The bull and bear case for stocks ahead of a pivotal week

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — July 28, 2025

The S&P 500 recorded five straight new highs last week, as volatility dropped to levels last seen in February. A batch of solid second quarter earnings reports and progress on trade deals helped lift sentiment and stock prices throughout the week.

This week, stocks will face one of their most pivotal weeks of the year thus far, with key earnings reports, a Federal Reserve rate decision, the July nonfarm payrolls report, and the August 1 reciprocal trade deadline all on deck.

Last week in review:

-

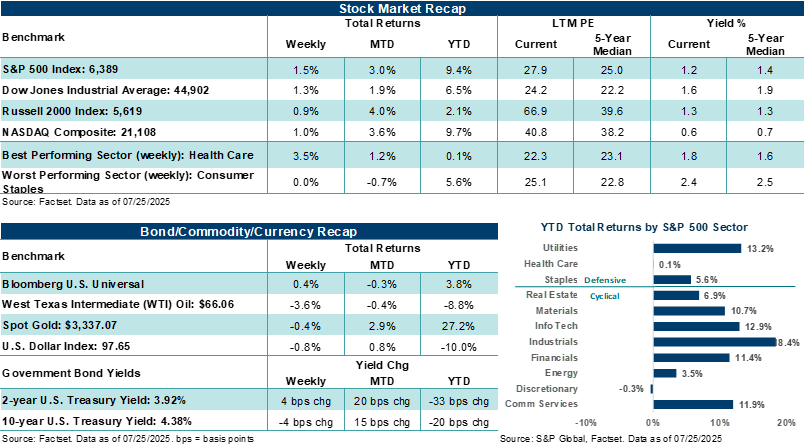

The S&P 500 Index inched toward 6,400, ending the week higher by +1.5%. The NASDAQ Composite rose +1.0%. Alphabet gained +4.4% after the search giant beat Q2 profit expectations and raised its capex spend for the year based on ongoing strength across artificial intelligence. 80% of S&P 500 companies reporting second quarter profit results have surpassed analyst estimates, which is above the five-year average.

- The Dow Jones Industrials Average (+1.3%) and Russell 2000 Index (+0.9%) also finished the week positively.

- U.S. Treasuries finished mixed across the curve, while the U.S. Dollar Index, Gold, and West Texas Intermediate (WTI) crude all ended lower.

- The U.S. announced trade deals with Japan, Indonesia, and the Philippines. Although there are some discrepancies between how the U.S. and others interpret the details of the agreements, investors see recent trade announcements as an indication that tariff headlines could be skewed positively heading into Friday's deadline.

- Finally, July preliminary services activity came in stronger than expected, though manufacturing activity continued to act as a drag. June new and existing home sales came in lighter than forecast, while core durable-goods orders unexpectedly contracted. President Trump's tour of the Federal Reserve's building renovation project with Fed Chair Powell was largely uneventful. Bottom line: While Trump continues to pressure the Chair to lower interest rates, Powell isn't in jeopardy of losing his role as Chair, and in our view, will remain in his position until his term ends in May.

“We would lean toward being more bullish than bearish on U.S. stocks through year-end, but not outside of a balanced portfolio based on risk given the environment. However, that view is contingent on positive corporate profitability and economic growth this year, avoiding worst-case tariff scenarios, and investors remaining willing to ‘buy the dip’, seeing potential short-term dislocations as a longer-term opportunity to invest.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

What's going right for stocks at the moment, and what might investors be ignoring?

With major averages like the S&P 500 and NASDAQ Composite continuing to hit fresh highs, we thought it would be appropriate to highlight some of the bullish items investors appear to be gravitating toward, as well as some of the more bearish items that don't appear to be receiving much of investors' mindshare currently.

What's helping move stocks higher?

- Corporate profit and economic resiliency: Despite concerns about tariffs and inflation, Q2 S&P 500 profits are coming in ahead of estimates, outlooks thus far have been stable, and analysts expect another strong quarter of Big Tech profits this week and into year-end. Further, tame headline inflation readings, benign weekly jobless claims, and relatively strong services activity (the engine of U.S. growth) show economic trends remain on solid footing.

- Consumer confidence has stabilized: Consumer confidence reached a five-month high this month, suggesting that the demand environment, which helps drive corporate profitability and economic activity, could remain supportive through year-end.

- Policy tailwinds: The recently passed One Big Beautiful Bill continues current tax policy for most, lowers taxes for some, and increases spending on defense and border security, while raising the debt ceiling. Clarity around taxes and fiscal priorities, combined with less regulation over time, and possibly increased M&A and IPO activity over the coming quarters (a potential driver of stock demand and profitability for Financials), has investors comfortable looking through more obvious trade concerns at the moment.

- Rate cuts may be on the horizon: Whether it's one or two twenty-five basis point rate cuts from the Federal Reserve later this year, or a new Fed Chair in May that supports easier monetary policy, investors expect policy rates to move lower at some point, and arguably, against a backdrop of still manageable inflation and solid employment conditions.

- FOMO is back in action: With stocks at all-time highs and investor confidence on the rise, the "Fear of Missing Out" is helping push risk-on behavior that is benefiting a wider set of stocks, including small-cap stocks, which are back to keeping pace with larger-cap benchmarks this month.

What could disrupt the market?

- Trade: Friday marks President Trump's August 1 trade deadline, and when high reciprocal tariff rates are expected to kick in on countries and regions that haven't struck trade deals with the United States. Investors currently expect the date to come and go without much disruption, instead, assuming countries and regions will strike trade deals with the U.S., or reciprocal tariffs, if put in place, would only be in place for a short time before being rolled back to a lower rate, say 15%. In our view, stocks have not properly priced trade scenarios with more negative consequences around trade, like if tariff friction escalates, is more lasting, and/or stalls economic momentum over time.

- Still flying blind on tariff impacts: While economic and profit resilience is currently being cheered by investors, higher tariff rates for imports into the U.S. haven't been in place long enough to likely be fully reflected across the economy. The average U.S tariff rate has moved from roughly 2.5% at the end of last year to over 15% depending on the measure. And that's before we see more developments on forthcoming sectoral tariffs on pharmaceuticals and semiconductors. Note: Tariffs are a tax on consumption. There is mounting evidence that an increasing number of companies are already starting to pass on tariff costs to consumers. Markets could see more volatility if further evidence shows tariffs are slowing activity or consumption.

- Seasonal weakness: The S&P 500 Index is more prone to bouts of weakness and drawdowns in August and September.

- Mixed earnings and outlooks: Although secular trends in Artificial Intelligence could keep a positive spin on Big Tech, other areas, particularly industries susceptible to tariff pressures (e.g., autos, retail, certain industrial companies), may see more mixed profit results through year-end, particularly if tariffs increase from current rates.

- Stretched valuations: With the S&P 500 trading at 24x this year's earnings estimates, everything may need to line up perfectly from a macroeconomic standpoint through year-end to keep stock prices grinding higher and without a meaningful bout of volatility.

- All the other stuff: High debt and deficit spending, unpredictable White House rhetoric and actions, geopolitical instability, slowing growth trends, etc.

Bottom line: We would lean toward being more bullish than bearish on U.S. stocks through year-end, but not outside of a balanced portfolio based on risk given the environment we laid out above. However, that view is contingent on positive corporate profitability and economic growth this year, avoiding worst-case tariff scenarios, and investors remaining willing to "buy the dip", seeing potential short-term dislocations as a longer-term opportunity to invest.

The week ahead:

- Nearly one-third of S&P 500 companies will report second quarter results this week, making it one of the busiest earnings weeks of the season. Boeing, P&G, Starbucks, Visa, Meta Platforms, Microsoft, Apple, Amazon, Exxon Mobile, and Chevron are some of the key reports investors will be watching. Notably, reports and outlooks from Magnificent Seven companies Meta Platforms, Microsoft, and Amazon will carry outsized attention given their heavy influence on AI trends and major stock averages.

- The Federal Reserve is expected to hold its policy rate steady on Wednesday. However, markets are largely geared for a rate cut at the September meeting. This will place this week's updated policy statement and Fed Chair Powell's press conference following the decision squarely in investors' crosshairs as they search for additional clues regarding rate policy.

- Friday's July nonfarm payrolls report is expected to show job growth slowed to +115,000 from June's +147,000. The unemployment rate is expected to tick higher to 4.2% from 4.1%. Reports on labor market trends this week, including ADP and JOLTS updates, should help inform the Fed's September decision.

- A first look at Q2 GDP on Thursday should show a meaningful rebound from the tariff front running of imports that sapped growth in Q1.

- Friday's U.S. trade deadline could weigh on market sentiment this week if trade deals or agreements with key trading partners aren't put in place. However, the U.S./EU deal on Sunday suggests progress is being made on this front.