Annuities and taxes

Annuities can be taxable based on the type of annuity you have and when you withdraw funds, which can have different potential implications for your retirement savings and income

To make the most of an annuity, it’s important to consider their general tax rules.

In this article:

Taxation of qualified vs. non-qualified annuities: Key differences

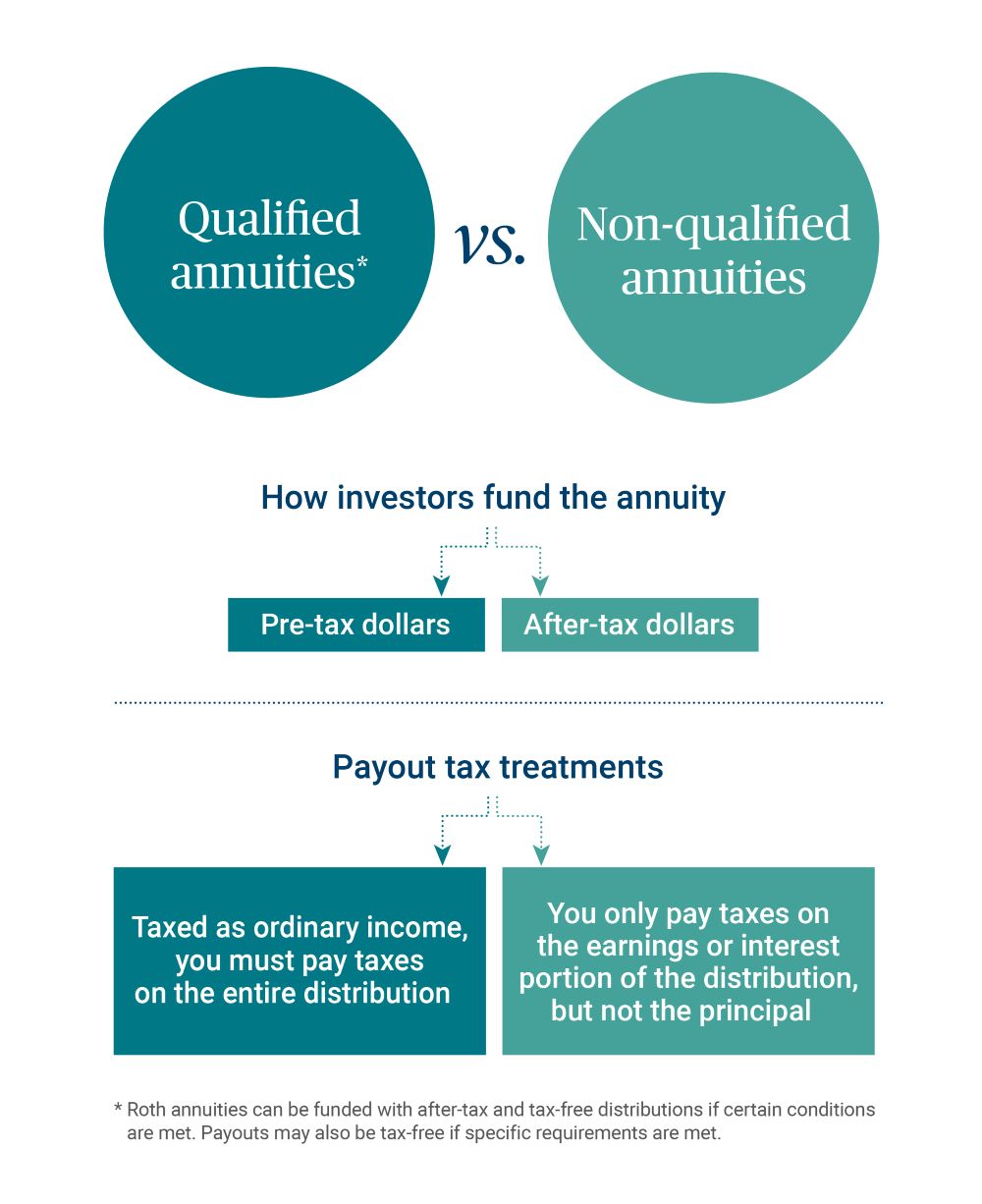

Taxes are determined by the specific type of annuity you purchase – either qualified or non-qualified. With a qualified annuity, you generally fund your annuity with pre-tax dollars, though Roth annuities are funded with after tax money. Non-qualified annuities are funded with after-tax dollars. This also affects the tax treatment of your payouts.

Qualified annuity taxation

- Funding: Qualified annuities are generally funded with pre-tax dollars, however Roth annuities are funded with after tax money.

- Distributions: Qualified annuities are subject to required minimum distribution (RMD) guidelines unless it is a Roth IRA (Roth 401(k)s will no longer be subject to RMDs in 2024). You must begin taking distributions from a qualified annuity by April 1st of the year after you reach your RMD age, unless your annuity is in an employer-qualified plan and you are still working (and also not a 5% or greater owner of the business). The RMD age is 73. In 2033, the RMD age will increase to 75.

- Payouts: You will pay normal income taxes on the entire distribution amount. Annuities purchased with a Roth IRA or Roth 401(k), however, may be tax free if specific requirements are met.

- Other considerations: If you invest in an annuity to fund a retirement plan or an IRA, the annuity will not provide additional tax deferral benefits for that retirement plan or IRA plan.

How is a non-qualified annuity taxed?

- Funding: Non-qualified annuities are funded with after-tax dollars and grow tax deferred.

- Distributions: Non-qualified annuities are exempt from required minimum distribution guidelines during life. Once you start taking distributions from a non-qualified annuity, any interest or earnings within the annuity will be distributed before the premium or principal amount.

- Payouts: The distributions of interest (or earnings) are taxed as ordinary income but you won’t pay taxes on distributions of the premium or principal you initially deposited.

Tax implications of withdrawing from an annuity

An annuity can be a smart addition to your retirement plan, but it’s important to keep in mind that if you make a withdrawal prior to the designated time period, you can expect to pay early withdrawal penalties on your annuity.

- Annuity withdrawals made before you reach age 59½ are typically subject to a 10% early withdrawal penalty tax. For early withdrawals from a pre-tax qualified annuity, the entire distribution amount may be subject to the penalty. If you withdraw money early from a non-qualified annuity, typically only withdrawn earnings and interest will be subject to the penalty.

- While there aren’t many exceptions to the 10% early withdrawal penalty, you can explore potential options with your tax advisor that may be available to you based upon your individual circumstances.

- In addition to potential tax penalties, withdrawals may also be subject to surrender charges by the annuity issuer. This may happen if the amount withdrawn exceeds any penalty-free amount during the surrender charge period. Surrender charges vary by the annuity product you purchase, so make sure to check with the annuity issuer before withdrawing money from an annuity.

If you are considering withdrawing from your annuity early, it’s a good idea to speak with a tax professional.

An Ameriprise financial advisor will help

Annuities can offer steady income and tax benefits making them a popular way to save for retirement. There are a variety of annuity products available to help meet retirement savings and income needs. An Ameriprise financial advisor will review your individual financial situation and partner with your tax professional to evaluate your annuity tax strategy.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.