How average habits can compound into excellent results

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — October 20, 2025

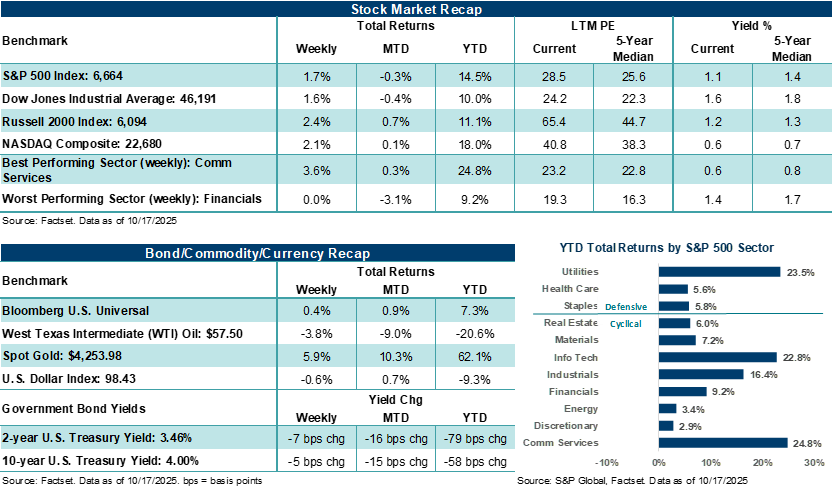

Major U.S. stock averages finished the week with solid gains despite some volatility. The third-quarter earnings season kicked off with strong reports from key banks, but potential stress in lower-rated credits among smaller banks unsettled investors at the end of the week. Ninety S&P 500 companies are scheduled to report third quarter earnings results this week, with General Motors, Coca-Cola, Capital One Financial, Lockheed Martin, Netflix, Tesla, Ford and Procter & Gamble just some of the companies on the docket.

Last week in review:

-

Following a choppy week of trading, the S&P 500 Index gained +1.7% and the NASDAQ Composite gained +2.1%.

-

The Dow Jones Industrials Average and Russell 2000 Index rose by +1.6% and +2.4%, respectively.

- Most of the key banks and asset and wealth managers reporting Q3 results and outlooks finished the week higher on strong profit results and outlooks. Consumer and business fundamentals, credit trends, capital market activity and asset flows were positive in Q3, with the group pointing to healthy activity and outlooks in Q4. However, growing concerns have surfaced about potential cracks in riskier pockets of the credit market, following the disclosure by two smaller regional banks last week of their exposure to some bad loans. Regional banks have been under pressure for weeks as investors have grown concerned over the degree of loan exposure to non-depository financial institutions (NDFI) (i.e., riskier credits). While there may be tentacles of bad loans that extend beyond investors' current knowledge of overall exposure, the banking system is sound and well-capitalized to handle potential stress, in our view.

- The 2-year U.S. Treasury yield hit fresh three-year lows, the U.S. Dollar Index saw its worst week since early August, and West Texas Intermediate (WTI) crude ended lower for the third straight week. Gold hit new highs, notching its ninth consecutive week of gains. Over the nine weeks, the precious metal has increased by more than +25%.

- In Washington, the U.S. government remained closed, with Democrats and Republicans both insistent on their requirements to reopen. President Trump said on Friday that his proposed 100% tariffs on China were not sustainable, giving markets some hope at the end of the week that there is an opening to de-escalate U.S.-China trade tensions.

“Systematic investing helps weather the near-term chop in the market by allowing your portfolio to ride higher when investments are gaining, accumulating more exposure when they're losing and ultimately increasing the size of your overall portfolio over time to benefit during the next wave higher.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

How average habits can compound into excellent results

With so much going on across the investment landscape today, between an artificial intelligence boom, a U.S.-China trade war, wars across the globe, elevated inflation, monetary policy machinations, mixed economic trends and the U.S. government that remains closed for the people's business, there are tons of cross-currents that investors face at the moment. However, there's one factor that investors can always control, regardless of the circumstances or market dynamics: Their own behavior or reaction to changing events.

Notably, individual behavior and how one responds and interacts with the environment can significantly influence outcomes and success rates across various dynamics. For instance, an individual who smokes one cigarette a month for twenty years is unlikely to see a huge adverse effect on their health. However, an individual who smokes a pack of cigarettes a week is much more likely to see adverse health effects over a two-decade period. Conversely, an individual who exercises three days a week and eats a moderately healthy diet over twenty years is likely to be far more fit than their peers, outside of other less controllable health factors. Bottom line: Behavior matters. Like in life, investment success depends on consistent, healthy habits and unwavering discipline formed over many years. Longer-term investors, for the most part, should discount most of the factors listed above, as their impact tends to diminish over time, becoming relatively smaller in relation to overall asset performance. And when it comes to investment outcomes, goal success is usually reaped by those who can maintain their ability to follow a well-charted course that's designed to navigate the market's vices and periodic pitfalls.

These figures are shown for illustrative purposes only and is not meant to represent the past or future returns of any specific investment or investment strategy, or to imply guaranteed earnings. This illustration does not reflect sales charges or other expenses that may be required for some investments.

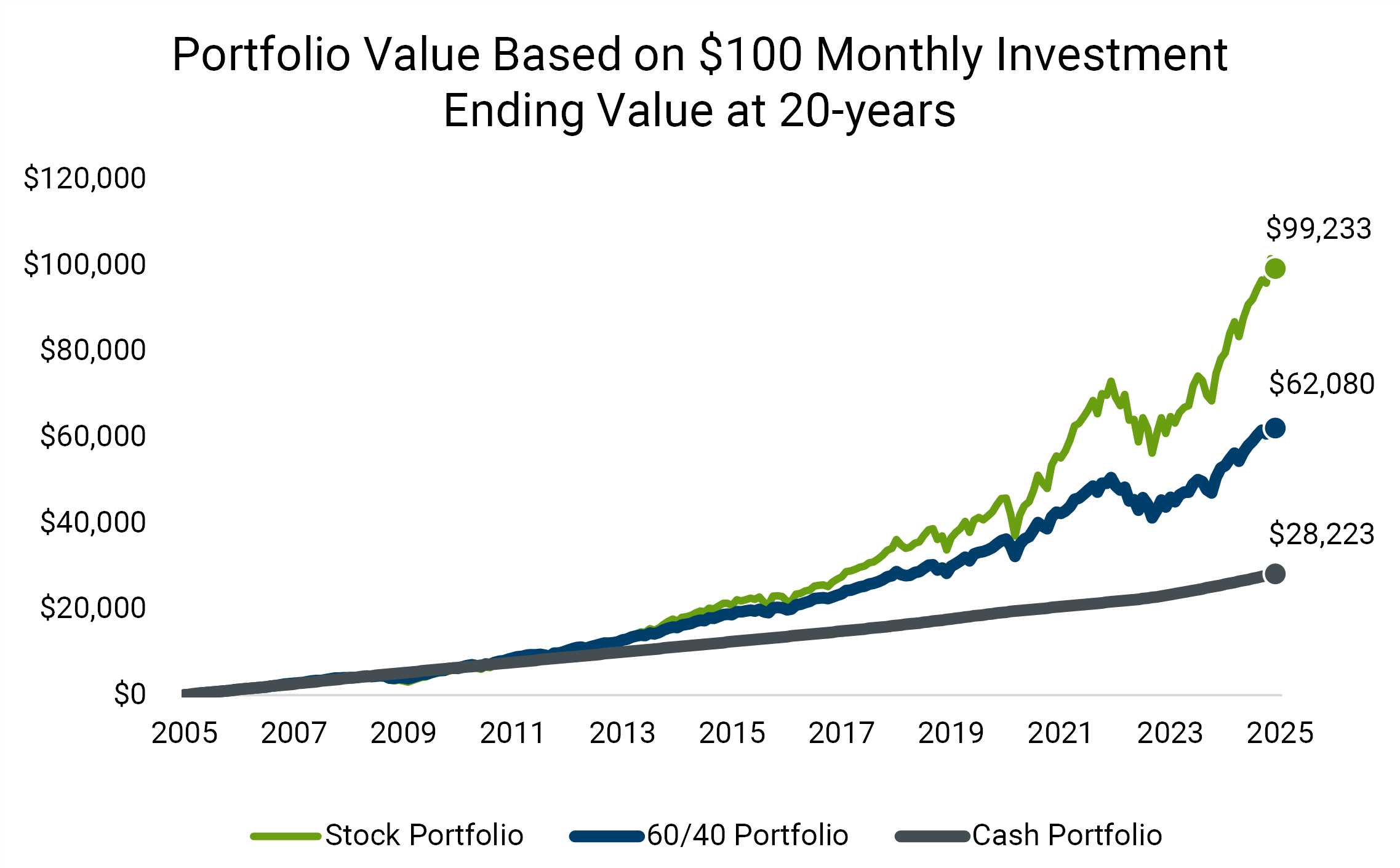

As the Ameriprise chart above shows, sourced from Ibbotson Associates data on stocks, bonds and cash, simple disciplined saving over twenty years adds up and can build significant wealth over time. In this example, starting from a $0 balance, a $100 monthly investment ($24,000 cumulatively over twenty years) grew to almost $100,000 if invested in large-cap U.S. stocks. The same 20-year investment grew to over $60,000 if invested in a 60% stock/40% bond portfolio (measured by the Bloomberg U.S. Aggregate Bond Index) and nearly $30,000 if invested in cash, represented by 30-day U.S. Treasury bills.

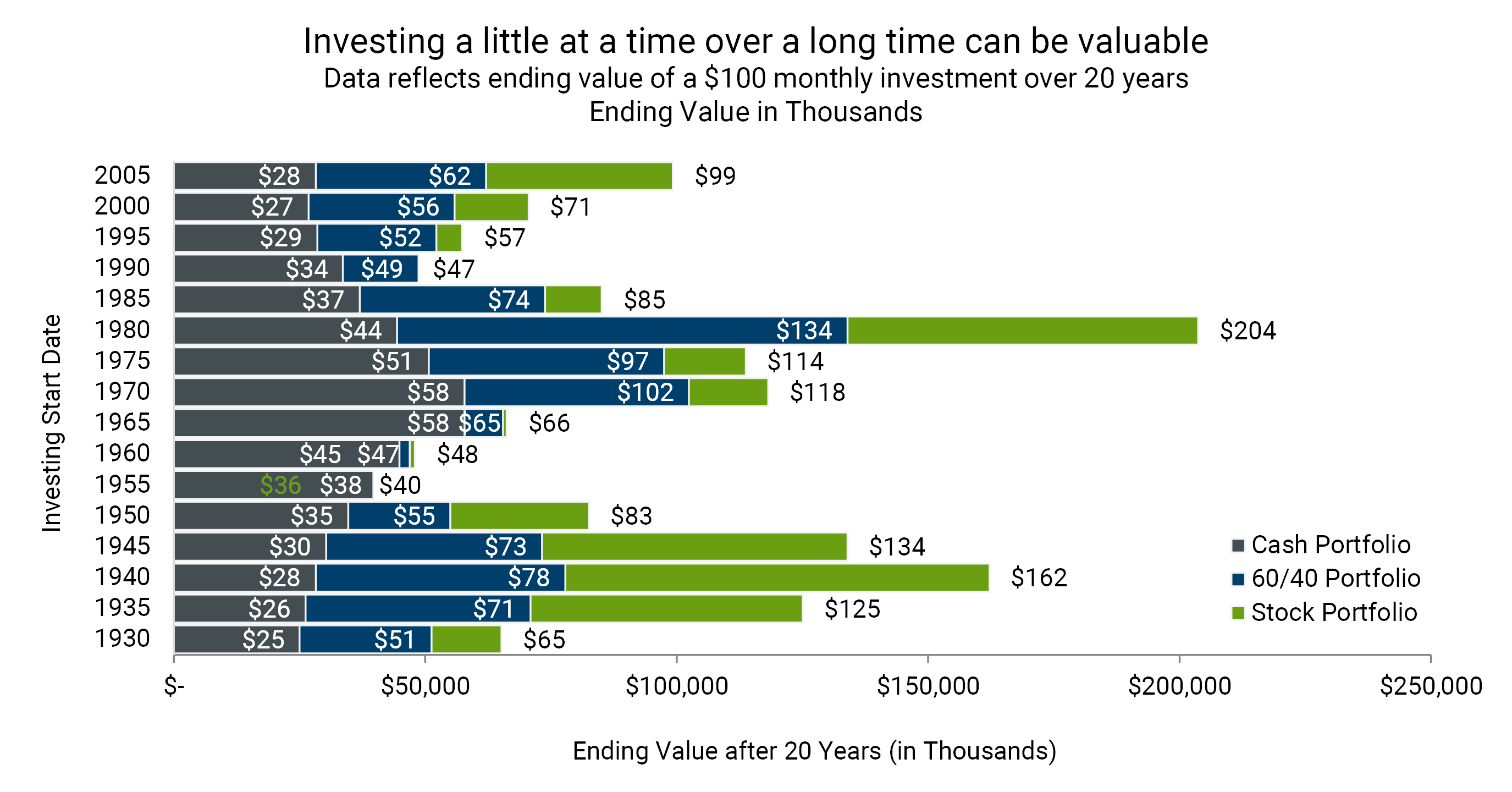

Interestingly, and as the Ameriprise chart below shows, also sourced from Ibbotson Associates data, history suggests that systematic investing, even at modest amounts, adds up over time and has created increased wealth for an investor, no matter the decade, whether it's invested in stocks, a 60/40 portfolio, or cash. Bottom line: The power of disciplined and systematic saving, the law of compounding and what is less obvious in these numbers — staying the course when it's sometimes difficult to do — are how "average" investment principles can lead to building extraordinary levels of wealth over time.

These figures are shown for illustrative purposes only and is not meant to represent the past or future returns of any specific investment or investment strategy, or to imply guaranteed earnings. This illustration does not reflect sales charges or other expenses that may be required for some investments.

If you're reading this and in the accumulation stage of your investment journey, consider having fewer beverages of choice at your local hangout or meals at a restaurant per month to modestly boost your savings rate. If you're just beginning your investment journey and feel that starting from zero is too daunting to be worthwhile, hopefully, this data helps inspire you to start saving today and continue over time. Building wealth is a journey, and its purpose is to buy you "time" in the future. Think of the dollars saved today as small payments into purchasing a life free from work and the means to enjoy your time the way you want in the future. And if you're retired and no longer investing systematically, the law of compounding, one of the most important features of this data, continues to apply to you. Fun fact: The Social Security Administration estimates that, at age 65, men will live an average of 18.3 more years, while women live an average of 20.8 years longer past 65. Considering that's just the average, it's fair to say most investors entering retirement today or already several years into retirement need to maintain exposure to stocks for portfolio growth and can continue to benefit from the law of compounding over time.

Importantly, as the year winds down and investors continue to wrestle with near-term developments across earnings results and outlooks, incoming economic data (when the government reopens), as well as AI/trade/interest rate items over the coming months, investors should keep the following perspective top-of-mind. Systematic investing helps weather the near-term chop in the market by allowing your portfolio to ride higher when investments are gaining, accumulating more exposure when they're losing and ultimately increasing the size of your overall portfolio over time to benefit during the next wave higher. In our view, now is a great time, before the holiday and end-of-year rush begins, to reach out to your Ameriprise financial advisor to review your portfolio and investment strategy and possibly discuss whether now is a good time to increase your contributions. Based on the data above, it's frequently a good time to invest, be it that one has enough time and discipline to stay invested, and has the appropriate strategy based on their risk, time horizon and goals.

The week ahead:

-

A U.S. government shutdown, U.S.-China trade developments, a barrage of earnings reports and credit concerns will likely drive headlines this week.

-

Investors and the Fed will receive the delayed September Consumer Price Index (CPI) report on Friday.