Debunking 10 common myths about insurance

Get the facts about the most common insurance misconceptions.

Whether it’s auto, homeowners, life or disability income, insurance can be complicated. And it’s no surprise that many people have misconceptions about how different insurance policies work, what they cover and how much they cost.

Your Ameriprise financial advisor can provide you with the facts regarding your own insurance needs and help you align coverage with your overall financial strategy. Here are some of the most common insurance myths — debunked:

Myth #1: You don’t need life insurance if you’re single and healthy

Fact: Even if you don’t have a spouse, or your untimely passing is less likely because you’re young and in good health, life insurance may still be a good idea for a few reasons:

- It can help ensure your loved ones are not financially strained to fulfill your final wishes, whether that be a funeral, cremation or other arrangements.

- If you have debt — such as a private student loan — that was cosigned by loved ones, it can ensure the loan doesn’t become a burden to them.

- You may have family members — such as younger siblings or extended relatives — who may depend on you for support. Life insurance can help provide for them in the event of your death.

- A cost-effective time to purchase a life insurance policy is typically when you are young and healthy since your premiums are likely to be lower and you’ll have a higher likelihood of approval. You may have limited coverage options in the future, if your health declines.

Myth #2: I’m too old to be underwritten for life insurance

Fact: You have options for purchasing life insurance even if you’re older.

Being older doesn’t mean you shouldn’t — or can’t — obtain a life insurance policy. While you may have limitations based on your health, there are still usually options for some level of protection.

Myth #3: Life insurance only benefits your heirs

Fact: Life insurance can help provide you with greater comfort knowing that your loved ones will be financially cared for in the event of the unexpected — an invaluable benefit for many.

But in addition, a properly designed cash-value life insurance policy can be a tax-efficient way to build wealth for the long term, offering you flexible access to cash value (through loans or withdrawals) at any age.1 For example, the cash value can be used to supplement your future retirement income, help pay for a child’s higher education costs or a home remodel to prepare for aging in place.

Myth #4: You only need life insurance if you earn income

Fact: Even if you don’t earn a paycheck, the monetary value of your support for loved ones is considerable and should be protected in your financial plans. For example, the amount and type of work provided by a stay-at-home partner or spouse — childcare, housekeeping, food preparation, household finances, transportation and more — often equates to more than a full-time job. If the support is suddenly gone, it may be necessary to pay for portions of it through outside services.

As such, consider securing adequate life insurance coverage for this person — whether it’s you, your partner or extended family member — to help protect your family’s quality of life from unnecessary financial hardship.

Myth #5: The life and disability income insurance I get through my employer is adequate

Fact: While the life and disability insurance coverage offered by many employers is a nice benefit, it often isn’t sufficient to protect your loved ones.

Most employer-provided disability insurance only covers up to 60% of base salary and does not cover bonuses, leaving a sizeable gap. Similarly, employer-provided life insurance often isn’t enough to truly protect your loved ones. Further, if you leave your job, it’s not usually possible to take it with you. Having your own policy can help ensure you’ll have protection you can count on, regardless of your employment status.

Learn more: Why life insurance? 6 ways it can help protect and achieve your financial goals

Myth #6: Disability income insurance is primarily for accidental injuries

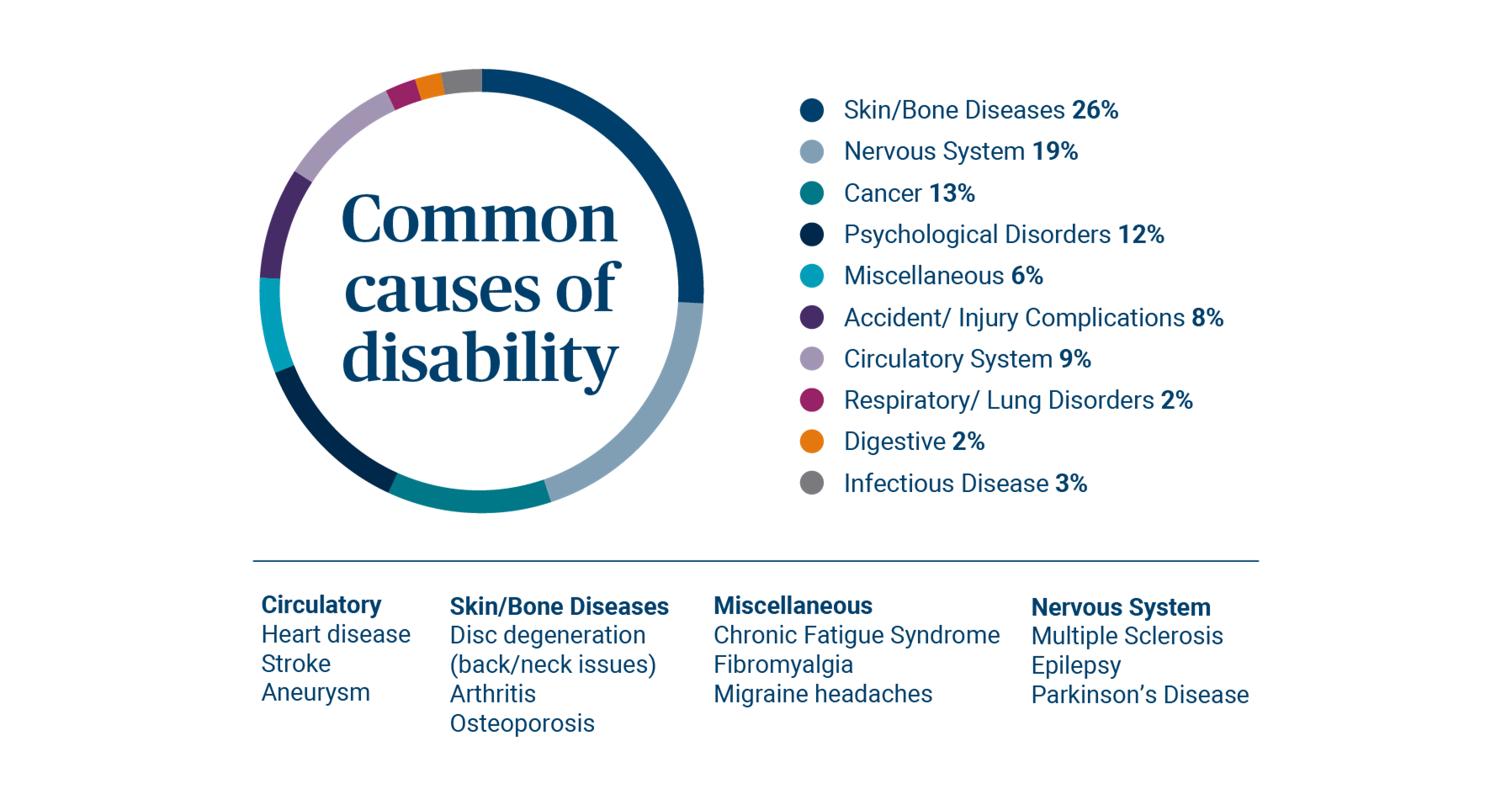

Fact: Only a small percentage of disability claims result from accidents, while disabilities resulting from illnesses are much more common.

In fact, about one in four of today’s 20-year-olds will become disabled at some point before they retire.2 Among the most common causes of disability are skin and bone diseases, cancer, nervous system conditions and psychological disorders.

Source: RiverSource Life disability insurance claims payments through Dec 31, 2022. The above is for illustrative purposes only and is not intended to be an inclusive representation of all claims.

Learn more: Protecting your earned income with disability insurance and life insurance

Myth #7: Long-term care insurance isn’t necessary once you’re on Medicare

Fact: Contrary to popular belief, Medicare does not cover all long-term care needs.

Individuals may receive coverage for short-term care — such as temporary stays in skilled nursing facilities — but Medicare doesn't cover care for extended lengths of time. Long-term care insurance can help bridge the gap as it helps pay for expenses related to long-term care needs that are not covered by Medicare, Medicaid or health insurance.

Learn more: Choosing long-term care insurance: Is it right for you?

Myth #8: Long-term care insurance is always “use it or lose it”

Fact: If you’re concerned about spending money on long-term care insurance that you’ll never use, there are options beyond traditional, stand-alone long-term care insurance policies.

For example, hybrid policies or individual life insurance policies with long-term care or chronic care riders can provide death benefits to heirs (tax-free) if the long-term care benefits aren’t needed.

Learn more: How to plan for the cost of long-term care

Myth #9: Always get a low deductible

Fact: Whether you’re dealing with auto insurance, homeowners insurance or renters insurance, having a low deductible isn’t always the best option.

If you have an adequate cash reserve that can cover the cost of an unexpected repair, a higher deductible is often a more cost-effective option.

Myth #10: Most people don’t need umbrella insurance

Fact: It’s a common misconception that you’re only going to be sued if you are among the wealthy.

However, lawsuits are fairly common and having a plan in place to protect your assets in the event of litigation can benefit you down the road. Umbrella insurance is one way you can help safeguard your wealth. For a relatively small amount of money, it can give you added liability coverage above and beyond the limits of personal home, auto and watercraft insurance policies.

Learn more: Protecting your property with insurance

Get personalized advice for your situation

Your Ameriprise advisor can provide you with the facts you need to find the right protection for you and your loved ones.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.