U.S. debt: Are we at a tipping point?

Russell Price, Chief Economist – Ameriprise Financial

September 15, 2025

This article is intended to provide perspective on how federal policy may impact the broader economic environment. These insights are not political statements from Ameriprise Financial.

The U.S. national debt has grown at an unprecedented peacetime pace over the last 15 years, with government deficit spending currently projected to outstrip government revenue growth and economic growth far into the future.

This trend has far-reaching implications for both long-term U.S. economic prospects and the global financial markets. Are we now at an inflection point?

Here’s our outlook on the national debt and deficit.

The current situation: Debt hits all-time highs

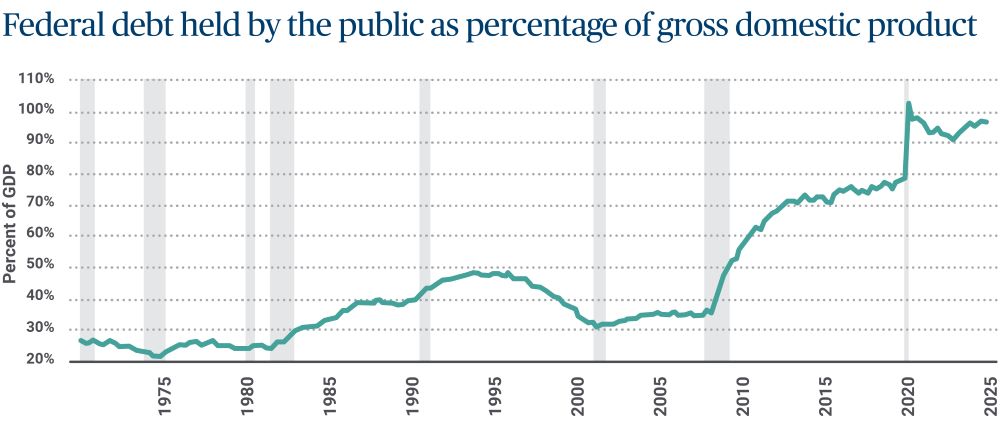

The unsustainable trajectory of the U.S. national debt has long been a topic of conversation. As a larger portion of the population retires and begins taking Social Security and Medicare, debt levels are expected to rise accordingly. However, recent deficit surges have far exceeded earlier projections, primarily due to fiscal measures employed during the 2007-09 Great Recession and the 2020 COVID-19 pandemic.

At the end of July, U.S. government debt issued and outstanding amounted to $29.5 trillion, according to the Treasury Department. Meanwhile, total U.S. gross domestic product (GDP), the broadest measure of U.S. economic activity, amounted to $30.3 trillion through Q2 2025, per the Commerce Department. The numbers equate to a debt-to-GDP ratio of 97.4%.

Sources: Federal Reserve Bank of St. Louis and U.S. Office of Management and Budget

Shaded areas indicate U.S. recessions.

Tariffs may offer some relief

If maintained, the recently implemented tariffs should boost government revenue, thereby narrowing annual deficits, all else remaining equal. Tariffs are paid to the federal government by the importing entity, typically a business.

In July, the Treasury Department reported tariff revenue for the month of approximately $30 billion, or $360 billion over the course of a year.1 With additional tariffs on the horizon, we estimate revenues could end 2025 at an annual rate of about $400 billion.

The added revenue from tariffs would be welcome, but relative to a Congressional Budget Office (CBO) projected fiscal 2025 deficit of approximately $1.9 trillion, the offset is still relatively modest.

Recent tax law changes could accelerate deficit issues

Still, while tariffs may offer some respite, the recently passed One Big Beautiful Bill Act (OBBBA) may further complicate the debt picture. The OBBBA is primarily built around tax cuts and higher spending —consequently adding materially to projected debt and deficits.

Find out how the One Big Beautiful Bill Act (OBBBA) may affect U.S. economic growth and the federal deficit.

How much debt is too much?

There’s no specific dollar value or debt-to-GDP ratio whereby a government’s debt situation officially becomes “too much.” Unlike humans, governments live on in perpetuity. As such, they never have to fully pay off their debts. In fact, some debt is typically necessary to conduct monetary policy and efficient financial market functioning.

Still higher national debt levels present several challenges for governments. Specifically, high deficits can:

-

Constrain the government’s ability to allocate funds to more pressing priorities.

-

Raise the portion of tax revenue required to finance the debt already incurred, otherwise known as interest expense.

-

Put upward pressure on interest rates as government borrowing needs “crowd out” those of businesses and consumers.

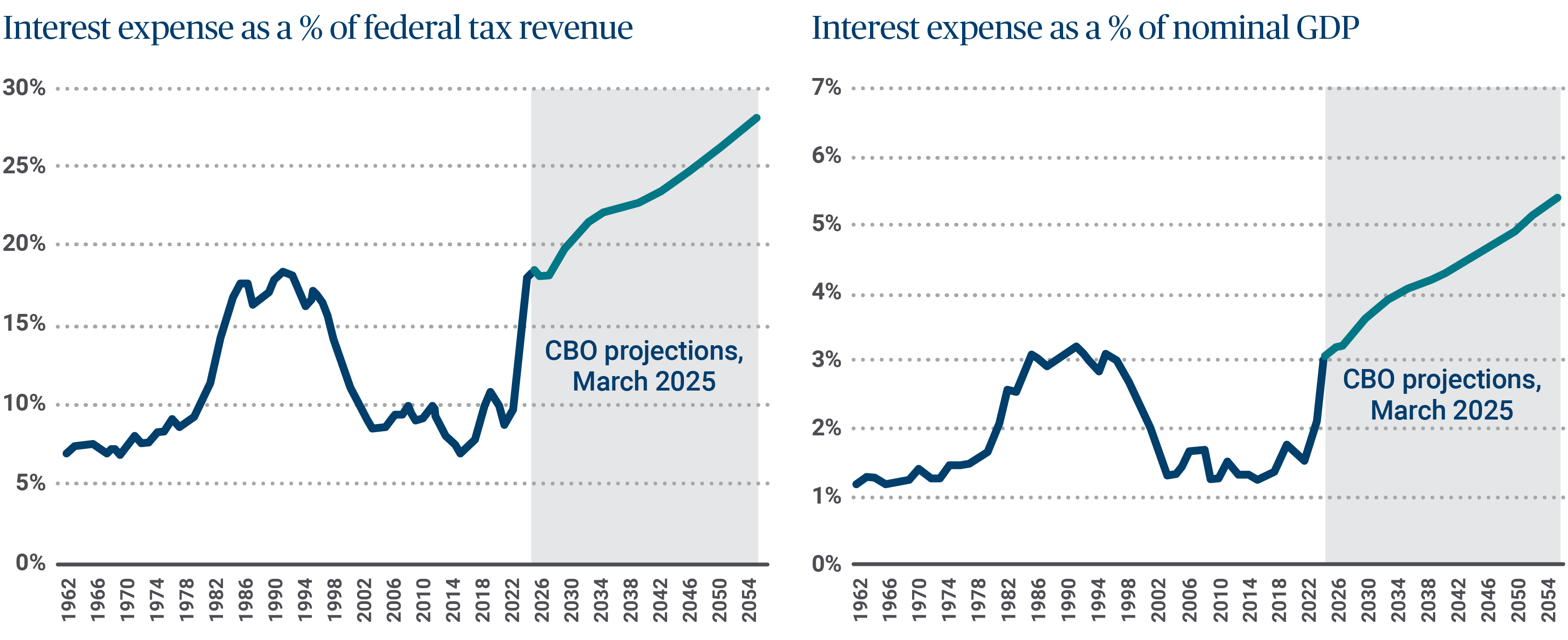

Government debts become especially problematic when an increasing and material percentage of the annual budget needs to be allocated to pay the interest expense. Annual interest expense is the total dollar value of outstanding debt multiplied by prevailing interest rates. The charts below show the severity of the current problem. The numbers shown below were issued by the CBO in March 2025, prior to the passage of the OBBBA. We believe the OBBBA will push these numbers higher.

Source: Congressional Budget Office

Could AI come to our rescue?

A best-case scenario relative to the debt and deficit outlook would be stronger-than-expected economic growth. Stronger growth would lead to a higher dollar value of tax revenues, reducing annual deficits, as well as boosting the GDP side of the debt-to-GDP ratio.

Over the next few decades, the U.S. economy’s sustainable growth rate is estimated to be about 1.8%, as per the Federal Reserve and CBO. The number is calculated by taking the growth in the workforce times worker productivity.

The workforce population mostly depends on demographics, which typically aligns with projections. However, if advancements in AI can achieve a faster pace of labor productivity growth, which some forecasters believe is possible, it could have a meaningful impact.

But, in our view, a meaningful AI impact is likely a long shot. Although labor productivity can be volatile over short periods, it has been fairly static over the long term. The Internet revolution that began in the mid-1990s was also thought likely to boost productivity, which it did, for a period. Workforce productivity levels have since largely returned to historical norms.

Are we at a crisis point?

The government debt situation is not yet at a crisis point, but it's getting closer by the year. As a modest positive, governments that print their own currency (such as the U.S.) cannot technically go bankrupt. However, history is littered with the adverse outcomes for countries that tried to “monetize” their government debt (i.e., a central bank printing money to fund government deficits). At a minimum, such efforts typically result in a sharp decline in currency values.

Fixing the situation will require a combination of higher taxes and lower spending over the long term. Stronger-than-projected economic growth would also be a direct and welcome development, but a material outperformance of growth relative to current projections appears optimistic and unlikely.

There’s little doubt that the debt and deficit situation is growing more concerning as it draws greater attention and the government budget faces increasing strain. The longer elected officials wait to implement changes, the more difficult the situation will become, requiring the eventual remedies to be more consequential.

Bottom line

The U.S. government budget math will become increasingly difficult in the years ahead, if revenue and spending projections remain on an unsustainable path. If you have questions about how the broader macroenvironment may affect your personal investment portfolio, reach out to your Ameriprise financial advisor.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.