There are a wide array of options to save for college, but choosing one for your family will depend on your priorities, time horizon, long-term goals and tax situation.

An Ameriprise financial advisor can help you evaluate the different possibilities and develop a saving strategy that makes sense for you and your other long-term goals.

Here’s what to consider as you choose an appropriate saving vehicle for your situation.

1. Estimate costs and set your savings goal

Understanding the overall cost of your student’s education experience, including their lifestyle expenses, may give you a target to strive for, and help you determine which saving vehicle fits your goals. The number doesn’t have to be exact. You can always change the goal as your child’s interests and aspirations evolve. Consider using our college savings calculator to determine how much you may need to start saving.

Learn more: Financial planning for college: What to know before you start saving

2. Understand different college savings options

As you save for your student's college education, your strategy may include one or more savings vehicles, depending on your situation. There are different tax implications and considerations for each option.

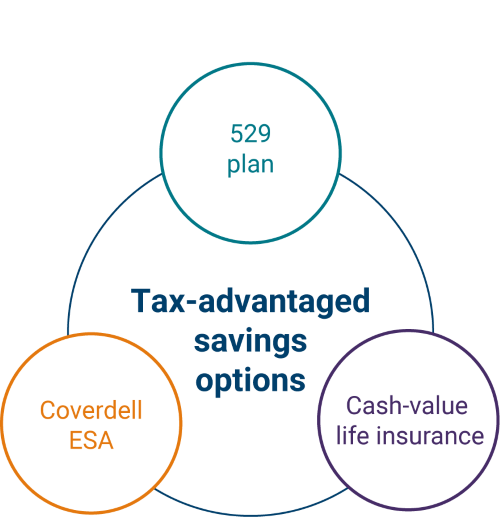

Tax-advantaged options

When saving for college, there are certain accounts that can provide your family with tax benefits.

529 plan

One of the popular options to save for college is a 529 plan, which is a tax-advantaged account primarily intended for higher education expenses.

A 529 plan allows an individual to contribute after-tax money into an investment account on behalf of a designated beneficiary. Almost all U.S. states offer a 529 plan, and investors are generally free to shop around for a plan that works for them, regardless of their residency status.

Here are some pros and cons:

|

Pros |

Cons |

|---|---|

|

|

Bottom line: A 529 plan can be a powerful college saving vehicle. There are many reasons why these are a popular account for education goals, but it’s necessary to understand how it works before you can take full advantage of it.

Learn more: 529 plans: frequently asked questions

Coverdell Education Savings Account

Formerly known as an Education IRA, a Coverdell Education Savings Account (ESA) is a college savings option similar to a 529 plan in that contributions grow tax-deferred — but come with more limitations.

|

Pros |

Cons |

|---|---|

|

|

Bottom line: A Coverdell ESA can be a useful vehicle, but it offers less flexibility and savings potential than a 529 plan.

Cash-value life insurance

The purpose of life insurance is to provide a sum of money at the death of the insured. However, it can be used for many purposes such as part of your college funding strategy. With a cash-value life insurance policy, a portion of your premiums goes toward a death benefit and another portion is allocated into a cash-value account. When properly structured, you can take out an income tax-free loan against your cash value to pay for school.

|

Pros |

Cons |

|---|---|

|

|

Bottom line: Permanent life insurance can offer investors an alternative way to pay for their student’s educational expenses. But college savings shouldn’t be the primary goal when deciding whether to open a policy.

Other college savings options

In addition to the above vehicles, below are a few other college savings options. For brokerage or savings accounts, you could set up an account dedicated to each student you are saving for, if you choose.

Please note: These options don’t have the same tax advantages as the accounts mentioned above and generally aren’t as optimal for college saving goals.

Brokerage accounts

The biggest benefit of using a traditional investment account to fund your child’s college is the flexibility and freedom it offers. These accounts don’t have limitations on how you spend your assets, what funds you can invest in or how much you can contribute.

However, you won’t receive any of the tax advantages if you were to use a 529 plan or Coverdell ESA. Instead, after-tax dollars fund brokerage accounts, and withdrawals are taxed as capital gains.

Bottom line: Using traditional brokerage accounts to save for your child’s education does not offer tax efficiencies. However, these accounts leave more flexibility for use of the funds than tax-advantaged college savings options. If you are willing to forgo potential tax savings in favor of more flexibility, then a brokerage account may be a good option to include in your strategy.

Savings accounts/CDs

While traditional savings accounts and certificates of deposits (CDs) may keep your money out of the market and can be lower risk, their earning potential doesn’t make them an ideal long-term college savings option for parents seeking to pay big expenses, such as tuition. Generally, the rate of return on these types of accounts doesn't keep pace with inflation or rising college expenses.

In many cases, these accounts are better used to build a cash reserve and save for less significant college costs that have a shorter time horizon and don’t count as a qualified higher education expense. For example, if your child is a year out from college and you want to help furnish their dormitory, a savings account may be a smart place to accumulate funds for that short-term goal.

Bottom line: Savings accounts and CDs don't provide the same opportunity for long-term growth as investment options, however, as you get closer to your student’s college years, savings accounts and CDs can be helpful vehicles to keep your money liquid for smaller expenses.

Retirement accounts

If you withdraw from a 401(k) or an IRA to fund your child’s college costs, you may be subject to additional costs, such as income tax or early withdrawal fees, and you could also impact your future retirement income. Overall, using a retirement account is generally not advisable to save for a child’s college expenses, but a Roth IRA does offer you the freedom to do so if it makes sense for your unique situation.

Bottom line: When it comes to balancing retirement and saving for college, retirement should be your priority. Remember: You can’t get a loan to fund your retirement years.

See how parents approach money matters, instill financial values and balance competing priorities.

One of your clients has some questions they would like to discuss with you at your next meeting.

warning Something went wrong. Do you want to try reloading? Try again

When you’re ready to reach out to an Ameriprise financial advisor for a complimentary initial consultation, consider bringing these questions to your meeting.

Reach out to %advisor% to start the conversation.

Or, request an appointment online to speak with an advisor.

At Ameriprise, the financial advice we give each of our clients is personalized, based on your goals and no one else's.

If you know someone who could benefit from a conversation, please refer me.

Background and qualification information is available at FINRA's BrokerCheck website.

1Not a recommended approach for the purpose of qualifying for FAFSA.