2025 year-end targets revised higher

ANTHONY SAGLIMBENE – CHIEF MARKET STRATEGIST, AMERIPRISE FINANCIAL

WEEKLY MARKET PERSPECTIVES — July 14, 2025

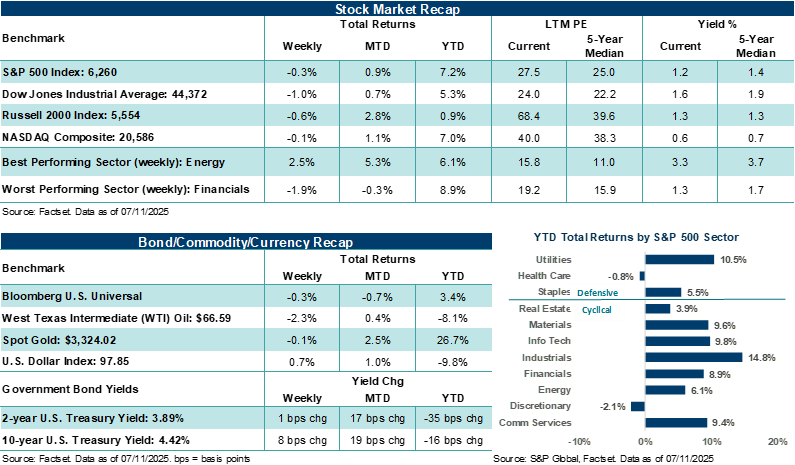

Major U.S. stock averages closed slightly lower last week, despite the S&P 500 Index and NASDAQ Composite touching new highs. A ramp higher in tariff threats from the White House, a lack of market-moving economic data, and guarded trading ahead of the second quarter earnings season kept the market in neutral.

This week, the second quarter earnings season kicks into gear with 42 S&P 500 companies scheduled to report results. On the economic front, fresh reads on inflation, including the June Consumer Price Index, will be front and center ahead of the July 30 Federal Reserve rate decision and the August 1 reciprocal tariff deadline.

Last week in review:

-

The S&P 500 and NASDAQ Composite hit new highs on Thursday but closed the week lower by 0.3% and 0.1%, respectively. NVIDIA became the first company in history to crack the $4 trillion market capitalization level.

- The Dow Jones Industrials Average and Russell 2000 Index also closed the week lower.

- Kicking off the Q2 earnings season, Delta Airlines closed the week higher by over +11.0%, boosted by stronger-than-forecasted profit results for the previous quarter and better guidance.

- U.S. Treasury prices were mostly weaker across the curve, with yields grinding a little higher.

- The U.S. Dollar Index ended the week in the green, Gold edged higher, and West Texas Intermediate (WTI) crude rose, despite announced OPEC+ production hikes. Copper gained nearly +9.0% due to President Trump announcing a 50% tariff on the important industrial metal.

- Speaking of tariffs, the White House sent out several tariff letters to various countries ahead of the August 1 deadline. If countries don't reach a trade deal/framework with the U.S. by the imposed deadline, tariff rates outlined in the letter will be applied. For example, Brazil would face a tariff rate of 50% on its imported goods to the U.S., Japan, and South Korea would face a 25% rate, and Canada would face a 35% rate for goods not covered under USMCA. President Trump also put out into the ether that all countries could face a universal reciprocal tariff rate of 15% to 20%, up from 10% currently.

- The June Federal Reserve meeting minutes provided few surprises, but suggested several members are divided about whether to cut rates in July or to even cut rates at all throughout the rest of the year.

- Finally, the latest New York Fed Survey of Consumer Expectations showed median year-ahead inflation expectations falling from May levels and fears of losing one's job falling to the lowest level since December 2024. In addition, the latest NFIB Small Business Optimism Index remained in line with expectations.

“At the end of April, we lowered our year-end S&P 500 targets versus our December forecast to reflect the extreme uncertainty around tariffs and, based on what was known at the time, likely negative impacts on growth, inflation, and profits. But over recent months investors have come to learn more about how this White House operates and seen its continued willingness to walk back aggressive trade stances, leaving more room for bilaterial negotiations with countries. It appears the Trump administration is unwilling to push a trade strategy that would move the U.S. economy into a recession or create lasting spikes in inflation. As such, we have moved our 2025 year-end Base and Favorable targets back to where we initiated them at the end of last year.”

Anthony Saglimbene - Chief Market Strategist, Ameriprise Financial

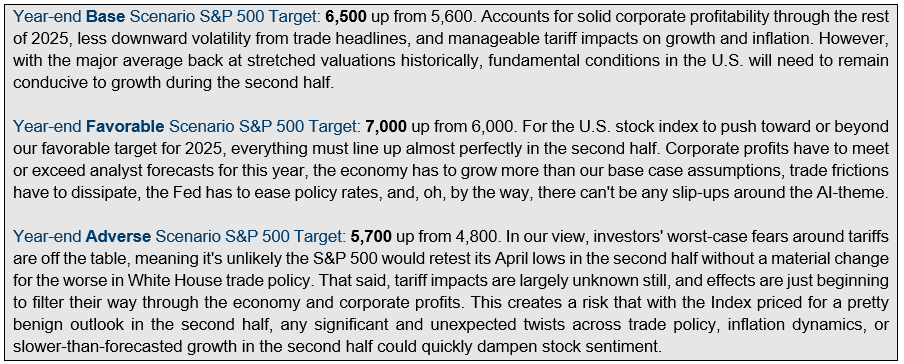

Ameriprise 2025 year-end S&P 500 targets raised, despite elevated trade risks in the second half.

At the end of April, we lowered our year-end S&P 500 targets versus our December forecast to reflect the extreme uncertainty around tariffs and, based on what was known at the time, likely negative impacts on growth, inflation, and profits. But over recent months investors have come to learn more about how this White House operates and seen its continued willingness to walk back aggressive trade stances, leaving more room for bilaterial negotiations with countries. It appears the Trump administration is unwilling to push a trade strategy that would move the U.S. economy into a recession or create lasting spikes in inflation. As such, we have moved our 2025 year-end Base and Favorable targets back to where we initiated them at the end of last year.

Of course, this doesn't mean there won't be periods of tariff volatility or surprises that develop in the second half, only that the Trump administration is more likely than not to ultimately course correct trade policy at some point if it becomes obvious that market reactions are turning too negative. At the moment, one could argue that U.S. trade negotiations with other countries aren't going very well. President Trump appears to be lashing out through aggressive tariff rate announcements, as seen last week and over the weekend, or is attempting to apply maximum pressure on countries ahead of the August 1 trade deadline.

Either way, the market's muted reaction suggests investors do not believe the President will ultimately act on his threats. With stocks near all-time highs and little effects thus far on inflation and growth from current tariff policy, Trump may feel he has some room to be aggressive. That said, if the White House acts on some or all of its recent tariff threats in the coming weeks, and this is not a "boy who cried wolf" situation, we believe the stock market is at levels that could lead to a modest drawdown in the summer. However, given solid fundamental conditions and the propensity for Trump to reverse course if and when market conditions become too disruptive, we would be a buyer of stocks on increased trade volatility.

As was the case in the first half, well-constructed diversification strategies likely remain key in the second half. We would note that a balanced portfolio of stocks and bonds based on risk tolerance outperformed the S&P 500 Index through the first six months of the year, which may continue in the second half if we see periods of increased volatility. Also, looking beyond large-cap S&P 500 and Big Tech companies, international strategies, high-quality bonds, and income-producing equities continue to offer attractive opportunities, in our view.

For more information on the themes we see driving stock prices through year-end and the scenario analysis that informs our year-end targets, please ask your Ameriprise financial advisor for a copy of Committee Perspectives: Second Half Outlook Brief.

Ameriprise year-end 2025 S&P 500 target summaries

Source: American Enterprise Investment Services, Inc.

The week ahead:

-

Several key banks will kick off the second quarter earnings season this week, with JPMorgan, Wells Fargo, Citigroup, and Bank of America all scheduled to report results. FactSet estimates are calling for Q2'25 S&P 500 earnings per share (EPS) to grow by roughly +5.0% year-over-year, which would mark the slowest pace of growth since Q4'23. However, we expect S&P 500 companies in aggregate to outperform profit expectations over the reporting season, with guidance across technology and other cyclical industries playing an important role in shaping stock direction over the coming weeks.

-

Inflation data will also be in the spotlight this week. The June Consumer Price Index is out on Tuesday, with the Producer Price Index updated on Wednesday. After four months of declines in gasoline prices, higher prices in June could put some upward pressure on headline CPI.

- June retail sales on Thursday are expected to bounce higher after a decline in May, and there will be a heavy slate of Federal Reserve speeches this week, with the Fed's Beige Book due on Wednesday.