2024 housing market outlook: Will prices continue to rise?

Russell Price, Chief Economist – Ameriprise Financial

March 19, 2024

The spring selling season will soon be underway for the U.S. housing sector. Here are our reflections on the lethargy that beset the market in 2023 and our forecast on whether activity will pick up in 2024:

A look back at 2023

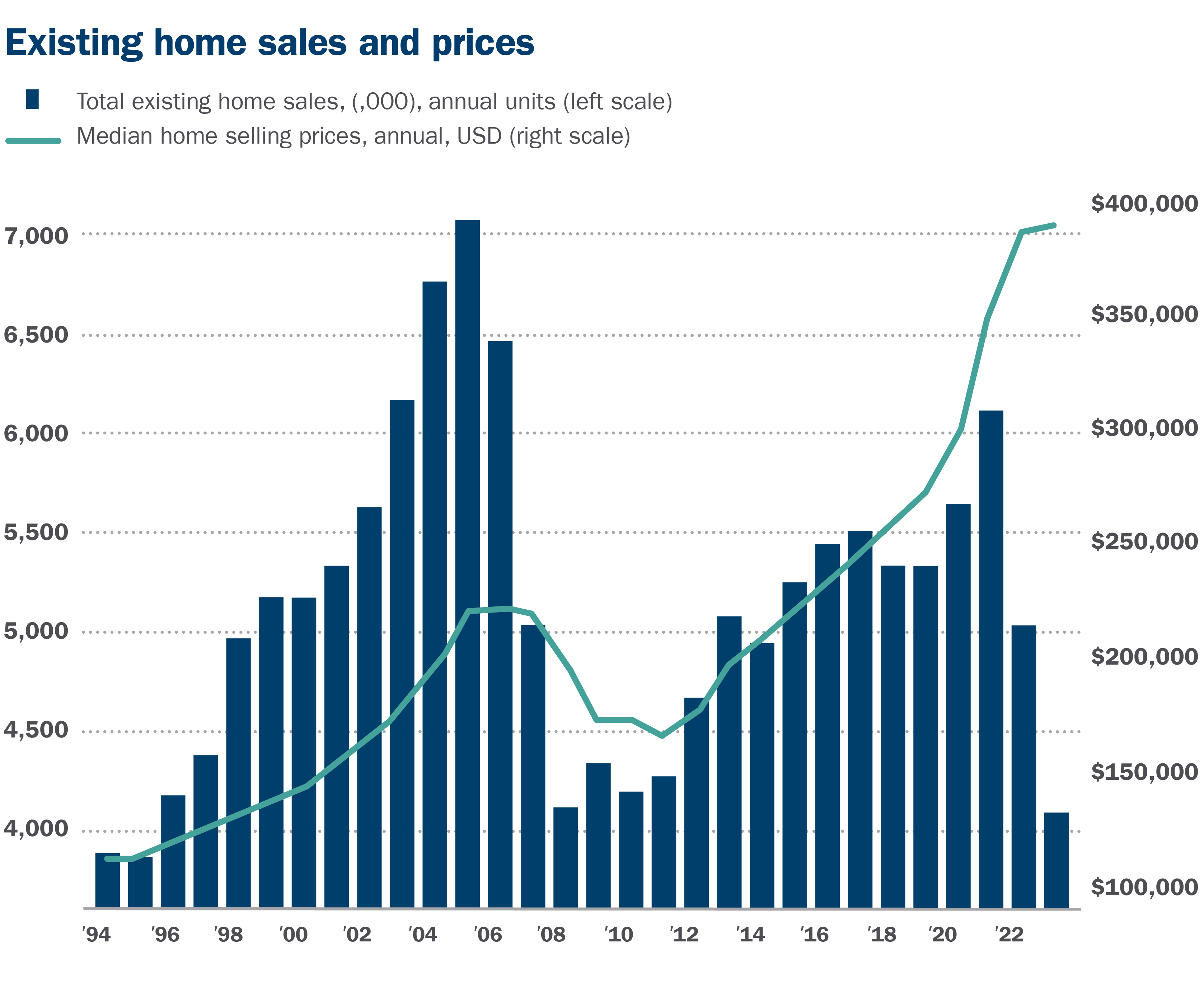

Existing home sales were the lowest since 1995

Existing home sales dropped 19% last year as mortgage borrowing costs were at more than 20-year highs for much of the year, according to the National Association of Realtors (NAR). Despite the sharp decline in sales, average selling prices ended the year modestly higher. According to the Federal Home Finance Agency (FHFA), home prices closed 2023 with an approximate 5% gain.

Source: National Association of Realtors

New home sales see strong performance

New home sales, however, performed much better than existing homes in 2023, as builders offered incentives and bought down mortgage rates to stimulate demand. Overall, new home sales were up 5% last year, according to the Census Department. Median selling prices, however, were down 7% year over year. The decline is largely reflective of sales mix and the aforementioned discounts available to prospective buyers, in our view.

Low inventory continues to support strong prices in 2023

Last year’s increase in average prices ― despite the large decline in sales ― is a dramatic departure from the experience seen during the housing bubble crash of 2007 through 2009. It also is at odds with basic economics: Typically, prices decline when demand goes down.

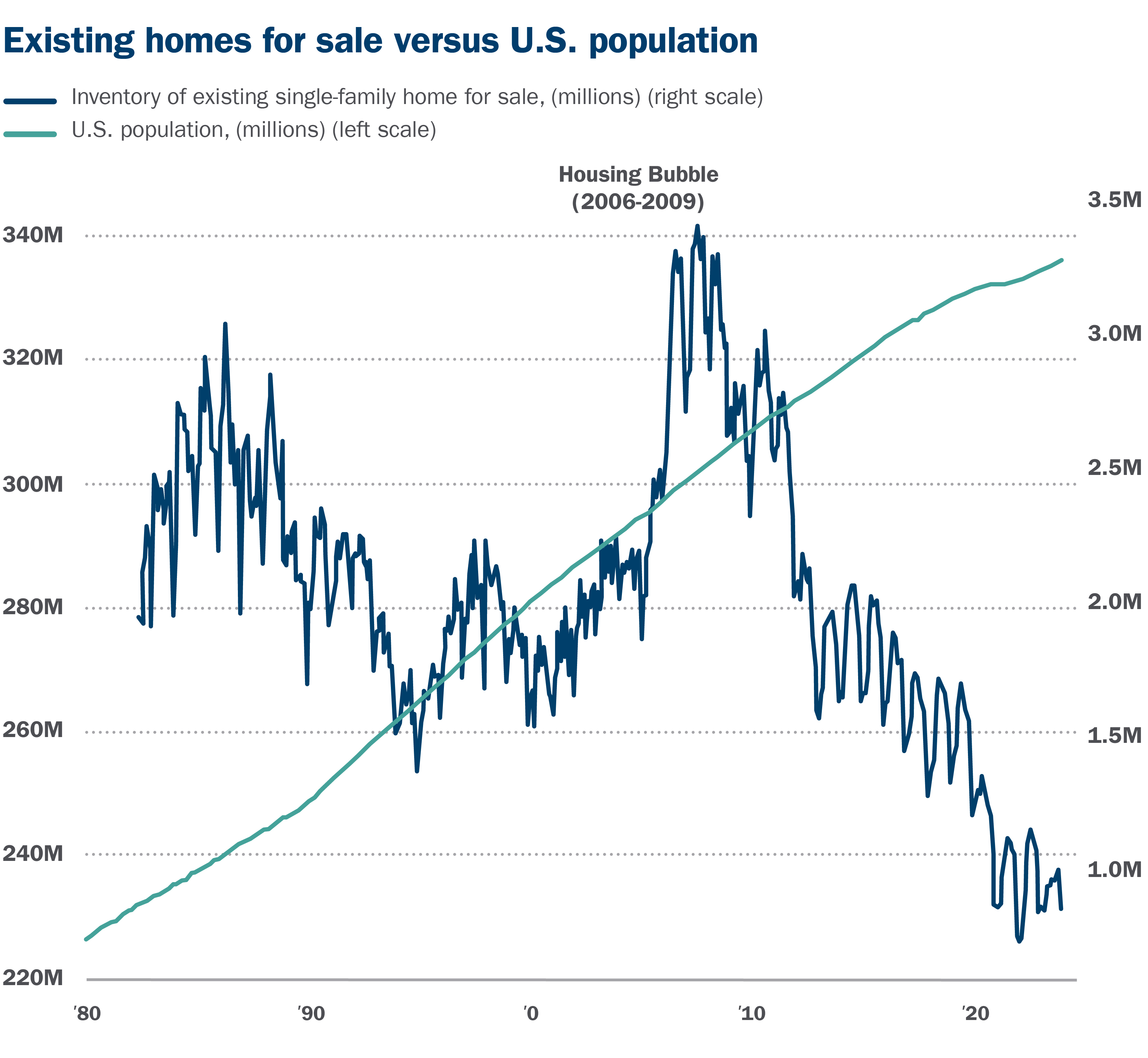

The divergence is largely a function of the U.S. economy’s very tight supply of homes available for sale. Last year, there were fewer homes available for sale than at any other time in decades.

As seen in the chart below, the housing market ended 2023 with about 870,000 existing homes available for sale, according to the NAR. In contrast, during the 1980s, there were typically between 2 and 3 million existing homes available for sale (2.4 million on average from 1982 through 1989). To put this into context, the number of homes currently available for sale is less than half those prior levels despite the U.S. population being 45% larger (1980 versus 2023 year-ending).

Source: National Association of Realtors

A look ahead to 2024

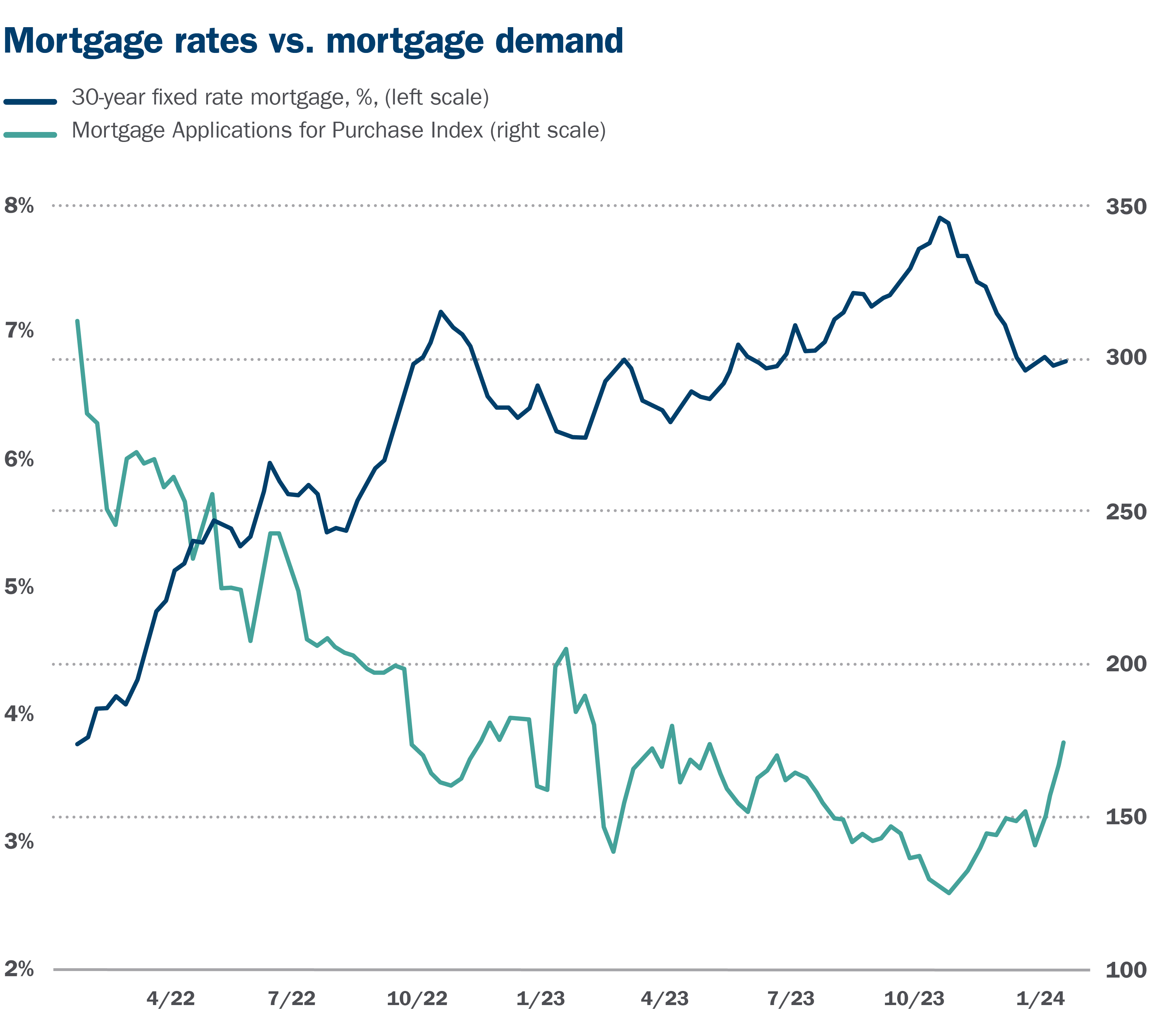

Momentum improves as mortgage rates decline

Mortgage applications for the purchase of a home have accelerated in recent months as mortgage borrowing costs have come off their recent highs.

At the end of January, the average rate on a 30-year fixed mortgage was 6.6%, down more than a full percentage point from the 7.7% rate at the end of October, according to the Mortgage Bankers Association. In response to lower rates, the Mortgage Applications Index jumped more than 39% on a seasonally adjusted basis from the end of October through the end of January.

Source: Mortgage Bankers Association

Interest rate dip may fuel rebound in sales in 2024

We believe there’s room for mortgage rates to decline a bit further this year, thus enabling a rebound in sales. In our view, there is strong pent-up demand for housing, as many potential buyers have been waiting for better affordability conditions, such as lower mortgage rates and/or lower prices.

We estimate existing home sales could be about 10% higher in 2024 with an approximate 5% increase in median selling prices. For its part, the NAR is forecasting a 13.5% increase in sales and for prices to be flat to slightly higher. Further, the Association predicts the 30-year fixed rate mortgage to average 6.3% for the year.

Sellers still have the upper hand over the long term

As seen in the first chart, there was a glut of homes available for sale during the housing bubble years of 2005 through 2008. However, many homebuilders went out of business in the years following the crash, leading to weak new building activity and, eventually, very limited inventory. It will likely take years for a rising pace of new building activity to improve the U.S. housing market’s supply and demand fundamentals, and until that time, it’s likely to remain a sellers’ market.

How does your home factor into your financial situation?

For many Americans, their homes are one of their most valuable financial assets and they can be an effective tool to build wealth. Talk with your Ameriprise financial advisor about how your housing expenses and home value factor into your broader financial portfolio and goals.

The views expressed are as of March 19, 2024, and are subject to change without notice at any time based upon market and other factors. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. It is given as a general source of information and is not a solicitation to buy or sell any securities, accounts or strategies mentioned and is not intended to be the primary basis for investment decisions. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such.

This information may contain certain statements that may be deemed forward-looking. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those discussed.

Information should not be construed as advice designed to meet the particular needs of an individual investor. Please seek the advice of a financial advisor regarding your particular financial concerns.

Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.