How are my investments taxed? 4 questions to ask

Create a tax-efficient investment strategy by understanding how the IRS treats different accounts and assets.

When it comes to investing, what you owe in taxes is unfortunately not always simple. Instead, what you pay to the IRS will depend on multiple factors, including what type of assets you own, where you hold them, when you sell them and how much you earn in a given year.

An Ameriprise financial advisor, along with your tax professional, can help you understand how taxes may affect your bottom line and your broader financial goals.

To help you understand how your investments may be treated by the tax code, here are four questions to ask.

What kind of account is your investment housed in?

Does your personal investment live in a taxable or tax-advantaged account? If your investments live in a tax-advantaged account, then they, first and foremost, must adhere to the IRS rules that govern those accounts.

Tax-advantaged accounts

Sanctioned and regulated by the IRS, tax-advantaged accounts are designated savings or investment accounts that offer special tax benefits. These types of accounts were created by the government to incentivize Americans to save for certain priorities — like retirement, health care or college education — in an exchange for a tax benefit.

However, because these accounts offer special tax benefits, there are limits on how you can use them, including how much you can contribute each year, when you can withdraw funds and what the funds can be used for. If you don’t adhere to these rules, you may be subject to additional taxes and penalties from the IRS.

Bottom line: If your investments are housed in a tax-advantaged account, then they are subject to the tax rules that govern them. However, there are many different tax-advantaged accounts, and each differs on how contributions and withdrawals are treated from a tax-perspective.

Here’s an overview:

|

TAX-ADVANTAGED ACCOUNTS |

||||||

|---|---|---|---|---|---|---|

|

Type of tax-advantaged account |

What it’s designated for? |

How contributions are taxed |

Can you buy and sell within the account without incurring taxes? |

How withdrawals are taxed |

Tied to employer? |

Subject to RMDs? |

|

401(k) plan |

Retirement |

Pre-tax or after-tax basis |

Yes |

Ordinary income |

Yes |

Yes |

|

Traditional IRA |

Retirement |

Contributions can be tax deductible |

Yes |

Ordinary income |

No |

Yes |

|

Roth IRA |

Retirement |

After-tax basis |

Yes |

Not taxed if all requirements are met |

No |

No |

|

Roth 401(k) |

Retirement |

After-tax basis |

Yes |

Not taxed if all requirements are met |

Yes |

No |

|

529 plan |

Education |

After-tax basis |

Yes |

Not taxed if used for educational purposes |

No |

No |

|

Health savings account (HSA) |

Health care |

Pre-tax basis |

Yes |

Not taxed |

No (but you must be enrolled in a high-deductible health plan) |

No |

Learn more: Tax diversification: A tax strategy to help your assets last

Taxable accounts

Taxable accounts are savings and investments accounts that do not offer tax benefits. However, what they lack in tax benefits, they make up for in flexibility and liquidity. Taxable accounts — such as brokerage and savings accounts — can be used for any type of financial goal, are not tied to any employer, are not subject to RMDs and generally do not need to follow the same set of rules and withdrawal restrictions that tax-advantaged accounts do. How the growth of assets in taxable accounts are taxed depends on whether you are selling the asset or taking interest or dividends from it.

Advice spotlight

It’s generally wise to max out contributions to tax-advantaged accounts before investing in taxable accounts. This strategy allows you to keep more of your investing gains by saving on taxes now and in the future.

Are your investment earnings a capital gain or ordinary income?

If your investment does not live in a tax-advantaged account, you’ll want to determine whether your investment earnings are considered ordinary income or a capital gain. Ordinary income is subject to the typical federal income tax rates and brackets. Capital gains are subject to a special capital gains tax rates, which can be lower than federal income tax brackets.

In other words, are you selling an investment or earning interest/dividends from it? Here are some guidelines to figure out which tax your investment is subject to:

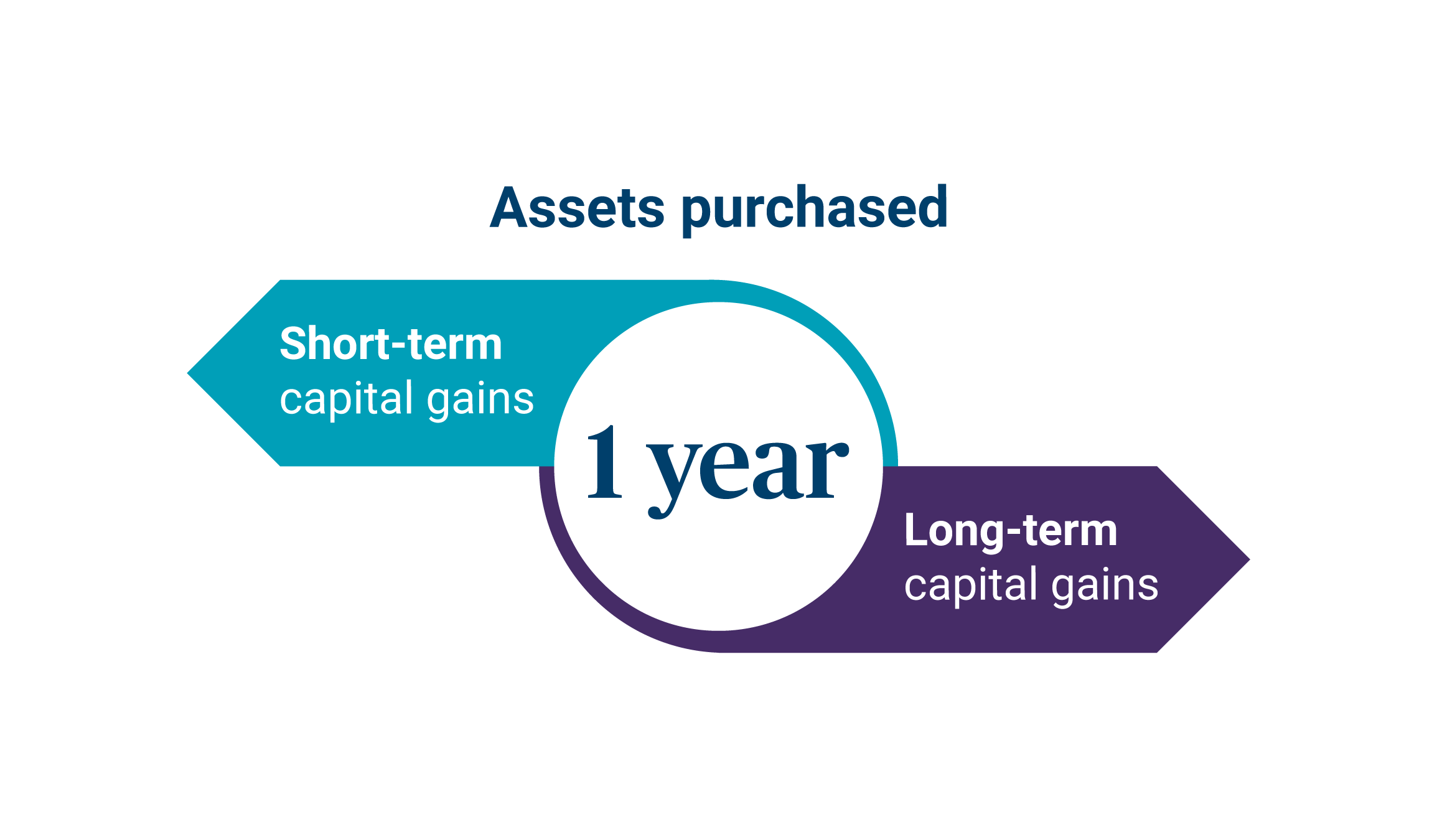

- If you are selling the asset, then any profit you make from the sale is considered a capital gain and is generally subject to the capital gains tax rates. These are determined by your income and the length of time you owned the asset. If you do not make a profit, you are not subject to the capital gains tax and you should consider whether tax-loss harvesting may help your situation.

- If you are earning interest on the asset, these earnings are typically considered ordinary income and are subject to the regular federal income tax rates as they occur.

- If you are earning dividends, your earnings may be taxed as ordinary income or capital gains as they are earned. Generally speaking, if your dividend is considered a qualified dividend, for example, then it will be taxed as capital gains whereas if your dividend is considered an ordinary dividend, it will be taxed as ordinary income.

Learn more: Capital gains taxes on assets and investments, explained

Advice spotlight

Consider how you can use the lower capital gains tax rate to your advantage. If possible, wait until you’ve owned an asset for at least a year before you sell it for a profit. This will typically allow the asset to be treated as a long-term investment, meaning you’ll likely pay a lower tax rate on the capital gains.

What type of asset is your investment?

After determining how your investment earnings are taxed, consider whether there are special tax considerations depending on the asset type. For example, there are unique considerations for the following asset classes.

Stocks

If you are seeking to sell a publicly traded stock, then any profit you make will be subject to the capital gains tax rate. If you are seeking to realize income from a dividend-paying stock, then you will need to determine if the dividends are considered qualified or ordinary. Qualified dividends will be taxed as capital gains. Ordinary dividends will be taxed as ordinary income.

Bonds

If you are seeking to sell a bond, then any profit you make will generally be subject to the capital gains tax rate. Bond interest income is generally taxed as ordinary income, however there are certain unique tax benefits if the interest comes from municipal and government bonds:

|

BONDS |

||

|---|---|---|

|

Type of bond |

What is it? |

How interest income is taxed |

|

Corporate bond |

Debt obligation issued by corporations. |

Corporate bonds are subject to federal, state and local taxes. Interest income will be taxed as ordinary income. |

|

Municipal bond |

Debt obligation issued by states, counties, cities and other state and local government agencies — to pay for capital projects. |

Unlike corporate bonds, the interest income from municipal bonds is exempt from federal income taxes. They may also be exempt from state taxes if issued by the state where you file taxes, though the rules vary from state to state. |

|

Government bond |

Debt obligation backed by the U.S. government, such as U.S. Treasury notes. |

Interest earned is subject to federal income taxes, but not state or local taxes. |

Mutual funds

Mutual funds are actively managed investment instruments that allow you to pool your money with other investors to buy stocks, bonds and other investments. Like other asset types, your tax treatment will be contingent on whether you are selling the investment or earning interest/dividends from it. However, it’s important to know that if a mutual fund you own generates and distributes dividends, interest or capital gains, you could owe taxes, even if you haven’t sold any of the shares or received any cash from them.

ETFs

Exchange-traded funds (ETFs) are passively managed investment funds that operate like mutual funds and typically track a specific index, business sector or commodity. Like other asset types, ETFs are taxed depending on whether you sell the investment or earn interest/dividends from it. The sale of the investment is subject to capital gain taxes, while dividends or interest will typically be taxed as ordinary income.

However, there are some unique considerations. ETF dividends are taxed according to how long the investor has owned the ETF:

- If you have owned the ETF for more than 60 days before the dividend was issued, your dividend is typically considered “qualified” and is taxed anywhere from 0% to 20%, depending on your income.

- If the exchange-traded fund was held less than 60 days before the dividend was issued, the dividend income is typically taxed as ordinary income.

- Certain currency, commodity and precious metal ETFs have more complicated tax rules, so talk to your tax professional about how those assets are taxed.

Cash investments

Cash investments — such as high-interest savings accounts, certificates of deposits (CDs) and money market accounts — are savings instruments that allow you to deposit money to earn a specified return in interest. The income that you generate from these investments is typically considered ordinary income. Generally, how much interest you’ve earned for the year will be detailed in a 1099-INT form sent by the bank or financial institution where you hold the account.

|

CASH INVESTMENTS |

||

|---|---|---|

|

Type of cash investment |

How contributions are taxed |

How interest is taxed |

|

High-interest savings accounts |

After-tax basis |

Ordinary income |

|

Money market accounts |

After-tax basis |

Ordinary income |

|

Certificates of deposit (CDs) |

After-tax basis |

Ordinary income |

Annuities

An annuity is an investment product that is designed to provide a regular stream of income to the annuity owner during their retirement years. Annuities are only taxed when you withdraw money or receive payments, though how much you’ll pay is determined by the specific type of annuity you purchase and whether it was purchased within a tax-advantaged account, such as a 401(k) or Roth IRA.

|

ANNUITIES |

|||

|---|---|---|---|

|

Type of annuity |

Funding of purchase |

How withdrawals are taxed |

Subject to RMDs? |

|

Qualified annuity |

Pre-tax basis |

Ordinary income |

Yes |

|

Non-qualified annuity |

After-tax basis |

Ordinary income* |

No |

|

Roth annuities |

After-tax basis |

Not taxed |

No |

*Only interest or earnings growth is taxed.

Learn more: Tax planning for annuities

Are you a high earner?

If you are a high earner and report net investment income, then you may be subject to an additional tax on your earnings, called the net investment income tax (NIIT). The NIIT, which went into effect in 2013, is a 3.8% tax that the IRS levies on higher-income individuals, trusts and estates that earn net investment income.

Learn more: The net investment income tax (NIIT): What it is and how to potentially minimize it

Use the tax code to your advantage

An Ameriprise financial advisor can work with your tax professional to make sure you understand how your investments are taxed — and how those assets connect to your broader financial goals.

One of your clients has some topics they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.