Are investors overplaying the Federal Reserve’s hand?

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — September 15, 2025

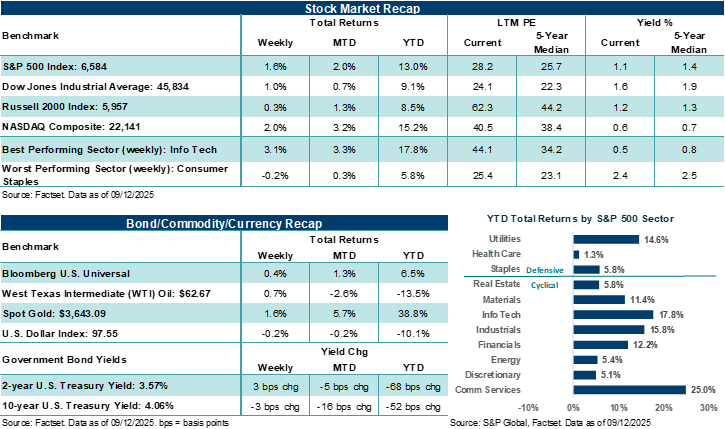

The S&P 500 Index, NASDAQ Composite and Dow Jones Industrials Average all recorded fresh all-time highs last week, with the S&P 500 Index finishing its fifth positive week in the previous six. The NASDAQ Composite closed out a second straight week of gains, while the Dow posted its first positive week in three. Shaping last week's market gains was cooler-than-expected August producer inflation, slightly hotter-than-expected consumer inflation, a rise in jobless claims and investor reactions to earnings reports from Adobe and Oracle.

The Federal Reserve's rate decision and Chair Powell's statements post-meeting this Wednesday could help set the stage for how stocks finish September.

Last week in review:

-

The S&P 500 Index and NASDAQ Composite gained +1.6% and +2.0%, respectively. Oracle jumped +25.5% on the week after reporting outsized revenue growth in its cloud infrastructure business, while Adobe finished the week flat, but showed positive earnings takeaways from its artificial intelligence applications.

-

The Dow rose roughly +1.0% and the Russell 2000 Index gained +0.3%.

- U.S. Treasury prices were mostly firmer across the curve as yields fell. Gold rose roughly +1.5%, the Dollar Index finished the week slightly lower, and West Texas Intermediate (WTI) crude posted a gain despite OPEC+ agreeing to boost production.

- The August core Producer Price Index (PPI) came in cooler than expected, with a deceleration in final demand goods. However, some tariff-related categories, like electronics, saw increased prices. That said, the headline Consumer Price Index came in a little hotter-than-expected last month, while the core measure (ex-food and energy) was in line with forecasts. Tariff-related categories were mixed, with shelter costs playing the largest role in keeping CPI elevated.

- In its annual review, the Bureau of Labor Statistics revised nonfarm payrolls lower by 911,000 jobs for the period between April 2024 and March 2025. The job revisions were on the high end of estimates and add to current concerns about softer labor trends.

- A preliminary look at September University of Michigan consumer sentiment fell versus August levels, with economic views among lower- and middle-income consumers falling materially. Roughly 60% of consumers in the survey provided unprompted comments about tariffs, with concerns about labor markets and inflation also cited. September one-year ahead inflation expectations remained unchanged at +4.8%.

- In Washington, the White House pressured Europe to place 100% tariffs on India and China to help prompt Russia to end its war in Ukraine, and a federal court granted a preliminary injunction blocking President Trump's move to fire Fed Governor Lisa Cook. As a result, the Trump administration appealed the decision.

“The market setup coming into the Fed's two-day meeting this week has been largely ‘risk-on’ from a stock perspective, particularly as investors appear primed for not only a September rate cut, but possibly a couple of additional cuts before year-end. However, it may only take a surprise reacceleration in inflation over the coming months or continued softness in the labor market to sour the good vibes investors are currently feeling amid expectations of successive Fed rate cuts against a backdrop of still healthy economic conditions.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

The market wants three Fed rate cuts by year-end. But are investors overplaying the Fed's hand?

The Federal Reserve will meet on Tuesday and Wednesday, delivering not only a closely watched updated policy statement and likely fed funds rate cut for the first time since December, but an updated Summary of Economic Projections.

As the Fed assembles this week, we believe the market and economic backdrop remains constructive and supportive of equity prices, with some obvious mixed dynamics investors need to consider. On one hand, corporate investment tied to Artificial Intelligence and cloud computing is strong, and consumer spending overall is resilient, with banks reporting stable credit conditions. August inflation data showed manageable tariff effects, and bond markets have remained rather subdued over recent weeks. On the other hand, job conditions are softening, consumer sentiment is again weakening on tariff and inflation concerns, and Washington noise continually simmers, but mostly in the background for investors. Thus, the market setup coming into the Fed's two-day meeting this week has been largely "risk-on" from a stock perspective, particularly as investors appear primed for not only a September rate cut, but possibly a couple of additional cuts before year-end. However, it may only take a surprise reacceleration in inflation over the coming months or continued softness in the labor market to sour the good vibes investors are currently feeling amid expectations of successive Fed rate cuts against a backdrop of still healthy economic conditions.

Helping to support a rate cut this week includes a series of weaker-than-expected reports on the labor market and roughly in-line inflation data from last week. We believe the Federal Reserve has some space to adjust policy rates lower on Wednesday despite still elevated inflation levels to help support labor markets, which are clearly weakening. That’s essentially the main message investors expect to be reflected throughout the policy statement and Fed Chair Powell's press conference on Wednesday. But from there, that's where the certainty ends on forward policy, at least for us.

Market odds heavily skew toward the fed funds rate ending the year at 3.50% to 3.75%, or 75 basis points lower than where it stands today. This implies a steady drumbeat of 25 basis point rate cuts over the next three Fed meetings, including this week's meeting. Notably, the last three quarterly Summary of Economic Projection reports have shown a median fed funds rate at the end of 2025 standing at 3.9%. By the end of 2026, current market odds imply the fed funds rate will sit at 2.75% to 3.00%, or 150 basis points lower than current levels. It will be interesting to see how Fed rate projections evolve this week, particularly as an increasing number of policymakers have reflected a more dovish tone in speeches since the last projections update. And while labor markets have certainly softened over recent months, the question investors will be asking Mr. Powell on Wednesday is if they have softened enough to imply a steady pace of rate cuts through year-end and potentially beyond, understanding inflation remains elevated. And speaking of inflation, last week's data showed tariff effects creeping in below the surface, with increases in services inflation, food and energy that remain elevated, areas that Fed policy can't easily bring down.

Bottom line: This week's Fed update will hold key information about how policymakers want to frame the economic environment post rate cut (i.e., the policy statement), how Fed officials see their economic forecasts evolving as a result (i.e., Summary of Economic Projections), and how Fed Chair Powell personally views conditions as well as dynamics shaping Fed headlines outside of the economy (i.e., press conference). In our view, there will be no shortage of information for investors to glean from this week's Fed meeting, and as a result, help determine if the market has current rate cut expectations through year-end geared correctly.

The week ahead:

-

In addition to the Fed's rate decision, statement, updated economic projections and Chair Powell's press conference following the meeting, markets could react to other, more complicated factors swirling around the Fed at the moment. Given Powell's term as Chair ends in May 2026, shifting dynamics around his potentially eroding influence within the FOMC, additional governor dissents and political pressure from the administration to lower rates may color the market's interpretation of this week's policy update.

-

On the economic docket, August retail sales (Tuesday) will be the key release, with industrial production, housing, and trade data all on the docket. And speaking of trade, U.S. and China officials resumed talks on trade and other matters in Madrid, Spain, on Sunday and will continue their discussions on Monday.

- Finally, headlines will begin to turn to the fast-approaching September fiscal deadline where Congress must pass a government funding bill by September 30. Thus, prospects for a government shutdown will likely be on the back of investors' minds as we move closer to month-end. Republicans could look to vote on a clean continuing resolution this week that would fund the government through November 20. However, the bill will likely fall short of receiving the seven Democratic votes needed to pass in the Senate, and a bipartisan agreement still looks out of reach. That said, we expect some form of a funding agreement to eventually pass through Congress, and any potential market volatility associated with a shutdown (should one occur) to be temporary.