What is a mutual fund? Basics, pros and cons

Explore the potential benefits of investing in different types of mutual funds and how this solution may fit into your broader investment strategy.

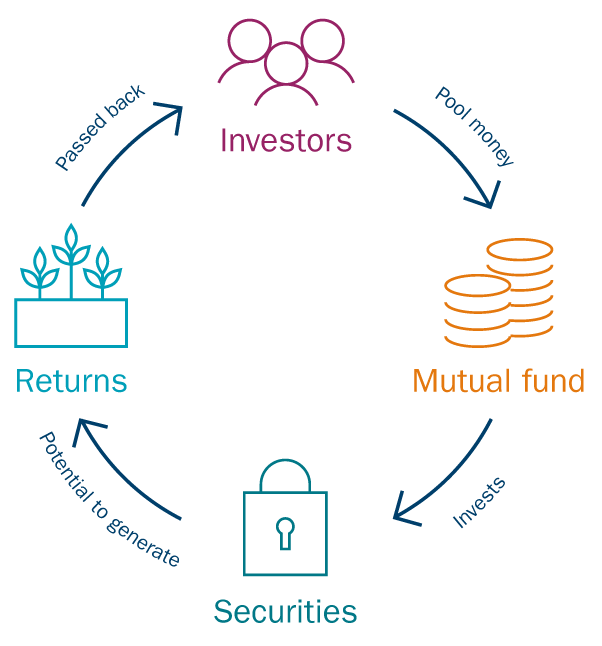

Mutual funds are a type of investment vehicle that pools money from many investors to invest in a variety of asset types. They can help you diversify your portfolio over the long term.

An Ameriprise financial advisor can help you select the appropriate types of mutual funds that align with your financial goals, risk tolerance and time horizon.

Here’s an overview of the basics of investing in mutual funds:

What are mutual funds?

A mutual fund is an investment that pools your money with that of other investors who share similar investment goals. Professional money managers use the pool of money to buy securities that can help achieve the mutual fund's specified objectives.

Mutual funds offer professional management and diversification, but they involve investment risks, including possible loss of principal and fluctuation in value.

What are the types of mutual funds?

There are a variety of types of mutual funds, which usually fall under one of the following four categories:

- Equity (stock) funds are invested in corporate stock of publicly traded companies. These funds can be classified based on a variety of components, including company size, industry or sector type, or based on potential growth and value.

- Bond funds are made up of debt instruments that the government or a corporation issues to investors to raise capital. They often carry less risk than stock funds; however, they may have less potential for growth.

- Money market funds invest in cash or cash-equivalent short-term debt from entities like the government or corporations. Money market funds are generally considered to be a low-risk investment.

- Hybrid funds are comprised of at least two or more asset classes — typically a blend of stocks and bonds. One of the most popular forms of hybrid funds are called balanced funds, which typically invest 60% in stocks and 40% in bonds.

Pros and cons of mutual funds

Mutual funds can be an efficient and cost-effective means of investing money; however they also come with risks and tradeoffs. Some pros and cons of mutual funds include:

|

Potential benefits |

Risks and considerations |

|---|---|

|

|

View a complete list of mutual funds and fund families that are available at Ameriprise Financial with our Mutual Fund Screener tool.

Basics of investing in mutual funds

Understanding a fund’s performance is critical to investing in mutual funds. When comparing different types of mutual funds, review their prospectus to ensure the funds' investment objective and risk level meet your individual investment goals. Consider the following factors:

- Past performance: While historical performance is not a guarantee of future results, understanding a fund’s previous performance provides valuable context — including its performance during market highs and lows.

- Turnover ratio: The value of a fund’s trades in a year compared to its total value of assets. For example, if one mutual fund invests in 50 stocks and that year replaces 20 of those, the turnover ratio would be 40%. Funds with higher turnover ratios tend to be more expensive than those with lower turnover rations due to costs accrued when buying and selling stocks.

- Total return: Total return is a measure of a fund's performance including reinvested dividends and capital appreciation. Listings may be calculated for different time periods — often weekly. Check for the durations being used.

- Operating fees, sales charges and other expenses: Investors may pay annual operating fees, shareholder fees and other fees and penalties.

- Expense ratio: Also known as a mutual fund’s annual operating fee, this number can be calculated by dividing a fund’s annual expenses by its average net assets. The higher the expense ratio, the higher the cost to the investor.

- Shareholder fees or sales charges: These commissions and redemption fees are also known as either a front-end load or a back-end load depending on whether they’re assessed at the time of purchase or the time of sale.

- Early withdrawal charges: These may be incurred when withdrawing or selling the holding early.

How might mutual funds fit into your portfolio?

An Ameriprise financial advisor can help you determine which type of mutual funds may be appropriate for your investment portfolio, given your financial goals, time horizon, risk tolerance and personal needs.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.