The economic impacts of the new tax law changes, explained

Russell Price, Chief Economist – Ameriprise Financial

August 18, 2025

This article is intended to provide perspective on how federal policy changes may impact the broader economic and market environment. These insights are not political statements from Ameriprise Financial.

The newly signed One Big Beautiful Bill Act (OBBBA) cuts taxes and boosts near-term spending at the expense of future government debt and deficits. How might this new law affect the U.S. economy and consumers over the short and long term?

Here are our perspectives:

What does the One Big Beautiful Bill Act do?

Among the law’s most notable provisions is the extension of the personal income tax rates that were initially lowered under the 2017 Tax Cuts and Jobs Act (TCJA). Without this permanent extension, tax rates would have shifted back to pre-2017 levels at the end of this year.

Beyond personal tax rates, this law has a wide reach, covering Medicaid eligibility, business investment expensing, car loan interest deductions and much more. On the spending side of the ledger, it increases spending on homeland security and national defense while cutting spending for Medicaid, education and some clean energy programs, among others. The law establishes a myriad of new tax credits, including the “no taxes on tips and overtime” credits, as well as a one-time tax credit for eligible tax filers ages 65+.

Learn what the new law’s key tax provisions could mean for your finances.

Economic impact: An initial economic boost, then challenges

Overall, we believe the economy should see a modest boost over the next several quarters due to the law. Some economic benefits could be seen by the fourth quarter of this year, but most should come in 2026. Specifically, the “no tax on tips and overtime” provisions will likely boost consumer spending power, while the bonus depreciation of business investments provision should also support business spending.

In future years, however, U.S. growth prospects are likely to be hindered by higher government borrowing needs, which could put added upward pressure on interest rates. Additionally, interest expense on the national debt is set to capture a growing percentage of tax revenue in future years, thus continuing to crowd out other federal spending priorities.

Here are a few estimates of the law’s economic impact:

-

Lower tax rates: The continuation of current tax rates is estimated by the Joint Committee on Taxation (JCT) to reduce personal income tax payments by about $3.4 trillion over 10 years.

-

No tax on tips and overtime: The “no tax on tips” credit should boost consumer income by about $10.1 billion in fiscal 2026 (the federal government’s fiscal year ends Sept. 30) while the elimination of taxes on overtime should increase paychecks by $32.8 billion, according to the JCT.

-

Overall GDP impact: Some estimates have OBBBA boosting U.S. real gross domestic product (GDP) by as much as 1.2% in 2026. However, those estimates are based on comparison to prior law in which the reduced tax rates enacted under 2017’s TCJA expire as previously scheduled.

In our view, consensus estimates, had not incorporated an expiration of the lower tax rates, given the strong likelihood of their extension — which ultimately occurred under OBBBA. As such, our full-year real GDP estimate for 2026 has risen modestly, to 2.2% from a prior 2.0%. More broadly, while provisions of OBBBA should offer a modest boost to growth, growth should also see pressure from higher tariff rates.

Bottom line: The law should boost intermediate-term economic growth (starting late this year). However, over the longer term, its legacy may be its costly addition to federal debt and deficits, which could then raise future interest rates.

OBBBA’s long-term legacy: U.S. debt situation grows more concerning

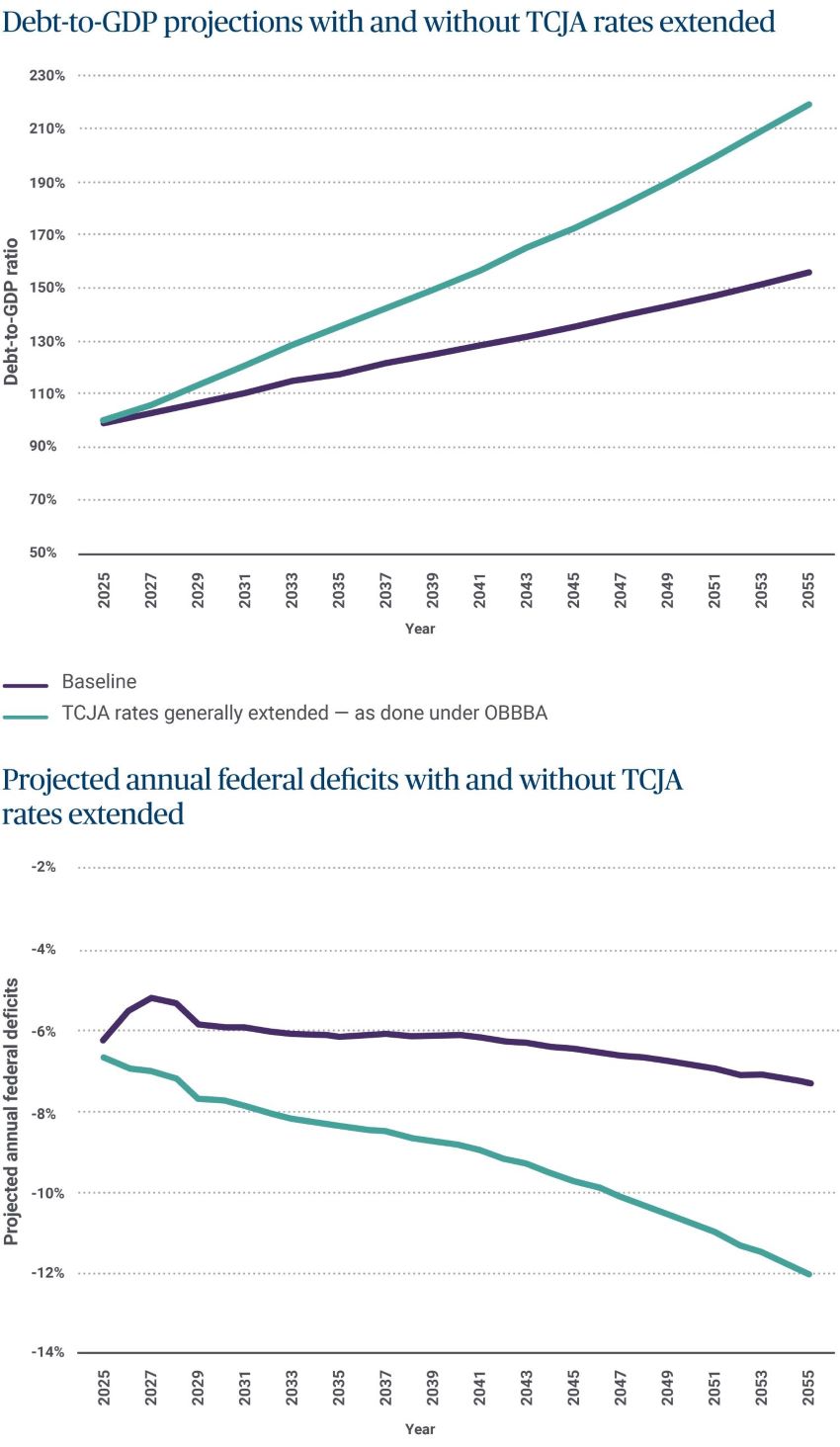

The Congressional Budget Office (CBO) projects federal debt and deficits to rise materially due to the revenue cuts and spending increases contained in OBBBA. While the CBO has not yet issued an official estimate for future years following the passage of OBBBA, in March, they forecasted the debt-to-GDP ratio would reach over 210% by 2054 if 2017’s TCJA rates were extended (as was the case in the OBBBA). For comparison, as of Q1 2025, federal government debt represented a debt-to-GDP ratio of 96% and had grown to $28.8 trillion by the end of 2024.

Source: Congressional Budget Office. This information is shown for illustrative and educational purposes.

In our view, changes need to be implemented relative to government revenue and spending that will enable the debt-to-GDP ratio to begin trending lower. We believe the goal should not be to balance the budget quickly, as abrupt changes could cause more problems than they would solve.

Elected officials need to enact budgetary changes over the coming years that put the government budget on a much more sustainable long-term path. In our view, realistic budgetary solutions will need to include adjustments on both sides of the equation, higher revenues (i.e. taxes) and lower spending, to be effective.

We do not necessarily see the situation as becoming a crisis over the near term. Unfortunately, however, it may take a crisis to get movement on this issue. It would likely be overly optimistic to believe Congress could pass dramatic long-term budgetary changes anytime soon, given today’s sharp political divide. Nevertheless, there are solutions, in our view. None are socially, economically or politically easy, but nor do they have to be economically calamitous. In our view, the sooner changes are implemented, the less severe the adjustments will ultimately need to be.

Bottom line: OBBBA comes at a time when U.S. government debt and deficits are already very high and projected to go much higher in the years ahead. In our view, the government debt situation is not yet at a crisis point, but it's getting closer.

Understand how the new law may impact you

Beyond the economic impact, the One Big Beautiful Bill Act may also have implications for your personal financial situation. If you have questions on what this new law may mean for your finances, reach out to your Ameriprise financial advisor. They can work with your tax professional to help you make sense of the new law and identify potential adjustments to your financial strategy.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.