Discover the flexibility of asset-based lending to handle unexpected expenses without sacrificing your long-term goals.

You can’t always predict when you’ll need access to liquidity. Asset-based lending can offer a practical solution to ensuring cash is available when you need it by leveraging the value of your assets. Whether to cover costs for a real estate transaction, manage a tax bill or simply supplement your cash reserves, borrowing against your assets provides flexibility without selling long-term investments.

Whatever your needs, an Ameriprise financial advisor can help you evaluate your asset-based lending options and ensure alignment with your financial goals and strategy.

What is asset-based lending?

Asset-based lending is a type of financing that uses property, securities or other investments, as collateral for the loan. Unlike traditional loans, which rely on a borrower’s creditworthiness or cash flow, this approach allows you to leverage your investment portfolio or another asset to unlock cash in the event you need it with little to no impact on your long-term financial goals.

Four different types of asset-based lending include:

-

Securities-based lending allows you to use your non-retirement investment portfolio — such as stocks and bonds — as collateral to access liquidity.

-

Margin loans leverage non-qualified securities to provide liquidity or additional purchasing power. Unlike securities-based lending, however, margin loans can be used to purchase additional securities.

-

Home equity line of credit (HELOC) allows you to borrow against the equity you’ve built in your home, providing flexible funds for home improvements or other expenses.

-

401(k) loans allow you to take out a loan against your own 401(k) plan, or essentially borrow money from yourself. Keep in mind, borrowing from your 401(k) reduces the amount invested, potentially impacting your long-term retirement savings growth.

Why borrow against your assets?

For quick access to cash, selling your assets might seem like the easiest option, but borrowing against them could be a smarter choice with added benefits:

-

Straightforward: The process is often as simple as filling out an application. Your lender may do a credit check, but you typically don’t have to go through an underwriting process.

-

Cost effective: Since you are putting up collateral in exchange for cash, interest rates can be competitive and adjustable.

-

Tax efficient: You won’t be subject to capital gains tax like you would if you sold an asset. Interest payments you make on the borrowed amount may be tax deductible.

-

Flexible: You could qualify for either no monthly payments or interest-only payments. Payment schedules are flexible, and some lending options allow you to borrow, repay and reborrow as needed.

When might it make sense to borrow against your assets?

Leveraging your assets for liquidity can be a strategic move in many scenarios. Here are some ways that asset-based lending can work for you:

-

Provide bridge financing for a down payment on a new home while waiting for your current home to sell.

-

Fulfill tax obligations, such as paying capital gains taxes from the sale of another asset or quarterly tax payments.

-

Allow you to pursue new business opportunities that require cash.

-

Complete home renovations without putting labor and materials on a credit card.

-

Fund a major purchase or family event, such as a wedding or vacation.

-

Pay for education expenses like tuition, room and board, and other materials.

-

Refinance high-interest debt, since interest rates on asset-based lending products are lower than interest rates on credit cards.

-

Create a safety net of funds for emergencies or unexpected health care expenses.

-

Transfer wealth to future generations by allowing you to retain assets, rather than sell them, when you need cash.

Borrowing against vs. selling your assets

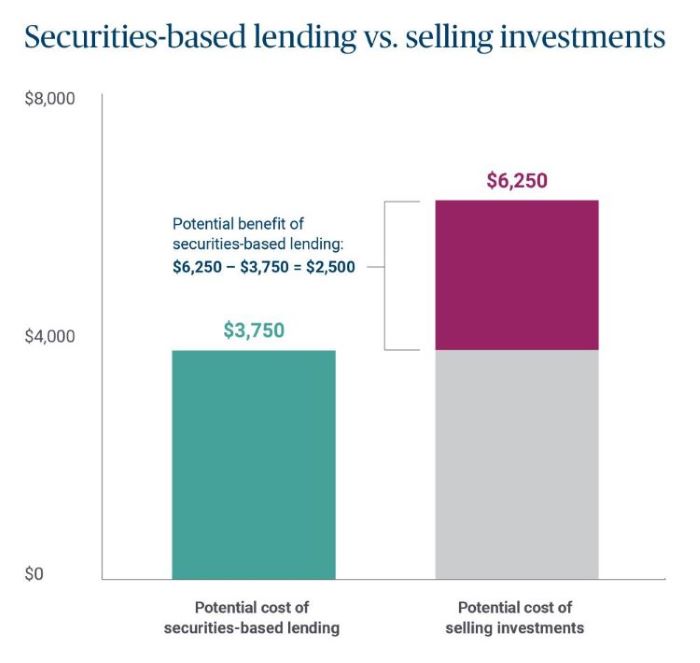

When weighing your options to meet short-term liquidity needs, asset-based lending is often more advantageous than selling. Consider the following scenario:

Liquidity need

You want to help your child pay for college by covering $50,000 of their education expenses. You’re considering whether to sell or borrow against your assets.

Potential cost of selling assets

Assuming a 5% market return and long-term capital gains taxes of 15% on half of the sold investment value, you would miss out on $2,500 of appreciation, interest and dividends, as well as incur $3,750 in taxes if you sold your investments.

Potential cost of borrowing

Alternatively, if you borrowed the $50,000 at a 7.5% effective interest rate for one year instead of selling assets, the total expense would be $3,750.

The example on this page is based on the assumptions stated herein. In the event any of the assumptions used do not prove to be true, results are likely to vary substantially from the example shown. This example is for illustrative purposes only and no representation is being made that any individual will or is likely to achieve the results shown.

Pros and cons of asset-based lending

| Lending option | Pros | Cons |

|---|---|---|

| Securities-based lending |

|

|

| Margin loan |

|

|

| Home equity line of credit (HELOC) |

|

|

| 401(k) loan |

|

|

We can help you leverage your assets for financial flexibility

At Ameriprise Financial, we recognize the value of exploring every financial opportunity. Contact your Ameriprise financial advisor for guidance on how asset-based lending can provide you with needed liquidity to support your financial goals.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.