Investing in the stock market: Pros, cons and investment options, explained

Leverage the high-growth potential of stocks to your advantage.

Investing in the stock market can be one of the most effective ways to grow your money over time. And there are many different ways to invest in this asset class to help achieve your financial goals.

But investing in stocks is not without its risks. When you work with an Ameriprise financial advisor, your personalized investment strategy will include different stock market investing options that align with your financial goals, risk tolerance and time horizon.

Here’s an overview of how to invest in the stock market:

What are stocks?

Stocks represent a piece of ownership in a publicly traded company, whose earnings and overall success affect long-term returns. Stock investors typically earn money in two ways: By selling their shares for more than they paid for them or by purchasing shares in a company that distributes a portion of their revenues to shareholders via a dividend. (Not all companies pay dividends, but those that do often distribute them quarterly in the form of cash or stock reinvestment.)

Learn more: What are the different types of stocks? An investor’s guide

The pros and cons of investing in the stock market

As with all investments, stock ownership comes with both risk and potential rewards. Here are the pros and cons of investing in the stock market:

| Potential benefits | Potential risks |

|---|---|

|

|

How to invest in the stock market

To invest in the stock market, you first need an investment account that can facilitate the trading of equities. This can be a traditional brokerage account or a tax-advantaged account, such as a retirement account, a 529 plan or health savings account (HSA), all of which allow you to trade in a variety of investments, including stocks. For many Americans, the primary way they invest in the stock market is through their employer-sponsored 401(k) plan or their IRA.

Once you have an investment account, you’ll be able to invest in a variety of investment vehicles, including different stock types. These options will likely vary depending on the type of account. Some accounts may limit you to investing in mutual funds.

Stock market investing options

To invest in the stock market, there are a variety of solutions available to help you manage risk. You aren’t limited to just buying and selling individual stocks — although that is an option, if it’s appealing to you.

- Individual stocks: Buying individual stocks offers you more control over what you’re investing in and it may have some tax advantages. However, there are also drawbacks: It can take time, research and a significant amount of money to build a properly diversified portfolio by picking individual stocks, which come in many different types. Even for experienced investors, finding stocks is easier said than done, requiring you to account for the company’s management team, financial outlook, competitive advantages (or disadvantages) and more.

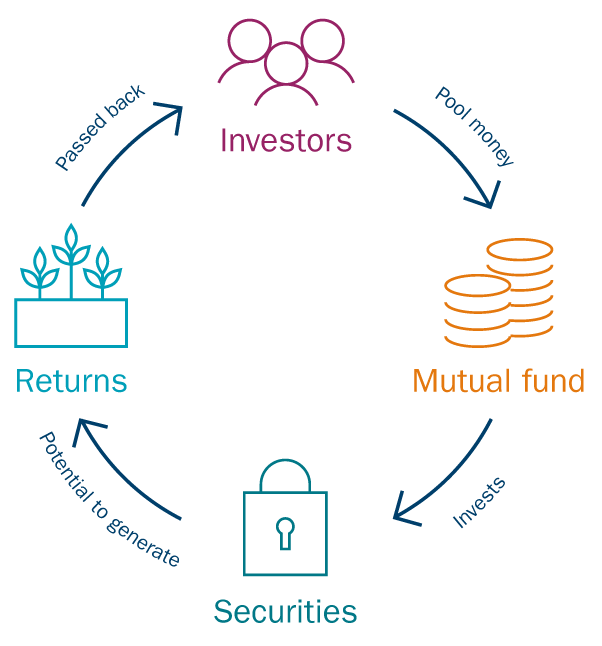

- Mutual funds: If you’d prefer not to invest in individual stocks, you have several options. One is the mutual fund, which pools money from a large group of investors to purchase various stocks, bonds, short-term money market instruments (or some combination of those assets). Because professional managers select and manage the holdings, mutual funds can be a quick and efficient means of investing in the stock market. What’s more, because of their structure, mutual funds don’t require a large investment to provide some level of diversification, an important element of a well-rounded investment portfolio. Mutual funds also provide the opportunity to follow a particular strategy, as different funds invest in a specific type of stocks, like international stocks or small-, mid or large-cap stocks.

3. Exchange-traded funds (ETFs): Like mutual funds, ETFs are pooled investments that allow you to invest in a variety of stocks, bonds and commodities. However, ETFs trade on an exchange like a stock, which means you can buy and sell ETFs throughout the day, and the ETF’s price will fluctuate throughout the day. Mutual funds and index funds, on the other hand, are priced at the end of each trading day, so the price will be the same no matter what time you buy or sell.

4. Index funds: An index fund tracks a benchmark index — like the S&P 500 Index or Dow Jones Industrial Average, for example — and aims to mirror that index’s performance. An index fund can be a mutual fund or an ETF. However, if they are the former, you can only trade them at the price at the end of each trading day, while the latter allows you to actively buy or sell them throughout the trading day.

5. Target date funds: Target date funds are a type of mutual fund that are designed to grow assets over a specific time frame, and typically contain a mix of assets, including stocks and bonds. With a target date fund, its asset allocation will change as it gets closer to its target date, which can be 5, 10, 15 or even 30 years from when you purchase it. Generally, the allocation of these types of funds will evolve from a more aggressive mix of investments to a more conservative mix as you get closer to retirement. While target date funds are often thought of as “set-it-and-forget-it” investment solutions because they track to a specific time horizon, it’s important to note that these funds are not designed with your personal needs in mind.

6. Options: Options are complex investments that give the holder the right or the obligation to buy or sell securities at a predetermined price within a set period. Purchasing options can allow you to control more shares than if you bought the stock outright with the same amount of money, potentially magnifying your returns. Options also provide protection from downside risk by locking in the price without the obligation to buy the stock. However, it’s possible to lose your entire investment within a relatively short period, and with certain types of options, it's possible to lose even more than your initial investment.

Options contracts exist for a variety of securities, but they are primarily associated with stocks, which involve two main types of contracts:

-

- Call options: If you’re the buyer, a call option gives you the right to buy a specified amount of securities at a predetermined price. If you’re the seller, it obligates you to sell a specified number of securities at a predetermined price.

- Put options: Put options are the flip side of call options. If you’re the buyer, a put option gives you the right to sell a specific amount of a company’s stock at a predetermined price. If you’re the seller, a put option obligates you to buy a certain amount of stock at a predetermined price.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.