Retiring during a challenging market

Imagine this: After years of working hard and saving diligently, your well-deserved retirement is right around the corner. But then, a market downturn or a recession hits — just as you’re about to transition to this momentous chapter.

It’s disappointing timing, but an unfortunate reality for many retirees. However, it’s important to remember it’s possible not only to retire during a challenging market — but to do so comfortably and confidently. Your Ameriprise financial advisor will work with you to create your retirement strategy with various economic and market cycles in mind.

Here are some strategies to remember when unforeseen market or economic developments appear to loom over your retirement plans:

1. Use a bucket approach to help shield your cashflow from market fluctuations

After decades of accumulating wealth, taking distributions from your retirement savings involves different strategies.

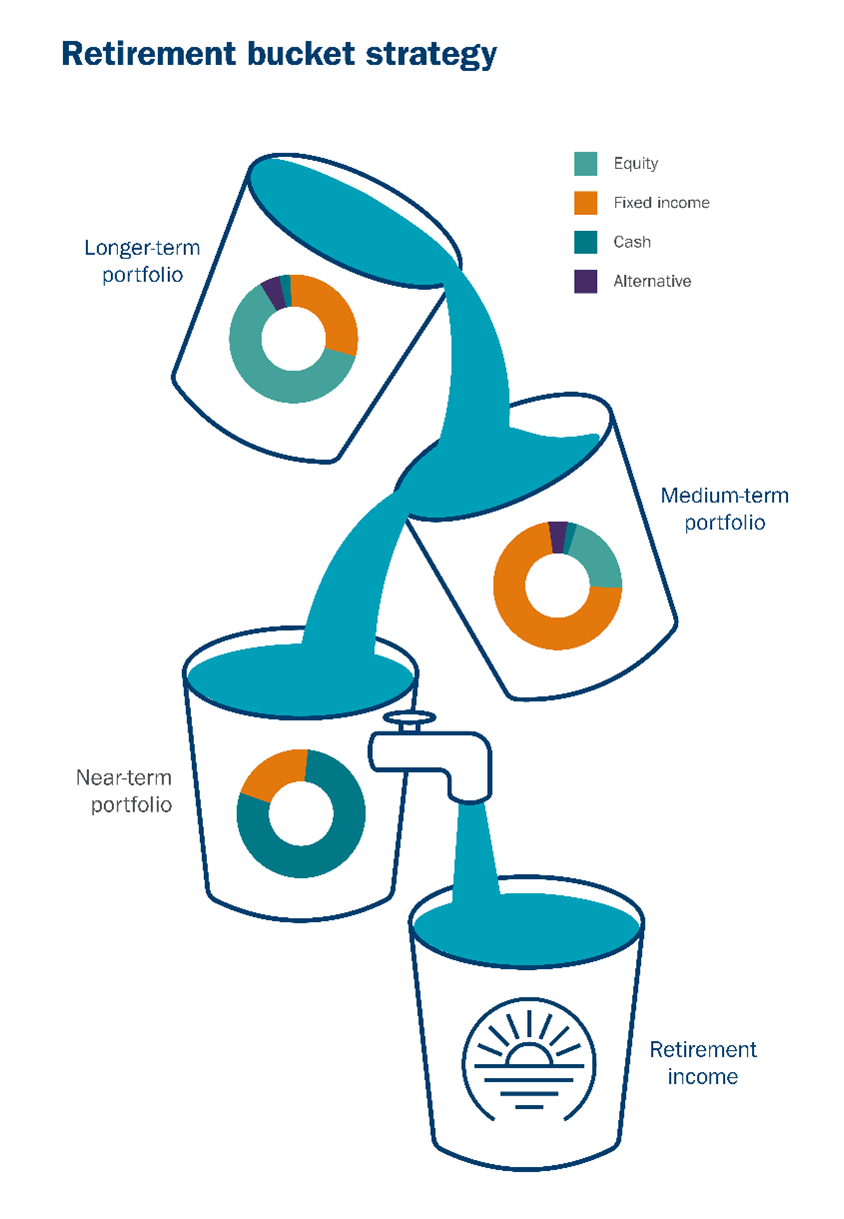

The retirement investment bucket strategy can help you balance your goal for income and growth in retirement without having to sell securities in a down market to meet your living expenses. With this approach you establish different “buckets” for different purposes:

- Long-term: Holds a portion of your retirement savings invested for growth. It comprises a majority of your retirement assets and is the bucket that helps provide growth to fight inflation and meet legacy goals.

- Medium-term: Invested to balance the need for income and preservation of capital stability, as well as to generate a higher yield than cash. It targets a slightly higher return and risk profile than the near-term bucket, but it is intended to be much more stable than the long-term bucket.

- Near-term: is designed to provide cash flow for spending and unexpected events. Generally, it’s advisable to hold cash or cash-like investments to cover at least 1–3 years of lifestyle expenses to help avoid the need to sell investments at an inopportune time, such as an extended market downturn.

The hypothetical allocations are for illustration purposes only and are not meant to represent the past or future investment strategies.

2. Take the market environment into consideration as you withdraw income

If you’re retiring during a recession, consider withdrawing cash and fixed income opportunities first to allow stocks and other investments that are down to recover. During good years in the market, replenish your cash and fixed income buckets.

After that, consider how income subject to required minimum distributions (RMDs) should be withdrawn. You can decide which investments to sell within your retirement accounts to make required withdrawals, and you can choose to reinvest unneeded cash back into an investment within another type of investment account to let it continue to grow for future needs.

3. Limit discretionary expenses, if needed

During times of economic uncertainty, many of us pare back where we can. And limiting discretionary expenses can be a useful cost-saving measure if you’re looking to preserve the sustainability of your income plan.

For example, you may cut down on leisure travel or consider more cost-effective options when exploring a new destination to visit. You could do more household chores yourself that you may otherwise outsource, including yard work, cleaning or home cooking. Or now may be a good time to sell a seldom-used vehicle or re-evaluate spending on nonessential items such as subscription services.

4. Delay large purchases to limit withdrawals

Market and economic cycles ultimately run their course. After all, bear markets all have one thing in common — they eventually end.

With this in mind, it may make sense to put off a major purchase, such as a new vehicle or a home renovation, until a recovery emerges. This will allow you to limit the withdrawals you make from your retirement accounts while the market is in flux.

If you’re considering a major purchase, mark your calendar one year out to reassess. You may find that conditions have improved or that waiting was the right choice for your situation.

5. Assess whether tax-loss harvesting may be appropriate for your situation

No one likes to lose money on their investments. But with tax-loss harvesting, you can at least get a tax benefit. Tax-loss harvesting involves selling a losing investment to generate capital losses that you can write off on your tax return to offset other taxable income. Be aware of wash sale rules. If you sell stock for a loss and buy it back within 30 days before or after the loss-sale date, the loss cannot be immediately claimed for tax purposes, but is added to the new basis. Consult with your Ameriprise financial advisor and tax expert to help you think through the pros and cons of this strategy.

6. If the timing is not ideal, consider whether you want to retire now

While you may be able to retire comfortably now, it might be worth reconsidering the exact timing.

For some, the sense of security they gain from continuing to work during a period of uncertainty may make delaying their retirement worth it. If you’re of this mindset, and you can continue to work into the near future, it may be wise to do so, whether it’s on a full-time, part-time, consultative or freelance basis.

Importantly, know that the retirement strategy you’ve created with your Ameriprise financial advisor is designed to help withstand these cycles so that you can stop working at your desired retirement age.

Market volatility resources

During periods of uncertainty in the markets, it can be challenging to determine what, if any, action to take. We have resources to help you navigate market volatility and prepare for a more confident retirement

We will help you work toward retiring more confidently — regardless of the markets

Don’t let a challenging market stand in the way of achieving the retirement lifestyle you’ve earned. Your Ameriprise financial advisor will help you develop a retirement strategy with goals such as downside preservation, income generation, capital growth and inflation mitigation. Please connect with them if you have any concerns about the impact of the current market environment on your retirement portfolio.