Can markets steady the ship and find calmer waters after a choppy start to the year?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — April 28, 2025

The S&P 500 Index and NASDAQ Composite posted their second-best weeks of the year last week, finishing higher for the second week of the previous three. Stocks jumped higher as the week progressed after President Trump softened his rhetoric on Fed Chair Powell and the White House indicated tariffs on China could be reduced once the economic superpowers enter a trade deal. A solid earnings report from Alphabet, improved sentiment on Tesla, and some dip-buying on NVIDIA also helped lift major stock averages throughout the week.

This will be one of the busiest weeks of the year so far for investors. Ongoing trade headlines, an economic calendar filled with key releases (including the April nonfarm payrolls report) and the peak week of the Q1 earnings season, including several Magnificent Seven companies reporting results, should keep investors' heads spinning throughout the week.

Last week in review:

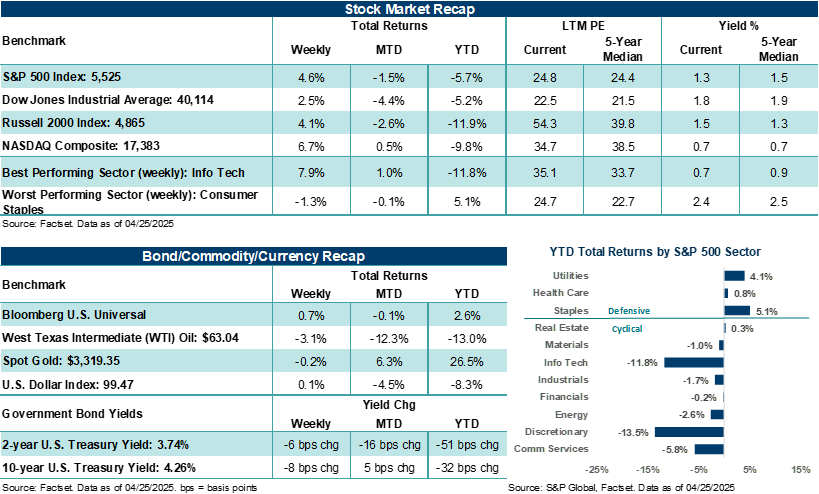

- The S&P 500 Index ended higher by +4.6%. The Index strung together a four-day winning streak that saw the major average gain +7.1% from Monday’s close. Information Technology led gains on the week, while Consumer Staples was the only S&P 500 sector to finish in the red.

“Bottom line: The White House will need to find a path forward that meets some of its trade objectives with China but also allows Beijing an opportunity to project strength to its people.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

- The NASDAQ Composite rose +6.7% last week and is now positive month-to-date. Strong gains in Alphabet (+7.1%), Tesla (+18.1%), and NVIDIA (+9.4%) helped drive the tech-heavy index higher last week. Alphabet beat analyst profit estimates and raised its dividend and share buyback level. In addition, Tesla missed earnings estimates, though the stock rallied after CEO Elon Musk said he would spend less time in Washington starting in May to focus more on his companies. Semiconductors rallied over +10%, helping to lift sentiment on NVIDIA.

- The Dow Jones Industrials Average (+2.5%) and Russell 2000 Index (+4.1%) also posted strong gains on the week.

- U.S. Treasury prices firmed as yields on the 2-year and 10-year eased.

- Gold finished lower, posting only its third weekly decline of the year. The U.S. Dollar Index finished the week fractionally higher, and West Texas Intermediate (WTI) crude ended lower.

- In Washington, after President Trump spooked the market and sent mixed signals on his Truth Social platform that the Federal Reserve’s independence may be in jeopardy, he quickly course-corrected with messaging that eased those concerns. In addition, U.S. Treasury Secretary Scott Bessent said he sees a de-escalation with China at some point and called the current standoff between the two countries “unsustainable.” Reports during the week suggested tariffs on China imports to the U.S. could come down between 50% to 65% at some point from the current 145% rate.

- In other items of the week, Federal Reserve speeches offered some dovish signs policymakers are becoming more attentive to growth risks given current tariff policies. And on that point, economic data released last week appeared shaded toward a slowing growth environment moving forward. April preliminary services activity missed estimates, and manufacturing activity surprised to the upside, yet the combination of the two fell to a 16-month low. A final look at April Michigan sentiment improved versus the preliminary reading, but confidence among consumers remained at its lowest level since June 2022. In addition, one-year ahead inflation expectations in the survey came in at +6.5%, remaining at the highest level since 1981.

Can markets find balance amid a sea of uncertainty after a volatile start to President Trump’s second first 100 days in office?

With April coming to a close this week and President Trump marking his second first 100 days in office on April 30, it’s not a stretch to say that U.S. markets have been on a rollercoaster ride since the 47th President took office. After seeing steep declines in the days following President Trump’s tariff announcements in early April, the S&P 500 Index and NASDAQ Composite have clawed back some of their losses. Each Index is higher by roughly +10% from its April low. Nevertheless, the S&P 500 is still down almost 8.0% since Inauguration Day on January 20. Simply, investor confidence in the global growth environment for this year has been shaken, given Trump’s unorthodox efforts to rewrite the rules of international trade. As we move through the coming weeks and months, below are a few key items we will be watching to see if markets can steady the ship and find some calmer waters after a choppy start to the year.

- With the 90-day reciprocal tariff reprieve scheduled to end in early July, so the White House will need to put some trade wins on the scoreboard sooner rather than later. Investors will want to see either trade deals or outlines of trade deals with our closest allies that help rollback or further delay the more aggressive tariff rates proposed.

- U.S. and China trade talks need to progress in a manner that deescalates tensions and brings down the essential trade embargo each country has placed on one another. In our view, China will likely outlast America’s tolerance for economic pain if the Trump administration isn’t willing to course-correct the current strategy if progress stays stuck in neutral. Mid-term U.S. elections next year and a potential revolt by the electorate if unemployment rises due to tariffs driving weaker economic growth or a recession could push the President to look for an off-ramp with China. Bottom line: The White House will need to find a path forward that meets some of its trade objectives with China but also allows Beijing an opportunity to project strength to its people.

- Corporate earnings estimates for the coming quarters will likely need to firm from here. Despite a solid start to the first quarter earnings season, quarterly profit estimates for the rest of the year continue to come down as companies report Q1 results. Investors need to believe earnings growth can remain positive this year for stocks to find more lasting support. Conversely, a deterioration in U.S. economic activity and/or the implementation of aggressive tariffs on global trade that lead to slower-than-expected or negative profit growth in 2025 could see stock prices head south again.

- Yet, weak consumer and investor sentiment, combined with stock corrections (even if they are severe), often see major averages eventually recover and go on to post positive returns over the next year if a recession is avoided. In addition, last week’s consecutive large daily moves in the S&P 500 are rare in the halls of history and usually come during periods of “extreme” uncertainty. Here, too, returns over the next year are generally positive and often by an outsized figure.

- Importantly, if markets do head south at some point to retest their early April lows, and those levels hold, we believe investors would become more comfortable allocating new capital moving forward, which could help stabilize stock averages as the year progresses. However, if those levels do not hold and stocks fall further based on weaker economic activity, we would expect the White House to ease some of its tariff policies and the Federal Reserve to lower its policy rate. Thus, investors, at some point, would likely begin to look ahead to better conditions, making it less likely major averages would close the year on their lows.

- Finally, a resilient labor market and inflation data over the coming months that does not lead to investors' and consumers' worst fears may go a long way in helping stabilize market conditions over time. We believe stock prices already reflect some level of slower economic activity this year. And as long as conditions around employment and inflation don’t deteriorate rapidly, consumer and business spending is also unlikely to deteriorate rapidly. In this scenario, we believe markets would find some balance over time and offer longer-term investors an opportunity to invest with increased confidence.

The week ahead:

The April nonfarm payrolls report on Friday and earnings updates from Meta Platforms, Microsoft, Apple, and Amazon throughout the week will be the notable events to watch.

-

180 S&P 500 companies are scheduled to report first quarter earnings this week. 73% of companies reporting Q1 results have surpassed analyst estimates thus far, which is below the five-year average of 77%. Notably, the Magnificent Seven is expected to see first quarter profit growth nearly triple that of the other 493 S&P 500 companies. In our view, the fundamental updates investors receive this week from key Mag Seven constituents could influence whether markets can build on this momentum and if the profit engine that powered these stocks higher over recent years remains on track.

- Throughout the week, housing data, updated looks at job openings, private payrolls, consumer confidence, ISM manufacturing, and PCE should provide fresh perspectives on how the economy is handling the tariff uncertainty. On Wednesday, a preliminary look at Q1’25 GDP is expected to show the U.S. economy grew by +0.8% quarter-over-quarter annualized, slower than the +2.4% rate in Q4’24.

- April nonfarm payrolls are expected to grow by +125,000, down from the +228,000 jobs created in March. The unemployment rate in April is seen holding steady at 4.2%. Over the last three months, job growth in the U.S. has averaged a healthy 152,000.