Open enrollment help: 7 things to consider

Make sure you’re taking advantage of all the benefits offered by your employer.

When open enrollment season begins, it may be tempting to save time by choosing the same employer-sponsored benefits you chose last year. However, putting these decisions on autopilot would be a missed opportunity.

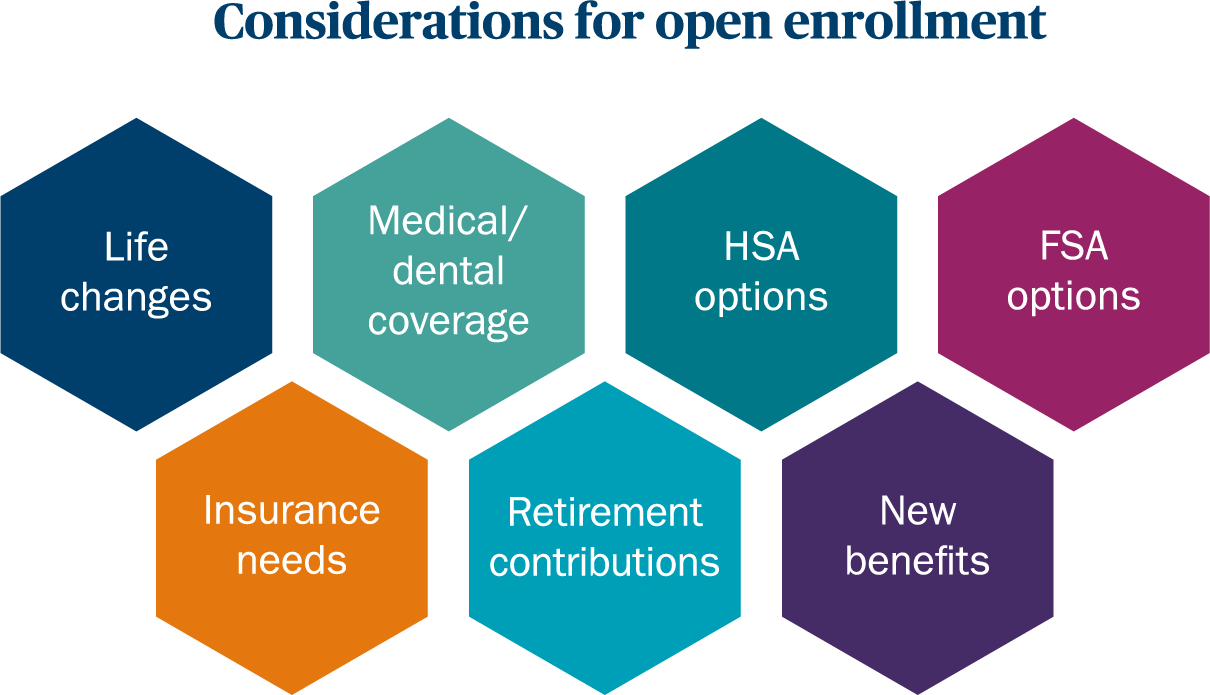

The reason is simple: open enrollment is your annual chance to comprehensively reassess and get help with all your benefit selections — from health and dental coverage to insurance and retirement needs — to ensure they’re aligned with your financial and health goals.

As you navigate this window of time, know that an Ameriprise financial advisor is here to help you make informed choices on coverage. Here are seven things to consider during your review of employer benefits:

1. Recent (and forthcoming) life changes

If you’ve experienced any major changes in your personal situation, health or financial status, you’ll want to utilize available resources to help ensure your open enrollment selections still make sense in the context of these new developments. Big life events — like marriage, divorce, or the birth of a child—will likely affect how you take advantage of all your employer benefits. The same goes if your health or financial goals have changed.

As you prepare for open enrollment, take a step back to review your current life circumstances as well as anticipated changes for the coming year. By grounding yourself in this information, you’ll set yourself up for a better holistic assessment of your needs — and how your benefits may address them.

2. Medical and dental coverage

Does your health and dental coverage still suit your lifestyle and needs? Consider how you’ve utilized your coverage over the past year and think critically about what medical expenses could transpire in the year ahead. Perhaps your spouse has a major surgery planned, or maybe it’s time for your teen to get braces. These possibilities should be key considerations as you decide on your health and dental plans for the upcoming year.

Additionally, you’ll want to account for any employer-instituted changes to your health or dental care, like plan changes or increases in costs or coverage. Getting open enrollment help can guide you through these changes smoothly. And if you're married, it's a good idea to compare your health and dental plans with that of your spouse.

Most employees will decide between two coverage options. Here’s a quick overview:

| High-deductible health plan | Low-deductible health plan |

|---|---|

|

|

3. HSA eligibility and contribution limits

If you decide to enroll in a high-deductible health plan, consider enrolling in a health savings account (HSA), a tax-advantaged account that enables you to use pre-tax money to cover eligible, out-of-pocket medical expenses. HSA funds that aren't spent in the calendar year can be rolled over each year, which also makes these accounts a good tool for saving for health care costs in retirement, when medical costs can be significant. Building up your HSA account during your working years can provide you with access to tax-free withdrawals to cover eligible health care expenses in retirement.

4. FSA eligibility and enrollment

If your employer offers a flexible savings account (FSA), you’ll first want to understand if it’s for dependent care or health care (or both), utilizing open enrollment resources. Here’s what to know about each:

- Dependent care FSA: Uses pre-tax dollars to pay qualified out-of-pocket dependent care expenses (like day care). Because your contributions to a dependent care FSA are made on a pre-tax basis, you end up paying less in taxes and taking home more of your paycheck.

- Health care FSA: Can be used for the same types of medical expenses as an HSA. Unlike HSAs, only a certain amount of leftover funds can be rolled over to the next year, and this rollover exception can vary by employer. Additionally, you may lose your FSA dollars if you leave the company. Check with your employer for details on their rules around FSA rollovers.

5. Your insurance needs

Review employer-provided or supplemental life insurance, long-term care insurance, disability coverage and other plan options. You may want to add a policy, review your premium amount, change your beneficiaries or increase the benefit on an existing policy.

If there's a gap between your needs and what your employer offers, an Ameriprise financial advisor can help identify other insurance options. And please connect with your financial advisor before considering reducing or eliminating a policy through your employer. It is generally not as easy or affordable to add coverage back after your initial benefit enrollment when you start a job.

6. Retirement contributions

While most companies allow employees to make changes to their retirement accounts throughout the year, with the help of available resources, open enrollment can be a convenient time to revisit those benefits. Consider using this window to also increase your contributions or adjust plan allocations to ensure you are at least taking advantage of any employer match benefits offered. And while you’re logged into these accounts, check your beneficiaries to ensure they’re up to date.

7. New benefits

Increasingly, employers are offering benefits that extend beyond health care, retirement and insurance, so make sure you’re taking advantage of all the new perks available to you. For example, some companies offer their workers pet insurance policies, prepaid legal plans, discounted identity theft protection and back-up childcare services.

Make the most of your open enrollment options

Know that your Ameriprise financial advisor is here to offer guidance and help ensure your employer benefits are in line with your personal financial and health goals.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.