What the upcoming U.S. elections could mean for investors

Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

Justin Burgin, Vice President Equity Research – Ameriprise Financial

Sep. 16, 2024

This article is intended to provide perspective on how potential election outcomes may impact financial markets and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

This year’s election season has provided more than its fair share of twists and turns. After a historic summer of unexpected events, the stage is now set for Vice President Kamala Harris versus former President Donald Trump on Nov. 5. As we approach election day with candidates and their policy positions more solidified, we take a closer look at key investor issues.

Making sense of the investor impact

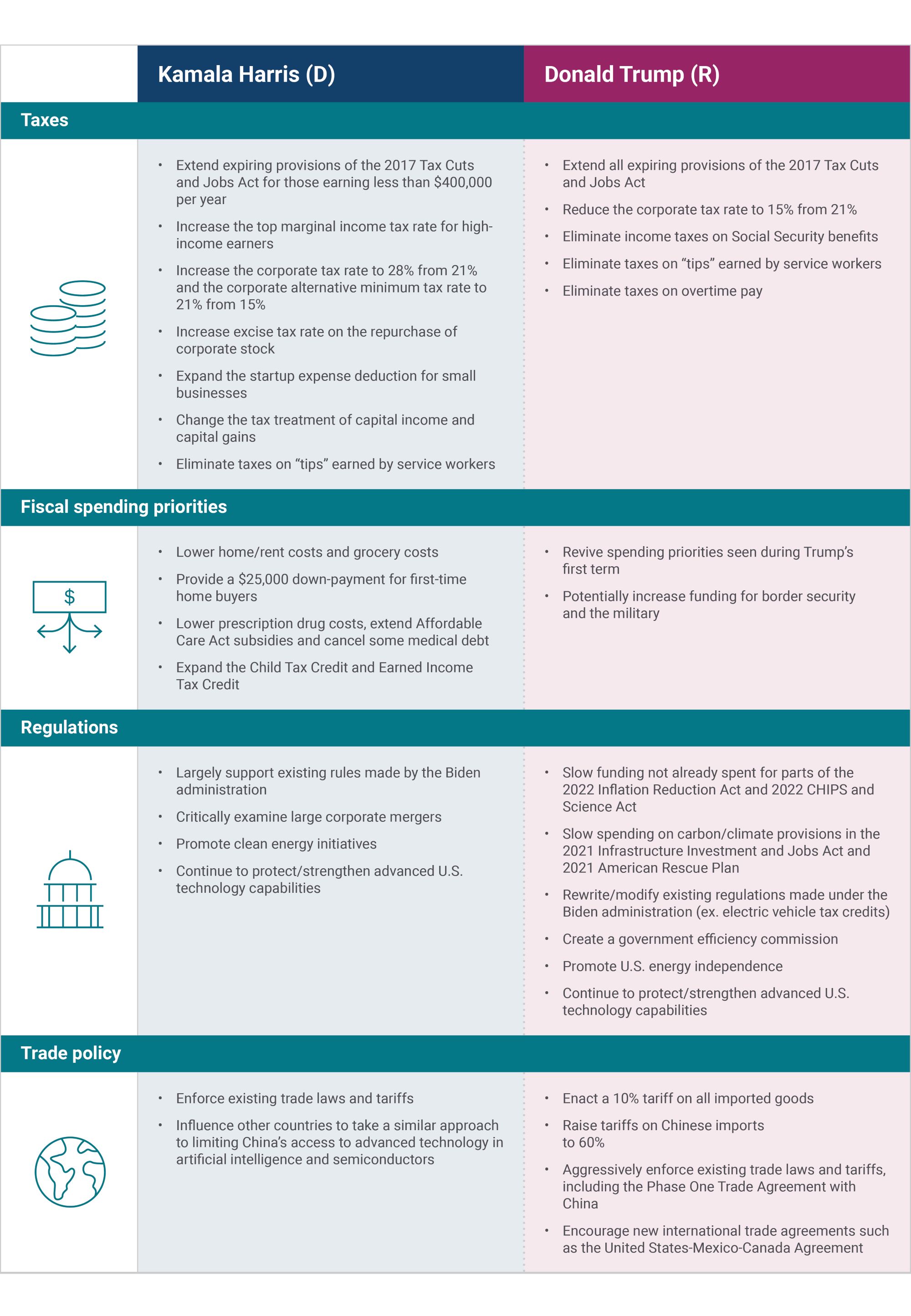

Both candidates offer different views of the current state of America, its economy and the appropriate direction of the country. And while the differences between the two candidates encompass a wide variety of policy issues, taxes, fiscal spending priorities, regulations and trade policy are the four areas that most impact investors, in our view.

Here’s a summary of where the candidates stand on key investment-related proposals:

Notably, major provisions of the 2017 Tax Cuts and Jobs Act expire at the end of next year, which will require Harris or Trump to negotiate a new deal with Congress that doesn’t raise taxes on millions of Americans in 2026. 62% of U.S. households will see their taxes increase in 2026 if Congress doesn’t act, according to the Tax Foundation. However, corporate tax rates, which stand at 21% currently, are not set to expire.

Bottom line: Each candidate’s proposals above are not written in stone and, in some cases — such as changing the tax code — require the approval of Congress. While we don’t address the cost of these proposals here, a growing U.S. debt burden and a declining appetite for running large spending deficits could limit what each candidate has proposed to help them win the election.

Download our U.S. election guide for investors

To help you make sense of these potential implications, the Ameriprise Global Asset Allocation Committee put together this investor guide that examines how the markets and economy have historically performed under past presidents and political environments.

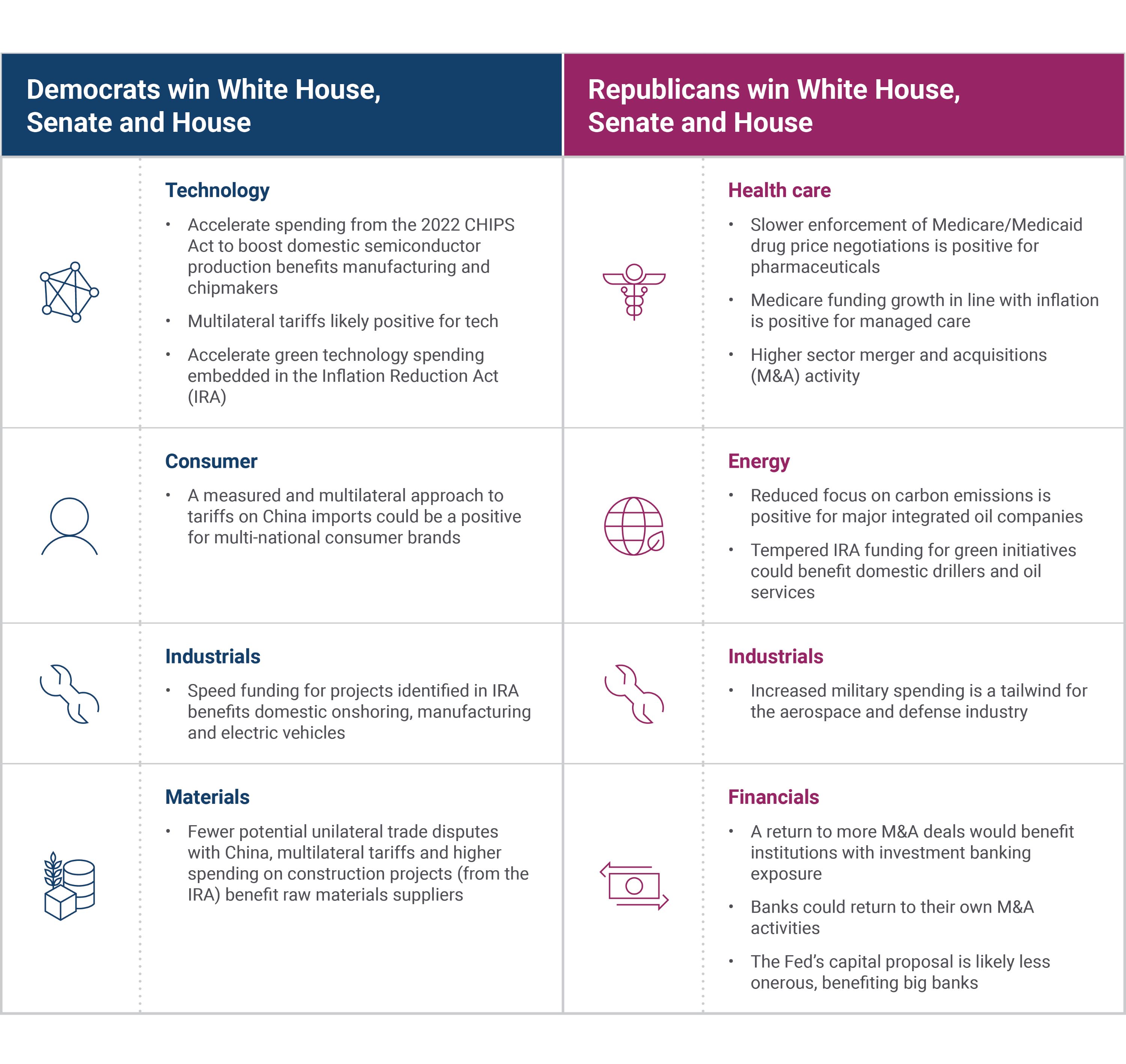

Download the guideElection 2024 sector outlook

While a presidential election is a significant event, markets tend to focus more on the congressional makeup for insight into the future operating environment. Major sectors of the S&P 500 Index could be impacted in an environment of “extremes,” where a single party controls the presidency, Senate and House of Representatives. While a three-way, single-party-win scenario is the least likely outcome, it provides a base case to gauge how a potentially significant sector headwind (or tailwind) could be more muted in a split Congress, a more likely outcome, in our view.

Here’s a summary of the potential sector implications if one party were to win the presidency, Senate and the House, in our view:

Additionally, an important (yet often overlooked) part of the post-election cycle is that of appointees, including the White House, Cabinet and sub-Cabinet positions. There are approximately 1,650 presidential appointments (many of which require Senate approval) that can help shape the rules for businesses and industries. Among the most high-profile include the president’s Cabinet secretaries, as well as leadership roles in key agencies such as the Federal Trade Commission (FTC), Federal Communications Commission (FCC) and the Federal Reserve.

Bottom line: While a divided government or narrow margins of control by one party limit sweeping policy changes on either side, the party that wins the White House will have the ability to shape how existing laws and regulations are enforced, augmented, or possibly changed. We suspect stocks and sectors could see some volatility based on these government undercurrents as a new administration takes shape. Yet, over the long term, stocks mostly move on profit expectations. Outside of a material change in corporate tax policy (which is not our base case), even stocks and sectors more impacted by the items listed above should eventually trade in line with underlying business conditions and growth in the economy once the rules of the road are established.

Election impacts on the broader market

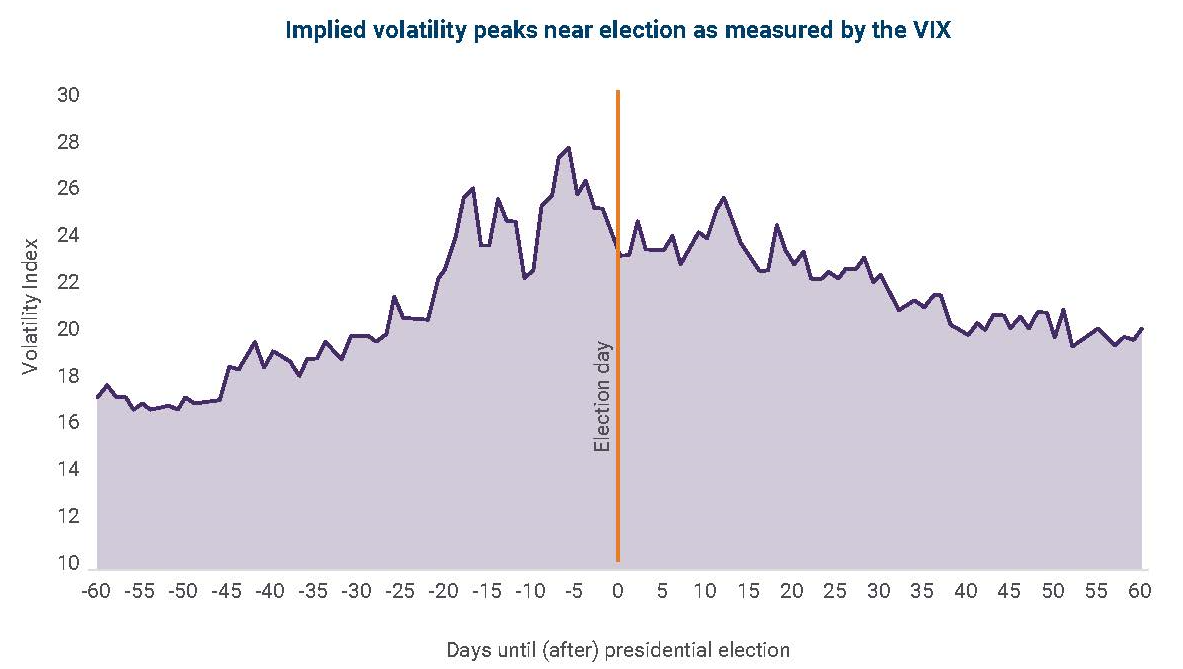

Based on history, election volatility/uncertainty for financial markets fall shortly after an election. Fundamental factors such as economic growth, earnings, the level of interest rates and asset valuations then return as the dominant drivers of the stock market and asset prices more broadly.

Nevertheless, investors should prepare for potential near-term volatility leading up to the election. Using history as a guide, markets tend to rise in an election year, but that is not to say there isn’t a period of volatility heading into the election. In fact, as our chart below shows, market volatility (as measured by the CBOE VIX Index) moves higher in the 60 days preceding the election (and peaking about one week before election day) and then heads lower in the ensuing 60 days.

Sources: Bloomberg, S&P Dow Jones Indices and Chicago Board of Options Exchange (CBOE) Volatility Index. Average S&P 500 total return 30-day volatility, 60 trading days prior to elections and 60 trading days after the election. Data begins with the 1992 election cycle and ends with 2020 election cycle.

Notably, finding agreement in Washington on how to address the expiring provisions in the U.S. tax code could be a lingering uncertainty for investors through a portion of next year. To some degree, this could act as a headwind for asset prices, particularly if the corporate tax rate looks like it could shift higher. However, other fundamental factors (such as potentially lower interest rates and a growing economy) may help counter some of the fiscal uncertainties.

Don’t let the political noise distract you from your investment strategy

Investors are better served by maintaining a well-diversified portfolio, looking through the political noise and recognizing that fundamental conditions in the U.S. market and economy sit on a solid foundation. That’s likely to be the case following the election and into next year, no matter who wins the White House. If you have any concerns about how the political environment may affect your personal portfolio, please reach out to your Ameriprise financial advisor.