Explore the pros and cons of refinancing your mortgage with this guide.

Refinancing your mortgage involves replacing your current loan with a new one, often to secure more favorable terms, such as a lower interest rate or an adjusted repayment schedule. This process is more than a matter of calculations — it’s about finding the right fit for your lifestyle and financial goals.

Whether you’re dreaming of a home renovation, hoping to pay off your home sooner or reducing your monthly mortgage payment, refinancing your mortgage may help you achieve your other financial goals. Whatever is driving your decision, an Ameriprise financial advisor can help you determine how refinancing could impact your current financial situation.

What types of mortgage refinancing options are there?

The two most common types of mortgage refinancing are:

-

Cash-out refinance: Swapping your current loan for a larger one so that you can tap into your home equity for cash.

-

Rate-and-term refinance: Switching to a new loan with a different interest rate and/or loan term.

Why refinance your mortgage?

Refinancing your mortgage can offer several benefits depending on your financial goals, the interest rate environment and your current situation.

- Lower monthly payments: A lower interest rate could reduce your monthly payment if your original loan is at a higher interest rate.

- Access to cash: A cash-out refinance allows you to tap into the available equity in your home and use those funds for home improvement projects, debt consolidation, investment opportunities or other financial needs.

- Improved loan terms: Refinancing allows you to take advantage of new loan terms that could help you save on interest, reduce your monthly payment, or move from a variable rate to a fixed rate for long-term payment stability.

- Lower long-term interest costs: Shortening your loan term through refinancing allows you to own your home faster and reduce long-term interest costs.

- Consolidated debt: By refinancing, you could consolidate high-interest debt like credit cards or personal loans into your mortgage.

When should you refinance your mortgage?

The optimal time to refinance your mortgage depends on your financial goals. However, there are certain circumstances where refinancing may be more favorable:

- Interest rates are lower than your current mortgage rate: If current interest rates have dropped below the rate on your existing mortgage, refinancing could lower your monthly payments and save you thousands in interest over the life of your loan, especially if you plan to stay in your home long term.

- Your home value has increased: If your property value has risen, refinancing allows you to access the equity you’ve built or stop paying private mortgage insurance if applicable.

- You’d like to pay off your home sooner: While some loans allow for prepayment without penalty, others carry a significant prepayment penalty. To avoid this penalty, refinancing to a shorter loan term (e.g., from a 30-year to a 15-year loan) can help you pay off your mortgage faster and save on interest, albeit with higher monthly payments.

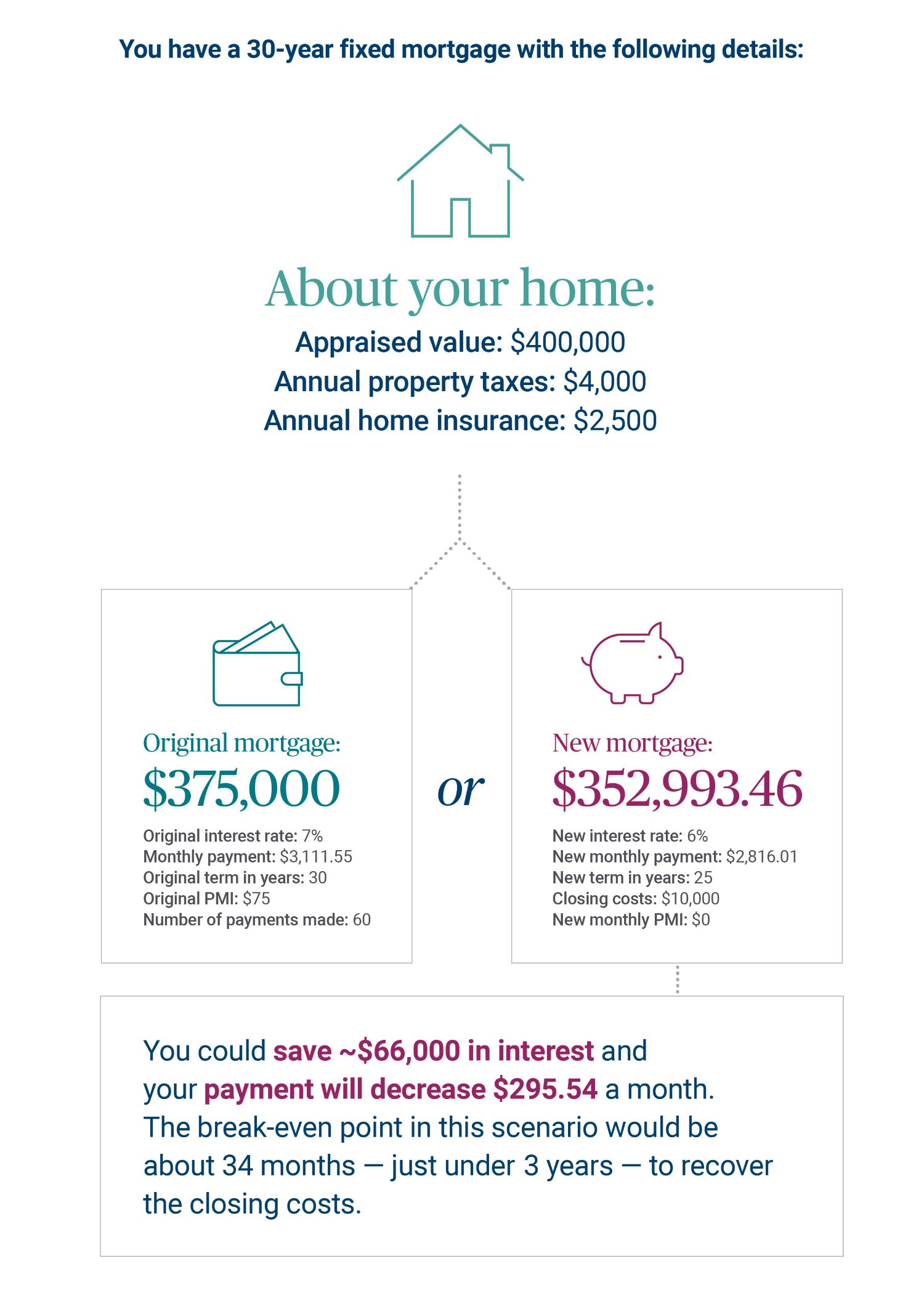

Mortgage refinance interest savings calculator

Use this tool to see how refinancing your mortgage could affect your monthly payments.

What should you consider before refinancing your mortgage?

There are several factors to consider when exploring refinancing including:

- Closing costs: Refinancing typically comes with closing costs that range from 2-6% of the loan amount.

- Your new monthly mortgage payment: Ensure your new monthly payment aligns with your budget. In the case of a shorter loan term, you’ll likely have a higher payment. If you’re using some of your home equity for cash and increasing your loan amount, that is also likely to increase your payment.

- How long you plan to stay in your home: If you plan to move in a few years, the upfront costs of refinancing may outweigh the benefits.

- Changes to mortgage terms: Refinancing can alter key terms of your loan, and each change has consequences on your repayment structure.

- Impact on your credit score: Refinancing involves a hard credit inquiry, which could temporarily lower your credit score.

- Future financial goals: Assess how refinancing might impact other priorities, like saving for retirement, paying off debt or funding education. Refinancing could cause you to have to pay a mortgage for longer, depending on the repayment terms of the new loan.

Crunching the numbers: Refinance or keep your current mortgage?

To illustrate how refinancing could be beneficial, consider the following hypothetical scenario:

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

Equal Housing Lender.

Equal Housing Lender.