Consider increasing your contributions to your IRA and 401(k) to the maximum limit so that you’re not missing out on any potential growth or tax benefits.

Saving any amount of money towards retirement is good — but if you can, consider contributing the maximum amount allowed by the IRS to your IRA and 401(k) every year.

Not only can maxing out your IRA and 401(k) make a huge difference to your retirement savings over time, but it can also provide potential tax benefits to you today and in the future. An Ameriprise financial advisor can help you create a personalized retirement savings strategy that takes full advantage of all the different retirement accounts available to you.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Here’s how making the maximum contribution to your retirement accounts can significantly boost your savings over time.

What are the annual retirement account contribution limits?

|

2025: Maximum individual contribution and catch-up contribution limits |

|||

|---|---|---|---|

|

Retirement account |

Annual individual contribution limit |

Catch-up contribution* |

Total individual contribution* |

|

Traditional and Roth IRAs |

$7,000 |

$1,000 |

$8,000 |

|

SIMPLE IRA and SIMPLE 401(k) |

$16,500 |

$3,500 for individuals ages 50+ $5,250 for individuals ages 60-63 |

$20,000 for individuals ages 50+ $21,750 for individuals ages 60-63 |

|

401(k), 403(b), 457(b), Roth 401(k) and Roth 403(b) |

$23,500 |

$7,500 for employees age 50+ $11,250 for employees age 60-63 |

$31,000 for employees ages 50+ $34,750 for employees ages 60-63 |

*Individuals 50 years or older can make catch-up contributions to IRAs and most workplace retirement plans. These special contributions are in addition to the regular contribution limits. To find out if you’re eligible to contribute to an IRA, please review these requirements.

Running the numbers: Is the maximum contribution worth it?

Making the maximum contributions to your retirement accounts can provide a significant boost to your retirement savings.

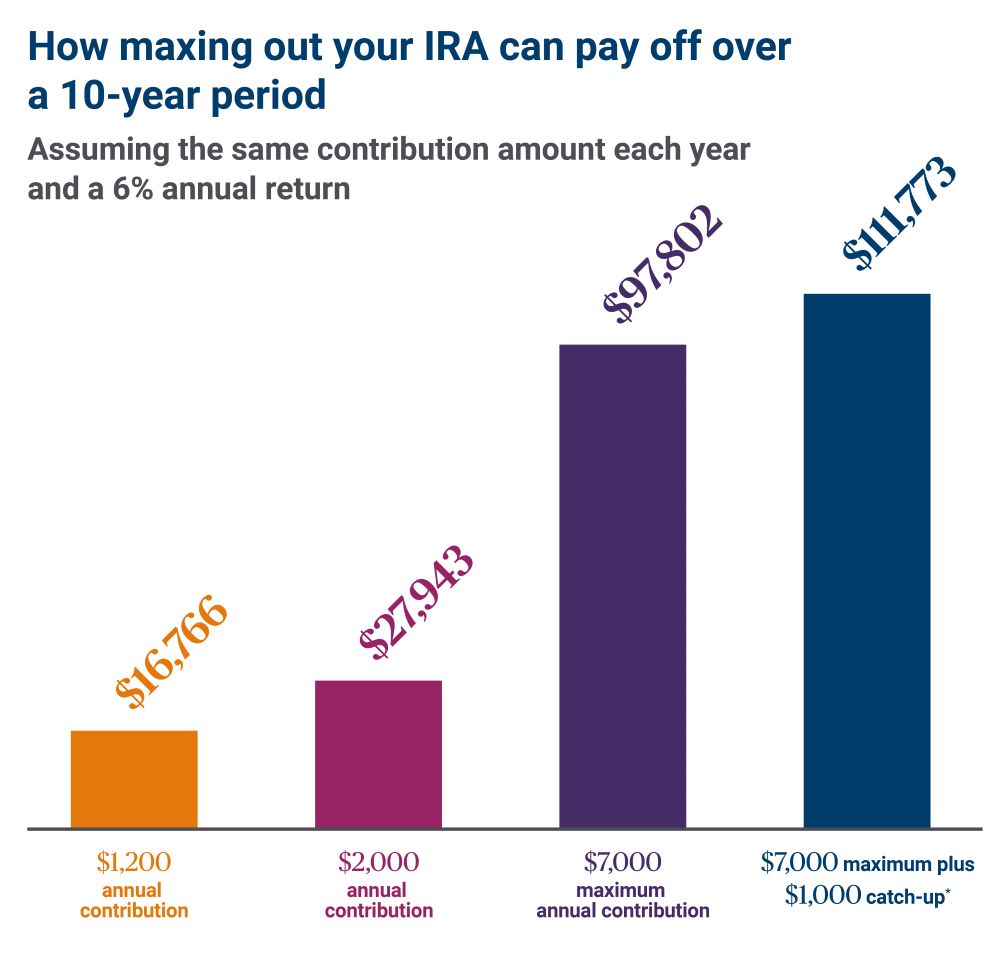

Below, we illustrate the powerful effect that making the annual maximum contribution to your IRA can have on the overall value of your retirement portfolio. For example, let’s say you contribute $1,200 to your IRA on an annual basis over a 10-year period. With an annual, compounded return of 6%, your savings would total $16,766. On the other hand, if you are age 55 and can contribute the maximum of $7,000 and the $1,000 catch-up contribution for 10 years, you would end with a balance of $111,773.

The numbers in the chart assume a 6% return over a time horizon of 10 years. This illustration is hypothetical and is not meant to represent a specific investment or imply any guaranteed rate of return.

*You must be at least 50 years old to make the $1,000 catch-up contribution.

Roth IRA vs. Traditional IRA calculator

Which type of IRA is right for you? Use this tool to calculate the potential financial benefits of a Roth IRA vs. a Traditional IRA.

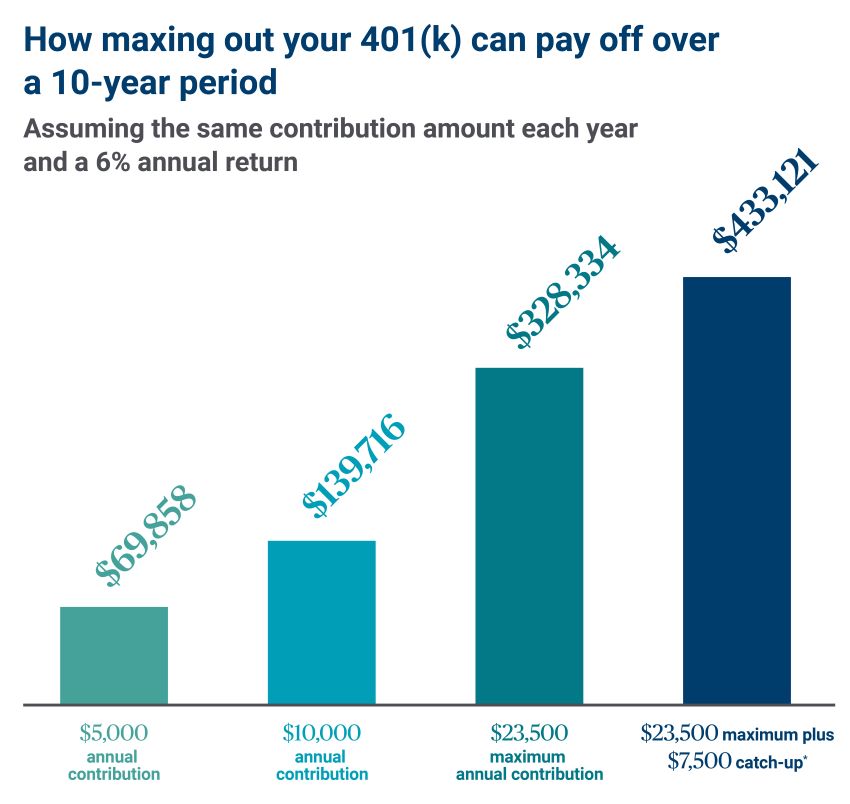

The savings opportunities are even more impactful for workplace plans, such as a 401(k) and 403(b), which have higher contribution limits. For instance, let’s say you contribute $5,000 to your 401(k) on an annual basis over a 10-year period. With an annual, compounded return of 6%, your savings would total $69,858. On the other hand, if you are age 55 and can contribute the 2025 maximum of $23,500 with a $7,500 catch-up contribution for 10 years, you would end with a balance of $433,121.

Further, pre-tax contributions to 401(k) plans have the immediate benefit of lowering your taxable income, which means a lower tax bill in the near term. And some employer-sponsored plans offer employer matching contributions, which can provide an even greater benefit.

The numbers in the chart assume a 6% return over a time horizon of 10 years. This illustration is hypothetical and is not meant to represent a specific investment or imply any guaranteed rate of return. It also does not account for any matching contributions from an employer.

*You must be at least 50 years old to make the $7,500 catch-up contribution.

Are you taking full advantage of your retirement accounts?

An Ameriprise financial advisor can help you determine what types of savings or investments are appropriate for your situation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.