in 2023. Information Technology is higher by nearly +29% this year, thanks to NVIDIA’s nearly +156% year-to-date gain. Communication Services has also seen strong gains so far in 2024, up roughly +25% this year. These two sectors account for 68% of the S&P 500’s total return this year.

- According to Bespoke Investment Group, when the S&P 500 made 25 or more new highs during the first half of the year, its median performance in the second half of the year was a gain of +9.6% going back to 1954. The logic here is that gains beget more gains.

“Though a majority of S&P 500 sectors and industries are expected to see solid profit growth in the second half, investors will likely want to see continued improvement in inflation, a path forward for lower interest rates, and stable economic conditions before they are comfortable allocating more investment dollars to cyclically exposed areas of the market.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- May headline retail sales rose +0.1% month-over-month, weaker than the +0.3% expected. April’s headline figure was also revised lower. Gas stations, home furniture, building materials and garden, food services and drinking places, and food and beverage stores all posted monthly declines. However, sporting goods retailers, online stores, and car dealers all saw monthly sales increases in May. Bottom line: We expect the consumer to be more discerning in how they spend moving forward. Importantly, many consumers are still spending at healthy clips on services activity like travel, leisure, and entertainment, which are categories not reflected in the retail sales report.

- To that point, a preliminary look at June manufacturing and services activity finds the services side of the economy accelerated more rapidly than expected this month. Services activity in the S&P Global Purchasing Managers’ Index expanded to its highest level since April 2022. While manufacturing activity also expanded a little more than expected this month, much of the economy’s continued momentum is coming from services activity. Continued strength across the services economy in the second half could complicate the Federal Reserve’s job of bringing inflation back to its 2.0% target by the end of the year. However, we believe normalizing growth patterns and elevated rates may take more bite out of outsized spending on services in the second half. Notably, markets may agree with that assessment, as odds of a September fed funds rate cut remained largely unchanged last week.

- U.S. Treasury yields ended up slightly, the U.S. Dollar Index rose, Gold prices fell, and West Texas Intermediate (WTI) crude rose on summer demand optimism.

- Finally on the week, Bank of America’s latest Global Fund Manager Survey shows that professional investors are the most bullish since November 2021, with cash levels the lowest since June 2021. As a result, survey respondents are the most overweight stocks and underweight bonds since November 2022. Notably, the Magnificent Seven trade (long Apple, Microsoft, NVIDIA, Amazon, Meta Platforms, Alphabet Inc., and Tesla) is the most crowded on record at 69%. However, professional money managers' allocation to Technology (roughly 20% in the latest survey) is down from the 36% peak in February and currently sits at its lowest level since October 2021. Bottom line: Like everyone else in the market, professional money managers are crowding into Big Tech at the expense of a broader Technology allocation. In a somewhat contrarian position, hedge funds are increasingly becoming more cautious, given still elevated Federal Reserve policy rates, narrow market breadth, and growing geopolitical risks, according to FactSet.

Can the stock rally broaden in the second half?

Clearly, the first six months of the year have gone to the bulls, with major U.S. stock averages like the S&P 500 and NASDAQ Composite hitting numerous fresh highs this year. That said, returns have been very concentrated and top-heavy across a handful of Big Tech stocks, with the rest of the market largely stalling, possibly waiting for additional signals that could unlock confidence in helping reestablish a broader stock rally (similar to trends seen in the first quarter).

The market currently sees signals that suggest further caution is warranted, and the stalled progress across sectors like Consumer Staples, Financials, Industrials, Materials, and Energy is a reflection of mounting growth concerns. This is likely a key dynamic investors will be looking at for further clarity in the second half when assessing the path forward for stocks.

In our view, the handful of mega-cap stocks that pushed the major averages higher in the second quarter was largely due to investors’ growing confidence in the profit conditions surrounding companies associated with key secular drivers, such as artificial intelligence. But for the rest of the market, confidence around future profit conditions isn’t so visible, particularly in an environment where interest rates and inflation remain elevated.

Though a majority of S&P 500 sectors and industries are expected to see solid profit growth in the second half, investors will likely want to see continued improvement in inflation, a path forward for lower interest rates, and stable economic conditions before they are comfortable allocating more investment dollars to cyclically exposed areas of the market. Bottom line: We believe the stock rally can broaden in the second half if inflation cools, the Fed remains on a path to cutting rates by year-end, and companies, in aggregate, can achieve analysts’ profit expectations through year-end.

The week ahead

The last full week of the second quarter will see updates on housing, consumer confidence, personal income, PCE, a final look at Q1 GDP, and a presidential debate between President Biden and former President Trump.

- The highlight of the week will be on inflation and personal income data, which will be released on Friday and included in the May Personal Consumption Expenditures Price Index report (the Fed’s preferred inflation measure). Bottom line: Personal income and spending trends last month are expected to continue to support a Federal Reserve rate cut in September. Core PCE inflation is expected to post its smallest annual gain since March 2021.

- The April S&P/Case-Shiller Home Price Index, building permits, home sales, and existing home sales for May will line the week’s calendar on the housing front.

- Tuesday’s look at June consumer confidence could see a slight dip in sentiment versus May, and a final look at Q1 GDP on Thursday is expected to remain unchanged at +1.3%,

On Thursday at 9 pm EST, the first 2024 presidential debate will be held at CNN’s Atlanta studios without a live audience. This will be the earliest presidential debate in American history. Traditionally, presidential debates are held between September and October. However, to help account for early mail-in voting, the candidates and their staff decided to have a debate earlier than traditionally scheduled. The next presidential debate is expected to be held on September 10.

Return to My Accounts

Return to My Accounts