Retiring in a down market

Help preserve your retirement portfolio during market volatility with these 5 strategies.

Market downturns can be difficult for any investor to stomach. But for those who are expecting to retire soon or are relying on their investment portfolio for income, a bear market can be a particularly challenging period.

Fortunately, with a strategic approach to preserving your assets, it’s possible not only to retire during a challenging market — but to do so confidently. By evaluating key strategies and making changes as needed to preserve principle, an Ameriprise financial advisor can help ensure you remain on track for your financial goals and help you retire on your terms.

Here are five strategies to consider when unforeseen market or economic developments appear to loom over your retirement plans.

1. Use a bucket approach to help manage cashflow

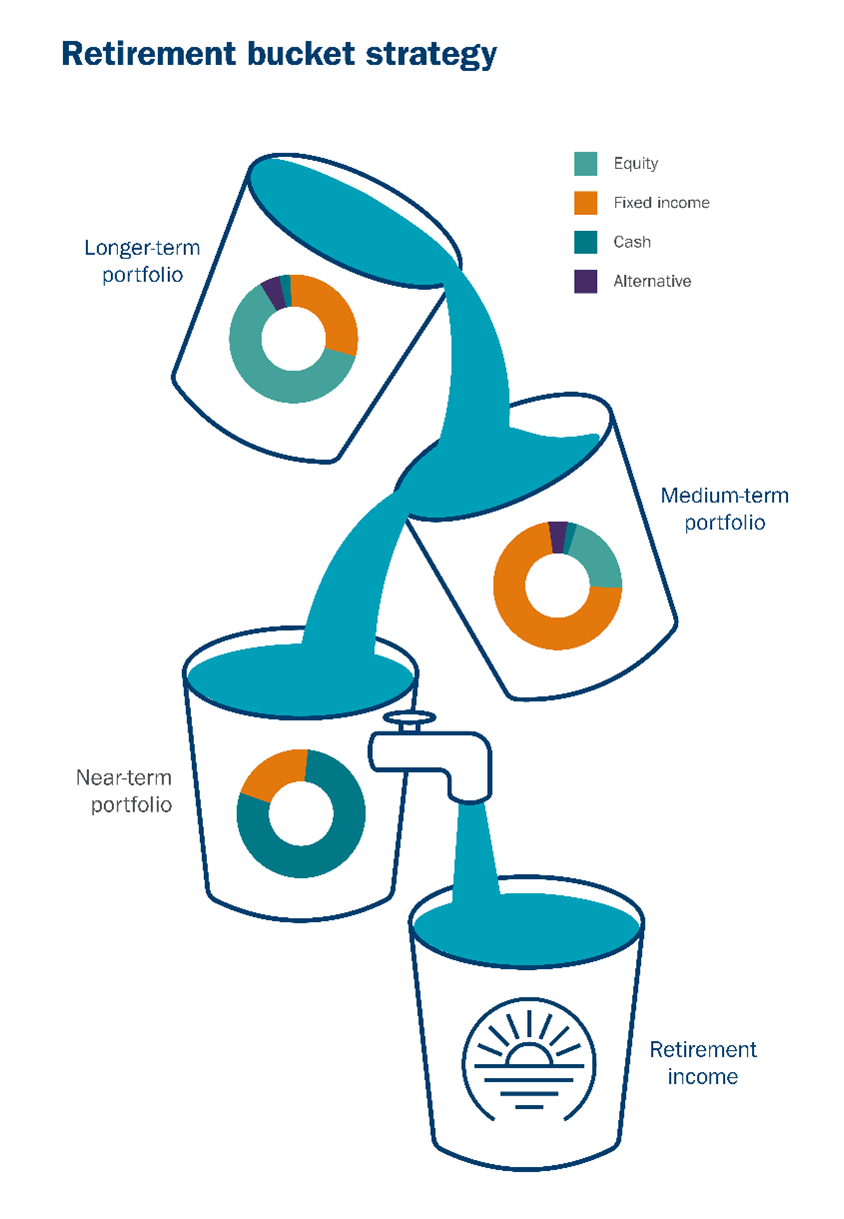

Retiring in a down market may involve several different strategies. One foundational approach to consider during periods of market volatility is the “bucket” strategy, which involves establishing different pools of assets for different needs and time horizons. Using this strategy can help balance your goals for income and growth without having to sell securities in a down market to meet living expenses.

Here's a look at the different buckets and their purposes under this strategy:

- Long-term bucket: Comprising most of your retirement assets, this bucket will hold the portion of your retirement savings invested for long-term growth, primarily in equities. It’s also the bucket designed to help you fight inflation and support your legacy goals.

- Medium-term bucket: This bucket invests in assets that are designed to balance the need for income and preservation of capital while also generating a higher yield than cash. It could include fixed-income investments that target a higher return and risk profile than those in your near-term bucket while still being less risky than those in your long-term bucket.

- Near-term bucket: For those in or near retirement, it’s generally recommended to hold cash (or cash-like investments) to cover at least 1‒3 years of lifestyle expenses to help avoid the need to sell investments at inopportune times, such as during extended market downturn. With that in mind, this bucket is designed to provide money for spending and unexpected events, and may include assets such as cash and cash investments.

The hypothetical allocations are for illustration purposes only and are not meant to represent the past or future investment strategies.

2. Be strategic about withdrawing income

During a market downturn, consider withdrawing cash and fixed income opportunities first to allow stocks and other investments that are down to recover. To limit or avoid having to sell assets, you may also want to consider taking any interest and dividends on investments in cash rather than reinvesting them. Finally, if you’re subject to required minimum distributions (RMDs), consider which investments you’ll want to sell to satisfy your RMDs while reinvesting unneeded cash so it can continue to grow for future needs.

3. Limit lifestyle expenses, if needed

During times of uncertainty, it can be smart to pare back where you can. Limiting lifestyle expenses can be a useful cost-saving measure if you’re looking to preserve the sustainability of your income plan. Some options to consider include cutting back on leisure travel, selling an old vehicle or re-evaluating spending on nonessential items such as duplicate or seldom-used subscription services.

4. Assess opportunities to save on taxes

No one likes to lose money on their investments, but a decline in value of your portfolio can offer potential tax-saving opportunities.

- Tax-loss harvesting: This strategy involves selling a losing investment from your brokerage or other non-qualified accounts to generate capital losses that you can then write off on your tax return to offset other taxable income. It’s a complicated strategy, so be sure to talk to your tax professional before selling any assets.

- Roth conversion: A market downturn can be an opportune time to convert a traditional IRA to a Roth IRA, as a decline in the value of your portfolio can potentially mean a substantially lower tax bill for the conversion. While you’ll owe taxes on the converted funds, you won’t have to pay taxes on the money as it recovers and grows, and Roth IRAs aren’t subject to RMDs. You may be able to save even more on taxes if you can do a conversion while your income is lower, as is often the case for those in the early years of retirement and qualifying Roth assets are inherited by your beneficiaries tax free.

- Net unrealized depreciation: When employer stock in your retirement plan has depreciated, you may want to consider selling the stock and repurchasing it in the plan to lower your basis for a future in-kind distribution after the stock has appreciated. Wash sale rules don’t apply in a retirement plan so you likely can repurchase the stock soon after the sale, but you will want to make sure the plan allows new stock purchases prior to selling. A later in-kind distribution of employer stock from your retirement plan as part of a lump-sum distribution may allow you to pay capital gains rates on the appreciation rather than the higher ordinary income tax.

5. Reconsider your retirement date

While you may be able to retire comfortably now, it might be worth reconsidering the exact timing.

For some, the sense of security they gain from continuing to work during a period of uncertainty may make delaying their retirement worth it. If that sounds like you — and you can continue to work into the near future — it may be wise to do so, whether it’s full-time, part-time, or as a consultant or freelancer.

Learn more: Working after retirement

Help shield your retirement from market volatility

While challenging markets can be uncomfortable, it’s important to remember that all downturns have one thing in common: They eventually end. An Ameriprise financial advisor can help you navigate market volatility during retirement and develop a strategy that accounts for downside preservation, income generation, capital growth and inflation mitigation.

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

warning Something went wrong. Do you want to try reloading? Try again

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.